The real legacy of Apple Pay

The concept of mobile retail payments is fundamentally sound. It’s a very natural expectation that a smartphone, that is both very powerful and very personal, should be used to facilitate payments while on the move.

However, whilst all the components to make mobile retail payments a reality have been around for some time, it’s the ecosystem to support the technology that has proved particularly challenging for any player -- including the card schemes -- to put into action. In short, everything worked in principle, but didn’t happen in practice.

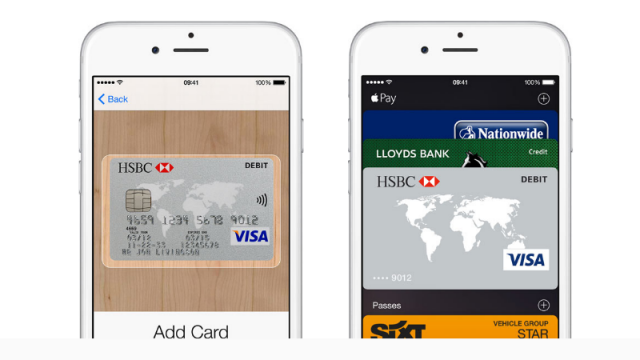

Apple Pay has galvanized the industry by making it a reality. And now in retrospect we -- consumers, as well as payment services providers -- all believe in the concept. This is the real legacy of Apple Pay.

bPay has been a relatively fast follower to Apple Pay in the UK and works in a slightly different way. Barclaycard, which also intends to support Apple Pay, is 'boxing clever' with bPay, by creating a range of contactless payment devices delivered in intelligent user-friendly packages: a key fob, contactless phone sticker and wristband each controlled by an app. Perhaps as importantly, they have offered a prepaid product, available to any UK customer and not just to Barclaycard account holders.

Will either hasten the demise of cash? Yes (although it will take a long, long, time for cash to die), because Apple Pay and -- to a lesser extent -- bPay will encourage retailers to speed up the proliferation of contactless points of sale, which are already at a tipping point in several countries. In terms of speed and convenience, contactless beats chip and PIN card payments, but it also beats cash.

What About Security?

Security is actually a contained problem with both Apple Pay and bPay. The present spend limits for both systems provide manageable exposure for both consumers and issuers. Apple Pay’s biometric authentication, assuming that it is not somehow cracked, makes abuse difficult. And bPay is prepaid, so consumers can decide how much to load.

The really big question is whether Apple Pay and bPay offer sufficient advantages over contactless cards, which are cheap, widely available and convenient, and frankly good enough for most uses. Apple Pay in particular, offers great promise for value-added services, such as loyalty incentives and voucher delivery. The appeal of these to consumers and retailers will ultimately determine whether mobile delivers a mainstream revolution in payments.

Alex Mifsud, co-founder and chief executive officer at Ixaris.

Published under license from ITProPortal.com, a Net Communities Ltd Publication. All rights reserved.