Global IT spending will reach $3.6 trillion in 2011

Worldwide IT spending will rise by 5.1 percent this year to $3.6 tillion, according to Gartner. The new forecast increases year-over-year growth from 3.5 percent. The analyst firm released the data last week; some news is better kept on hold until supernovas like the Consumer Electronics Show or the Verizon iPhone pass by.

Richard Gordon, a Gartner research vice president, expressed cautious optimism. The forecast "is far from certain, given continued macroeconomic uncertainty," he said in a statement. "Favorable US dollar exchange rates" is one factor precipitating IT spending.

"While the global economic situation is improving, the recovery is slow and hampered by a sluggish growth outlook in the important mature economies of the US and Western Europe," Gordon warned. "There are also growing concerns about the ability of key emerging economies to sustain relatively high growth rates. Nevertheless, as well as a fundamental enabler of cost reduction and cost optimization, investment in IT is seen increasingly as an important element in business growth strategies. As the global economy repairs itself in coming years, we are optimistic about continued healthy spending on IT."

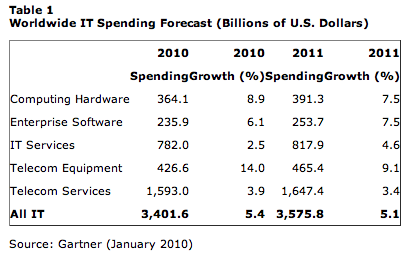

Gartner publicly disclosed information on five sectors: computing hardware, enterprise software, IT services, telecom equipment and telecom services. Telecom equipment had the strongest spending growth in 2010 (14 percent) and is expected to top the other categories in 2011 (9.1 percent). That's spending of $426.6 billion and $465.4 billion, respectively. While Gartner didn't say in its publicly disclosed information, the global cell phone market is one major factor driving telecom equipment spending. According to the United Nations, there are 5 billion cell phone subscribers worldwide, the majority in emerging markets such as BRIC (Brazil, Russia, India, China). Telecom providers are still building out networks in many emerging markets, particularly for providing data services.

Spending growth on computer equipment was 8.9 percent in 2010 but projected to be only 7.5 percent this year. That's $391.3 billion versus $364.1 billion, respectively. Gartner warned at least during the first half of the year continued global economic problems would affect PC growth. But the problems are much broader. The release of Windows 7 in October 2009 and Office 2010 in May 2010 precipitated an enterprise PC refresh cycle, particularly with as much as 85 percent of the install base running Windows XP. Many of those older PCs need upgrades or replacement to run Windows 7. While PC spending will ride the software's coattails this year, the bigger bump came in 2010.

Related: Enterprise software spending is on the rise, with Gartner forecasting 7.5 percent year-over-year growth in 2011, up from 6.1 percent in 2010. That's spending of $253.7 billion versus $235.9 billion respectively. IT services, which get a boost from new hardware and software upgrades, will see year-over-year growth rise 2.5 percent in 2010 to 4.6 percent this year. That's spending of $782 billion versus $817.9 billion, respectively.

By far, the sector with highest spending but lowest growth will be telecom services. Spending is predicted to reach $1.647 trillion this year.