The best open banking apps in 2021

Open banking is more than just a buzzword -- the emerging trend is reshaping traditional services and may become the industry’s future.

Through the use of application programming interfaces (APIs), third-party financial service providers (TPPs) can access customer data that would otherwise be kept secure. Some of these services include budgeting, comparing mortgage rates, creating savings portfolios and more. TPPs are growing in number due to the open banking revolution.

Customers crave convenience when it comes to banking. It's highly sought after, and banks and financial institutions must be creative with their offerings if they want to please clients. However, convenience cannot come at the expense of data protection. Establishments must keep their customers' information secure under all circumstances.

There are a handful of reasons why the traditional banking system is becoming more antiquated. Transferring and processing transactions are anything but immediate. Customers are using outside parties to help them manage their finances, but should they have to? Not with an open banking system.

Below are some examples of open banking apps that can give control back to the customer in terms of their finances.

1. Cleo

One of the most highly rated personal banking apps on the market is Cleo, which allows customers to manage their finances seamlessly. It uses an artificial intelligence (AI) chatbot to interact with the user, teaching them valuable ways to save and budget for upcoming expenses.

Utilizing this app allows customers to be more mindful of their spending habits, which teaches them fiscal responsibility in the long run. Cleo can also provide the user advances, a feature that offers them even more of a hand in managing their finances. The app claims that no extra fees are added to the loan, so people feel a sense of transparency about the amount of money they must pay back.

2. Chime

The online banking service Chime helps users handle their finances in an easy, modern layout. Chime's goal is to make basic banking easier than traditional methods. Some of its features include spending and savings accounts, credit building, getting paid early and fee-free overdraft protection, to name a few. Chime is a super helpful app that sends account balance notifications and helps customers track their spending.

Chime users are also given a Visa debit card to access their spending account, making transactions easier. Keep in mind that Chime itself is a fintech company, not a bank. In the open banking ecosystem, Chime and the rest of these apps are considered TPPs.

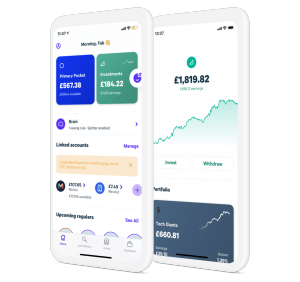

3. Moneybox

Because Europe has adopted the open banking system, some of the best apps are available in other countries. According to TechRadar, Moneybox is a top-rated app in the U.K., with a four out of five-star ranking.

Moneybox has over 600,000 customers and provides a handful of services, like homebuying, saving, investments and retirement options. No matter the financial need, Moneybox has its customers covered.

4. Canopy

Canopy's top priority as a financial service provider is to make the rental market more accessible for all parties, including renters, landlords and real estate agents. When Canopy receives a user's banking information, it provides insights and analytics to users regarding their current financial situation and credit score.

The mobile app aggregates data from a customer's bank and draws conclusions from that information. Someone who is trying to rent an apartment and is unsure if their credit score reaches the requirements can quickly check Canopy. It's making the rental process more straightforward, and it's all because the open banking system allows customers to gain more control over their finances.

5. Currensea

Another popular U.K. open banking app is Currensea, which provides customers with a direct debit travel card. Currensea is considered a frontrunner in the industry. Two ex-investment bankers developed it in 2017, and soon after, a multicurrency card was born. Customers using Currensea could travel worry-free, knowing foreign transaction fees could be bypassed.

Currensea claims that their service saves customers 85% on every transaction, an attractive offer for frequent travelers.

6. Plum

Plum has more than 1 million customers and a 4.7-star rating from over 30,000 reviews. Most U.K. banks are linked to Plum.

Customers who use Plum can benefit from setting aside a reasonable amount every few days to stash as savings. The best part is that the app uses AI to accomplish this. There's no need for a customer to go in and transfer manually.

These are only some examples of the various open banking apps available to customers today. It's expected that their prominence will prompt others to emerge and take over traditional banking apps, paving the way for other trends that will keep the industry current.

The Future of Open Banking Apps

It will be interesting for tech enthusiasts and financial industry leaders to monitor the future adoption of open banking. TPPs will likely grow in number as open banking becomes more prevalent. Customers need their transactions to be convenient, and this option will help them manage their finances more efficiently and securely.

Image credit: panuwat phimpha / Shutterstock

Devin Partida writes about AI, apps and technology at ReHack.com, where she is Editor-in-Chief