How financial services companies are using technology to fight the fraudsters [Q&A]

Account takeover attacks and online fraud of all types have skyrocketed during the pandemic as consumers have shifted almost all of their most important transactions to digital channels.

We spoke to David Vergara, senior director of security product marketing anti-fraud and digital identity solutions company OneSpan, to discover more about the emerging technologies that banks are beginning to use in the fight against fraud, including artificial intelligence, real-time risk analytics and behavioral biometrics.

Security industry responds to FBI warning of increased mobile banking risks

Earlier this week the FBI issued an alert about the risk of mobile banking platforms being targeted by cybercriminals during the current pandemic lockdown.

More than 75 percent of Americans used mobile banking in some form in 2019, but since the start of this year, a 50-percent spike in the usage of banking apps has been observed. Security professionals have been responding to the news.

Europe's fifth largest bank leaks sensitive information online

Santander, the fifth largest bank in Europe and the 16th largest in the world, has been leaking sensitive company data due to a misconfiguration on one of its websites.

Security analysts at CyberNews discovered that Santander's Belgian branch, Santander Consumer Bank, had a misconfiguration in its blog domain that allowed for its files to be indexed.

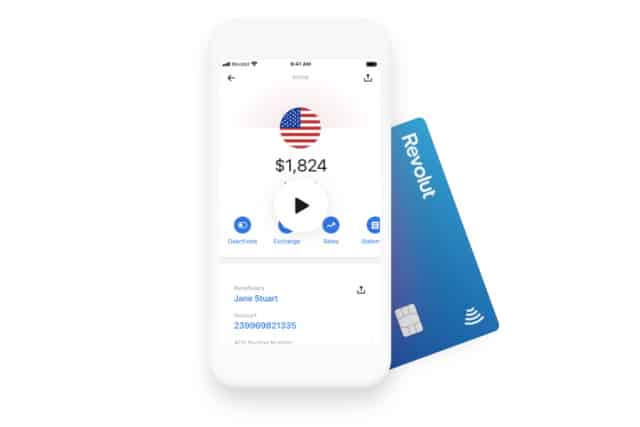

UK fintech Revolut officially launches its banking app in the US

Having amassed millions of customers in Europe, the British fintech Revolut is bringing its banking app and debit cards to the US.

The official launch comes after nine months of beta testing and has been facilitated by Revolut's partnership with Metropolitan Commercial Bank (MCB). While Revolut is not a bank, it offers many services including the ability to receive salary payments to your account, fee-free currency exchange, and a polished mobile app for easy money management.

Consumers put banks in the frame for holiday shopping fraud

As we head into the peak holiday shopping season, 66 percent of Americans believe they could easily become a victim of fraud, while another 65 percent think they are at a higher risk of having their financial information exposed as a result of their holiday shopping.

A new report from digital risk protection company Terbium Labs also shows that 68 percent would hold their bank at least partly responsible for fraudulent activity, no matter how the compromise occurred.

Common standards make access to and control of financial data easier

Ever more of our financial transactions are being carried out online, but if you have accounts with more than one provider, keeping track of information can be a challenge both for businesses and individuals.

Formed in October 2018, the Financial Data Exchange (FDX) is committed to uniting the financial industry around a single, interoperable and royalty-free standard for consumers and businesses to access their financial data.

Revolut is expanding its extraordinary multi-currency banking services to the US in partnership with Mastercard

Revolut is coming to the US. The innovative fintech firm has teamed up with Mastercard, and plans to bring its extraordinarily useful multi-currency card to America.

The digital banking service has already enjoyed huge success in Europe through its existing partnerships with Mastercard and Visa. Revolut's particular strength lies in the ease with which money can be converted between currencies with not only no or very low fees but also at incredible exchange rates -- all accessible through a mobile app.

Financial sector faces a broad range of cyberthreats

The finance industry is a prime target for cyberattacks and a new report from F-Secure shows that it's facing a wide range of threats that go far beyond traditional theft.

Attacks targeting banks, insurance companies, asset managers and similar organizations can range from common script-kiddies to organized criminals and state-sponsored actors. And these attackers have an equally diverse set of motivations for their actions, with many seeing the finance sector as a tempting target due to its importance in national economies.

Banking malware grows as cryptominers decline

The latest mid-year Cyber Attack Trends Report from Check Point shows mobile banking malware attacks are up 50 percent compared to the first half of 2018, while the number of organizations hit by cryptominers is down to 26 percent, from 41 percent last year.

Among the top banking malware variants are Ramnit (28 percent), a Trojan that steals banking credentials, FTP passwords, session cookies and personal data; Trickbot (21 percent), which first emerged in October 2016; and Ursnif (10 percent) a Trojan that targets the Windows platform.

Dark Web-leaked banking credentials leap 129 percent

A new report into the financial services threat landscape shows that there has been a huge increase in the number of banking credential leaks, while instances of compromised credit cards increased by 212 percent year-on-year.

The report from threat protection platform IntSights reveals many of the leaked credentials came from the Collection #1 database of over 773 million unique email addresses and 21 million unique passwords released onto the Dark Web in January this year.

Stricter payment requirements in Europe could drive fraud elsewhere

From September this year the second Payment Services Directive (PSD2) comes into force across the EU. This will require payment service providers to offer strong customer authentication (SCA) and third-party access to bank accounts or risk losing their their payment provider license.

But a new report today from fraud prevention company iovation suggests that stricter requirements for fraud prevention in Europe will drive fraud to other regions such as the US.

Banking Trojan attacks up by 16 percent in 2018

Attacks using banking Trojans are among the most popular with cybercriminals as they are focused directly on financial gain.

According to a new report from Kaspersky Lab, 889,452 users of Kaspersky Lab solutions were attacked by banking Trojans last year, an increase of 15.9 percent compared to 2017.

How Open Banking could make online transactions safer [Q&A]

We recently reported on how formjacking has become a popular and lucrative form of online fraud. It’s difficult for the consumer to detect which makes it a particular hazard.

But in the UK the new Open Banking standard, aimed at making it easier for consumers to share financial data across organizations, could make formjacking and other frauds obsolete. We spoke to Luca Martinetti, CTO and co-founder of financial API provider TrueLayer to find out more

Americans most worried about attacks on the financial sector

Americans are more worried about a cyberattack disrupting the financial and banking system than attacks against hospital/emergency services, voting systems or power grid/energy supply companies.

This is among the findings of a survey by ESET to mark National Critical Infrastructure Security and Resilience Month, which surveyed 1,500 Americans to discover their views on critical infrastructure attacks.

Financial services breaches triple since 2016

2018 has seen nearly three times as many breaches at financial services organizations as there were in 2016, according to a new report.

The study by cloud access security broker Bitglass finds there have been 103 breaches in this year’s report compared to just 37 two years ago.