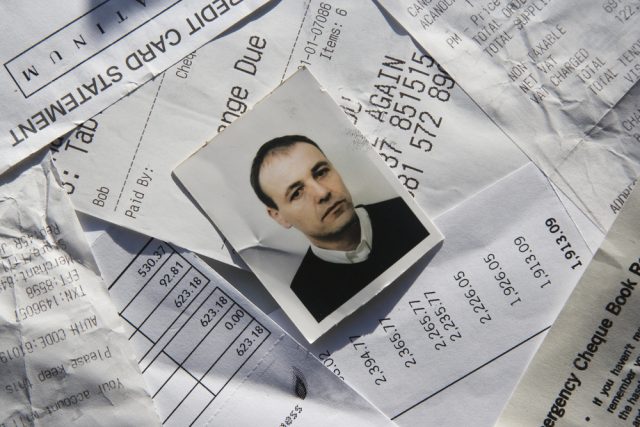

SentiLink's new ID Theft Scores targets stolen identities used to open financial accounts

Security has become slightly more difficult these days given that many people are now working at home and online. That’s just the beginning of the headaches for firms.

SentiLink, a leading security company, is trying to fight back against identity fraud with a new ID Theft Scores program. This is designed to complement its Synthetic Scores that are already in place and used by used by many top financial institutions in the US.

"All of us at SentiLink are extremely excited to introduce our new ID Theft Scores," said Naftali Harris, Co-Founder and CEO of SentiLink. "This new product is the culmination of months of hard work investigating cases to develop a deep understanding of the tactics fraudsters are using to steal identities and crystalizing these insights to produce the best model on the market. I couldn’t be more proud of our team and what we’ve built."

ID Theft Scores targets stolen identities used to open financial accounts and aims to prevent "same name fraud" where ID is stolen and used to apply for credit in the person's name.

"Companies using SentiLink’s ID Theft Scores are protected against common tactics used by fraudsters using stolen identities, and, more importantly, they are protected against emerging fraud vectors that traditional identity solutions are slow to detect," the company claims.

The service is available via API or batch upload.

Photo Credit: Robert Buchanan Taylor /Shutterstock