BlackBerry shipments grew five times faster than iPhone in Q3

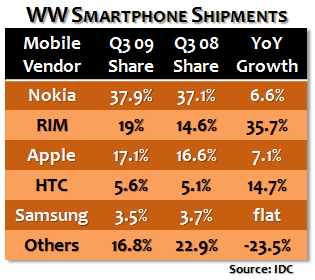

Despite last week's blog and news assertions that iPhone market share had reached 30 percent or even 40 percent, today IDC put Apple's smartphone smack in its place: No. 3, with 17.1 percent worldwide smartphone market share during third quarter. A year earlier, Apple ranked ahead of Research in Motion, which has reclaimed second spot, behind Nokia.

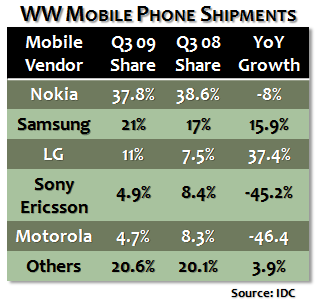

Manufacturers shipped 43.3 million smartphones during third quarter, up 3.2 percent from 41.9 million units in second quarter and up 4.2 percent from 41.5 million units in third quarter 2008. More broadly, manufacturers shipped 287.1 million handsets, up 5.6 percent year over year, according to IDC.

Nokia's overall handset and smartphone markets shares were almost identical, 37.8 percent and 37.9 percent, respectively. For smartphones, second-ranked RIM posted year-over-year shipment growth of 35.7 percent growth, compared to 7.1 percent for Apple. While iPhone is doing quite well, BlackBerry is doing much better. RIM shipments increased from 6 million to 8.2 million units year over year, while Apple shipments grew much less -- from 6.9 million to 7.4 million units.

Last week, I blogged that "iPhone cannot win the smartphone wars" and about a month ago that "iPhone's global success is more myth than marketing reality." Same day as my post from last week, ChangeWave released survey results asserting that BlackBerry smartphone market share was 40 percent, while Apple had reached 30 percent.

On October 27th, an Apple 2.0 blog post about the ChangeWave data set off a series of follow-up/copycat reports claiming that iPhone was in "striking distance" of BlackBerry, including All Things Digital, CNET, National Post, Technologizer and The Unofficial Apple Weblog, among, many, many, many others. Reports of iPhone soon overtaking BlackBerry were seemingly everywhere late last week.

But in keeping with reservations I expressed on Twitter last week: Apple's smartphone market share is nowhere near 30 percent. It's still quite aways from 20 percent. I tweeted: "Busy street. Do you see 3 iPhones or 4 BlackBerries for every 10 smartphones? No? Why then believe ChangeWave's 30% iPhone share claim?"

Several people responded that they in fact did see numbers that high. Michael Gartenberg, Interpret's vice president of strategy and analysis, tweeted: "it's all anecdotal which means nothing. That's why we do surveys ;)" To which I responded: "Right, but you also publish methodology with those surveys. This one has only number of people. Demographics unclear."

ChangeWave's presentation of the data reflects larger problems with how online news is degenerating into a mass grab for traffic and page views. ChangeWave was highly selective, presenting only market share data on Apple, Palm and RIM smartphones. The data polarized around BlackBerry and iPhone, conflict sure to make great blog titles and news headlines, particularly with Apple an endlessly hot topic. Meanwhile, ChangeWave's online report offered scant methodology -- other than number of people surveyed -- to support its findings.

ChangWave's methodology is much different than IDC's. The survey method gives a snapshot of what people are using now, which can be a very useful metric. But typically surveys are online, with people self-selecting to participate (I can only assume that's how ChangeWave collected the data). Self-selected surveys can skew the data, particularly for devices like BlackBerry and iPhone, which might have higher connected audience -- among other factors.

By comparison, IDC's data is more exact by counting the number of smartphones actually shipped during a three-month time period. While the data is more precise, it's less likely to reveal overall usage share -- something a well-done survey can do.

Gartner also counts number of units, but differently than IDC. Gartner counts sales to end users, while IDC tracks total units shipped, which doesn't necessarily mean sold. That's why Gartner unit shipments for iPhone are typically lower than Apple's shipment data, which corresponds with IDC data. Both Apple and IDC count shipments into the channel. The difference also explains why Gartner has consistently put BlackBerry ahead of iPhone, based on actual smartphone sales.

All three methodologies are useful for measuring a product's success, but in different ways. Gartner's data will contrast against IDC's, both offering necessary views on number of smartphones shipped and those actually sold. Gartner hasn't yet publicly released third-quarter smartphone shipment data.

As for iPhone, I predict the smartphone will remain in third place as long as US distribution is locked to a single carrier. Gartner predicts that by fourth quarter 2012, Android phones will be second to Symbian-based handsets (mostly from Nokia), with BlackBerry and iPhone neck-and-neck but RIM's device ahead.