IDC: Samsung smartphone shipments grew 439% in Q4 2010

I'm in a contrary mood. While everyone else is obsessing about iPhone and Research in Motion smartphone shipments, I'm singling out HTC and Samsung, which combined fourth-quarter performance foreshadows changes coming to the global smartphone market. Earlier today, IDC released Q4 and full-year 2010 smartphone shipments. Sidebar: For those folks still obsessing about Strategy Analytics tablet data, IDC likewise measures shipments into the channel. For actual sales -- that is to customers -- Gartner will soon deliver them.

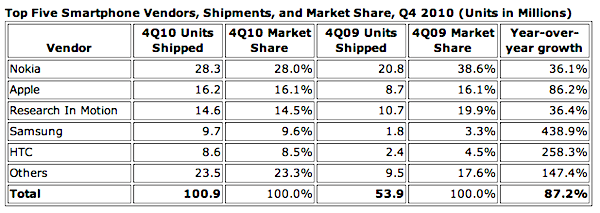

As others have reported, Apple nudged out RIM for second place in global smartphone share for fourth quarter, but not the year. While Apple shipments rose 86.2 percent, market share was a flat 16.1 percent in Q4 and the year-ago quarter. This trend I have repeatedly observed: ComScore smartphone shipment data released today and in January; Nielsen data released last week and early January; Canalys data released eight days ago and mid January. Apple is shipping a heck of a lot of phones, but the big growth and share gains belong to Android OS and its supporting manufacturers.

That brings me to HTC and Samsung, which are top-tier Android OEMs. The big story during the quarter isn't iPhone and RIM. "Android continues to gain by leaps and bounds, helping to drive the smartphone market," Ramon Llamas, IDC senior research analyst, said in a statement. "It has become the cornerstone of multiple vendors' smartphone strategies." He emphasized: "Android has multiple vendors, including HTC, LG Electronics, Motorola, Samsung and a growing list of companies deploying Android on their devices."

During fourth quarter, HTC shipments grew 258.3 percent share and Samsung 438.9 percent from Q4 2010. For the year, HTC grew by 165.4 percent and Samsung by 318.2 percent. Samsung market share nearly tripled year over year in Q4 -- 3.3 percent to 9.6 percent. HTC rose from 4.5 percent to 8.5 percent. For the year, HTC share rose to 7.1 percent from 4.5 percent. Samsung: 7.6 percent from 3.2 percent.

Another category also outgrew Apple during Q4 and nearly matched it for the year: Others, which includes Android-based branded smartphones coming out of China. Growth was 147.4 percent for the quarter and 88.7 percent for the year.

Increased competition will have huge impact during 2011, particularly as OEMs move Android down market to feature phones from smartphones. "IDC expects vendors to provide more mid-range and low-end smartphones at lower prices to reach the mass market," Llamas explained in the statement. "In the same manner, even high-end devices will become available at lower prices. This will result in greater competition and more selection for users."

Android's gains are coming mostly at Nokia's expense. While Nokia smartphone shipments grew handsomely during fourth quarter and for the year, market share receded rapidly. Year over year, Nokia smartphone market share plummeted to 28 percent from 38.6 percent during fourth quarter. For all 2010, Nokia's share loss was less: 39 percent to 33.1 percent year over year.

One more thing: IDC put Windows Phone smartphone shipments at 1.5 million -- or about 500,000 less than data released by Microsoft. The challenge now is to "sustain this initial growth in the quarters to come," Llamas expressed. By the way, HTC and Samsung also ship Windows Phone 7 handsets.