Android is unstoppable

I'm sometimes amazed how the Apple fanclub of bloggers and journalists use so-called facts to make iPhone a much bigger success than it really is. Perhaps they're living in denial about the Android reality. I don't really care why. For a week, and even today, I've put up with their prognostications that Android is suddenly in decline before Apple's Jesus phone. That's simply, and undeniably, not reality. It's pure fantasy.

Analyst firms sometimes complicate things by what they state about data they present and how statements don't reconcile with it. Today, Nielsen claims that "Apple is now driving smartphone growth", which has the fanclub in a tizzy fit of blog posts and news stories. Small problem: Nielsen's statement isn't supported by its own data.

Irreconcilable Data Differences

I contacted Nielsen late this morning, because of something that made no sense to me. In March, Nielsen revealed that 50 percent of adults buying smartphones chose an Android device. I had criticized Nielsen for over-emphasizing Android adoption gains, in its presentation. Its newest data report, presented as a blog post, over-emphasizes iPhone adoption gains. Suddenly Android's share among new acquirers is only 27 percent, but that's not a decline but part of an ongoing trend. Huh?

Turns out that Nielsen has changed how it presents the data. In the past, the analyst firm presented new acquirers as percentage of the smartphone market. Now, the data is percentage for smartphones in relation to all handsets. Smartphones accounted for 55 percent of new handset acquisitions between March and May. It was in getting the apparent discrepancy clarified that I could see how Nielsen's statement about Apple driving US smartphone growth is irreconcilable with the data.

I'll start with the data presented today, which shows Android phone adoption by new purchasers at 27 percent for March to May, which is flat compared to the previous three-month period. That 27 percent is among the aforementioned 55 percent of smartphone buyers. By comparison, iPhone lept from 10 percent to 17 percent. How is it that "Apple is now driving smartphone growth" if Android handset growth among new acquirers is so much greater than iPhone -- really iOS, as Nielsen is measuring smartphone operating systems? What's this new math that 17 is greater than 27?

Looked at differently, iPhone is taking little away from Android phone sales. Research in Motion handset sales to new acquirers, as measured by OS, dropped to 6 percent from 11 percent three months earlier. The Other category declined by 1 percent. Add it up and there's 6 percent of iPhone's 7 percent gain over three months. That's cannibalization, not segment-driving growth.

Now let's look at the data just for smartphones. Between March and May, Android adoption among new smartphone acquirers declined by 1 point to 49 percent, while iPhone's rose to 31 percent from 25 percent, according to Nielsen. BlackBerry lost four points to 11 percent. Windows Phone is 2 percent and Other 3 percent. By this reckoning, Android lost 1 percent of share to iPhone, which again picked up share among new purchasers from other devices (as measured by operating system). Regardless, since when is 31 greater than 49 -- and measure that "Apple is now driving smartphone growth"?

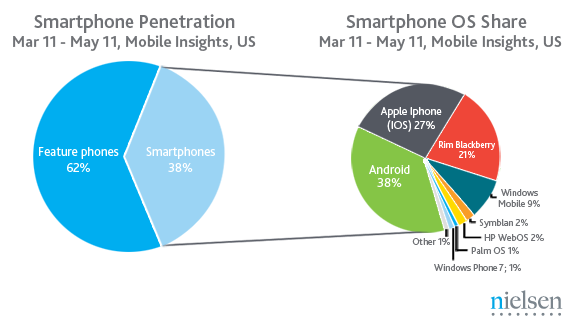

But there's more to consider. Nielsen also presents smartphone ownership by mobile operating system. Between March and May, Android share increased by 1 point to 38 percent compared to three months earlier, while iPhone was flat at 27 percent. Ah, where's the "Apple is now driving smartphone growth" in that? Meanwhile, BlackBerry dropped 1 point to 21 percent.

Responding to my request for explanation, Nielsen says the statement reflects Android's share being flat among recent acquirers -- however conceding as measured in absolute sales, Android's numbers are higher than iPhone's.

Measuring iPhone's Hype Meter

Reports like this fire up the Apple fanclub. Last week, blogging at TechCrunch, MG Siegler writes: "The Verizon iPhone Halted Android's Surge. The iPhone 5 Could Reverse It". A different Nielsen report -- chart really -- charged up Siegler. That one, for February to April, put Android adoption at 36 percent. A decline from an earlier period. Now it's up 2 percent March to May.

Nielsen's chart and a report from Needham analyst Charlie Wolf suggesting that Android would experience "share loss" in the United States engorged Siegler's iPhone enthusiasm: "Guess what happens when the iPhone 5 does launch in the fall on both Verizon and AT&T? It's going to be massive. So massive that I wouldn't be surprised if the one device does actually reverse the Android's march forward".

By the way, Siegler's link about the Wolf report goes to another Apple fanclub member -- Apple 2.0 blogger Philip Elmer-DeWitt. Wolf also is well known for his Apple enthusiasm, or over-enthusiasm.

Verizon iPhone possibly being the reason for the sudden surge in adoption of Apple's handset among new acquirers, in the United States, is what's driving their enthusiasm. That may be true, as are observations that iPhone's three models ($49 3GS, $199 iPhone 4 16GB and $299 iPhone 4 32GB ) compete against dozens of different Android phones. But it's a short-sighted ethno-geographic perspective, which is common about American tech bloggers and journalists.

The United States is but one market, albeit a large one. But the big growth is occurring well outside AT&T's or Verizon's sales area. For example, smartphone shipments to Asia grew 98 percent during Q1, with volumes strongest in China, India and South Korea, according to Canalys. IDC described first-quarter Android smartphone shipments to Asia-Pacfic as "exceptional".

Something else: This week, Google revealed that Android activations had reached 500,000 a day. Six weeks earlier, activations were 400,000 a day. There's nothing flat or declining in those numbers. Data compiled by Nielsen, Wolf or other analysts typically depends on surveys (that's not true for Gartner or IDC). Android activations are a real-time measure of adoption -- people who bought a phone and are now using it.

Based on current activations, Android phone sales are running an estimated 15 million per month -- or 180 million a year. That's consistent with Gartner's 179.9 million unit prediction for Android handsets this year. By comparison, Apple shipped 18.7 million iPhones during the first three months of the year. Over 90 days, that's 188,889 per day. Gartner predicts 90.6 million for iPhone (as measured by operating system) or about half the number of Android handsets. By that measure, I ask you which is driving smartphone growth? Not that an answer is necessary.

Last month, I asked: "Can Apple stop the Android Army's advances?" No. Android is unstoppable, as I predicted would be the case in September 2009 post: "Apple cannot win the smartphone wars".

Pingback: Android is unstoppable | App Flash