Global smartphone market grows 4% in Q4 2025 as Apple takes top spot

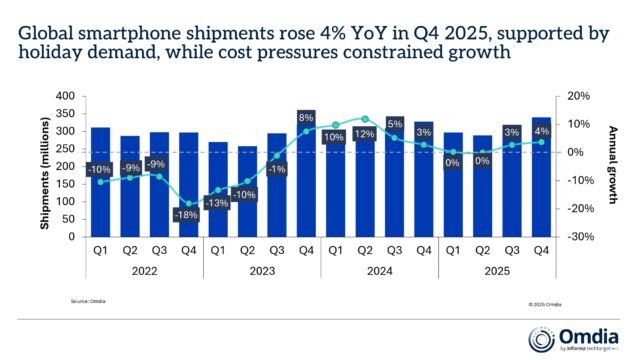

The global smartphone market returned to growth in the final quarter of 2025, according to new research from Omdia. Shipments rose 4 percent year over year, supported by the usual seasonal demand and tighter inventory control, although rising component costs began to pressure some vendors, making the market environment uneven.

Omdia’s data shows that growth in the quarter was concentrated among the largest manufacturers across several regions. Apple finished the quarter in first place with a whopping 25 percent global market share, while Samsung took second with 18 percent. Xiaomi, vivo, and OPPO rounded out the top five.

Apple delivered a record fourth quarter, driven by strong demand for the iPhone 17 lineup. The company also finished the year as the world’s largest smartphone vendor for the third consecutive year, ending slightly ahead of Samsung in total shipments.

Samsung held second place in the quarter, supported by momentum in the sub-$300 segment. Sales of Galaxy A-series devices played a key role, particularly models targeting price-sensitive markets.

Xiaomi retained third position with an 11 percent share, although its volume faced pressure in several core markets. Despite these challenges, the company kept its ranking for both the quarter and the full year.

vivo captured an 8 percent share, supported largely by performance in India. OPPO also posted an 8 percent share, returning to the global top five as shipments recovered toward the end of the year.

Smartphone shipments

For the full year, Omdia estimates global smartphone shipments rose 2 percent year over year to 1.25 billion units. The recovery was uneven, with a weaker first half followed by stronger demand in the second half. Emerging markets and positive reception of flagship launches helped lift volumes, although component constraints was a problem.

“Apple recorded its highest-ever fourth-quarter shipment volumes in 4Q25,” said Sanyam Chaurasia, Principal Analyst at Omdia. “The performance was driven by solid demand for the iPhone 17 series alongside continued traction from older-generation models during the holiday season. The base iPhone 17 exceeded expectations following storage upgrades at unchanged pricing, while Pro models gained momentum as Apple ramped up production through the quarter. Meanwhile, the iPhone Air acted as a portfolio showcase, with its slim form factor enhancing retail marketing and reinforcing the premium appeal of the Pro lineup.”

Memory supply conditions are emerging as a key constraint across the industry. Rising DRAM costs and tighter availability are already affecting vendor strategies, particularly in entry-level segments where margins are thinner.

“DRAM supply tightness has added considerable supply-side pressures to the smartphone industry, and is expected to be a key defining factor in 2026, said Runar Bjørhovde, Senior Analyst at Omdia. “Amid restricted DRAM supply of both LPDDR4 and LPDDR5, the battle to secure supply and limit cost increases is intense amongst all vendors. All vendors are utilizing mitigating tactics, for example, by emphasising long-term partnerships, utilizing scale to secure capacity, and focusing on their supplier base. The situation is particularly critical for vendors with heavier exposure to entry-level smartphones, which are highly price elastic and where memory and storage costs make up a higher share of the bill-of-materials.”

Looking ahead, Omdia expects pricing and operational efficiency to take priority as vendors plan for the year ahead. Higher component costs and slower replacement cycles are likely to drive product strategies and market structure.

“Rising cost pressures are reshaping how smartphone vendors approach 2026,” Chaurasia added. “Higher semiconductor costs, alongside a slowing refresh cycle, are expected to weigh on shipment momentum. In response, vendors are tightening configurations, aligning launch strategies closer with component availability and using channel-led levers such as services, trade-ins and ecosystem bundling to support higher price points. The push toward greater scale and supply-side leverage is already becoming evident, exemplified by realme moving under OPPO’s umbrella, reflecting early signs of consolidation as vendors seek greater scale to manage rising costs to maintain competitiveness in the decade’s second half.”

What do you think about the smartphone market’s direction heading into 2026? Let us know in the comments.

Image credit: daboost / depositphotos