UK fintech Revolut officially launches its banking app in the US

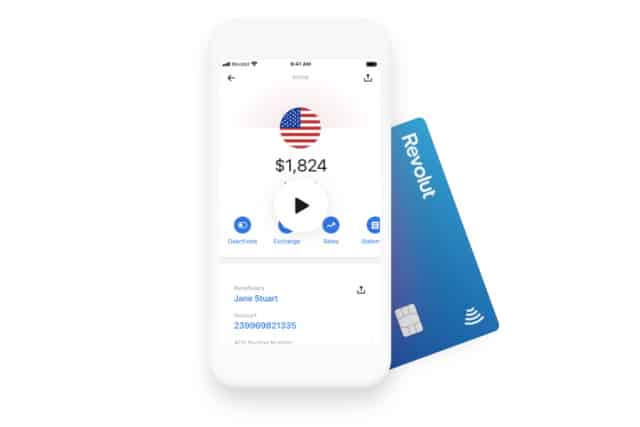

Having amassed millions of customers in Europe, the British fintech Revolut is bringing its banking app and debit cards to the US.

The official launch comes after nine months of beta testing and has been facilitated by Revolut's partnership with Metropolitan Commercial Bank (MCB). While Revolut is not a bank, it offers many services including the ability to receive salary payments to your account, fee-free currency exchange, and a polished mobile app for easy money management.

See also:

- Revolut raises $500m in funding, valuing it at $5.5bn and making it the most valuable UK fintech startup

- Revolut launches Revolut Junior to help kids learn financial skills

- Revolut is expanding its extraordinary multi-currency banking services to the US in partnership with Mastercard

Revolut's sophisticated app is at the heart of its success. It can be used to make in-person contactless payments, as well as making online purchases. The app also makes it easy to send and receive money, split bills between several people, and bounce money between accounts in different currencies -- all for free.

There's also a physical debit card which can be used in stores and online, and can be used to withdraw from ATMs. For customers sticking with the free package, there is a free ATM withdrawal limit of $300 per month, but there's no limit on -- or fees for -- shopping. You also have the peace of mind of FDIC backing which protects up to $250,000 of your money.

Upgrade to a Premium account for $9.99 per month, and the free ATM withdrawal limit increases to $600, and you have the option of creating an unlimited number of disposable virtual debit cards. In the pipeline there is also the more expensive Metal account which already exists in other countries and includes additional benefits.

You can find out more and sign up here.