Pandemic accelerates moves to the cloud

The COVID-19 pandemic has been a major influence on spending and digital transformation plans in 2020 with many businesses speeding up plans to move to the cloud.

A new study from BillingPlatform of 300 CFOs and senior finance executives shows that this trend is likely to continue into 2021. Respondents named their three top priorities as investing in cloud-based technologies (42 percent), identifying ways to drive higher revenue through new products and services (41 percent) and reducing operating costs or capital investments (36 percent).

Overcoming COVID-19: What finance leaders at recently-funded tech startups have learned so far

There’s no doubt that 2020 has been a testing year for everyone. According to data from PwC, 53 percent of CFOs expect a decrease in revenue and/or profits of up to 25 percent as a direct result of COVID-19. For many tech startups, that’s the difference between staying alive and closing for good.

With such uncertainty in the air, leadership teams have had to act fast and rethink their entire strategy.

Average financial services employees have access to over 10 million files

A new Data Risk Report from Varonis reveals that an average financial services employee has access to nearly 11 million files and for larger companies the number is 20 million.

This level of exposure means that if just one employee clicks on a phishing email there is potentially a huge amount of sensitive information at the hacker's fingertips.

Companies with good cybersecurity outperform the market

The risk of cyberattack and loss of data is very real for all companies and it's something that's starting to be a concern for investors too.

New research from security ratings company BitSight and Solactive, a German index engineering firm, shows that company's cybersecurity performance is an indicator of its business performance.

Hybrid cloud application delivery in financial services

The financial services sector is experiencing significant commercial disruption coupled with rapid innovation as established institutions strive to become more agile and meet evolving customer demand. As a result, financial services organizations are undergoing rapid digital transformation to meet changing customer needs and preferences, and to compete with a new generation of digital-native competitors. Hybrid cloud environments play a key role in this strategy, allowing greater speed, flexibility, and visibility over application delivery than on-premises data centers while also reducing costs.

But the move to hybrid cloud introduces new challenges as well. So, as financial services organizations plot their strategy for transformation, firms must make critical technical decisions about the clouds and form factors best suited to host their hybrid environment. They also need to consider how they will secure web applications against evolving threats such as ransomware, data theft, and DDoS attacks through measures such as DDoS protection and using a Zero Trust model. At the same time, they must also maintain regulatory compliance, governance, and auditability across complex, fast-evolving infrastructures.

These 5 trends in employee payments show the advance of American businesses

Businesses must constantly adjust to innovation. This year, American companies have incorporated new digital currency trends like never before. From cryptocurrency to AI, these offerings have revolutionized how employee payments operate.

Here are the top five trends in employee payments.

How financial services companies are using technology to fight the fraudsters [Q&A]

Account takeover attacks and online fraud of all types have skyrocketed during the pandemic as consumers have shifted almost all of their most important transactions to digital channels.

We spoke to David Vergara, senior director of security product marketing anti-fraud and digital identity solutions company OneSpan, to discover more about the emerging technologies that banks are beginning to use in the fight against fraud, including artificial intelligence, real-time risk analytics and behavioral biometrics.

Linux Foundation launches new community for finance professionals

The Linux Foundation is today announcing the formation of the FinOps Foundation to promote the discipline of cloud financial management through best practices, education, and standards

With support from founding members Apptio, Cloudeasier, Cloudsoft, CloudWize, Contino, Kubecost, Neos, Opsani, ProsperOps, Timspirit and VMware, the foundation is set to increase awareness and offer education for professionals in the emerging discipline of FinOps.

How my startup was born out of frustration

About seven years ago, as the COO of a financial services firm, I got pissed off. My company had a very simple service level agreement (SLA) with its clients: we would complete all of their financial transactions within three seconds. Period. And to ramp up our operations, we decided to move our infrastructure from on-site physical servers into the cloud.

But once we were on the cloud, we found that we were actually getting poorer transaction times -- way beyond our three-second SLA. We were not sure why, so we used a stack of off-the-shelf software to monitor the cloud’s operation. And when that didn’t give us the visibility we needed; we tried more applications. Even the cloud’s operators pitched in with their own professional service people. But again, no luck, no visibility, and worse, we started seeing a falloff in our business. Beyond that, we were spending twice as much on monitoring as we did on the cloud hosting itself. But to no avail, it didn’t offer us any help in troubleshooting our issue.

Sadly, Money in Excel is not the rebirth of the beloved Microsoft Money

More than a decade ago, we learned Microsoft Money was being canceled. At the time, I worked in banking and many of my clients were upset about it. Believe it or not, many people really depended on Microsoft's financial organization software. It was truly beloved. Why the company canceled it I don't know for sure, but I'd guess the Windows-maker saw the writing on the wall -- the future of money management was mobile apps and web-based account aggregation services, such as Mint.com. Financial software that you install to a PC's storage disk, such as Microsoft Money, was on borrowed time.

Fast forward to 2020, and today, Microsoft announces a new way to manage your money using a PC -- Money in Excel. Sadly, this is not the rebirth of Microsoft Money, but instead, a plugin/template for Excel that allows you to easily import your financial information. This is not really a Microsoft service, either. The Windows-maker has tapped Plaid.com to perform the actual aggregation. Once imported, you can then track your spending, including viewing graphical charts to better understand both where your money is and where it is going.

Fintech: Leak shows Google is working on a debit card to rival Apple Card

Leaked pictures suggest that Google is preparing to launch its own physical and virtual debit cards. TechCrunch cites multiple reliable sources in a report that gives a glimpse into Google's future fintech plans.

Images of not only the physical card itself but also screenshots of the Google Pay app with references to the virtual version of the card show off the design, as well as the spending tracking features that are in the pipeline.

Economic uncertainty gives fintech apps a boost

The COVID-19 crisis has led to major economic as well as health concerns and new research from mobile app marketing company Liftoff in partnership with analytics platform App Annie shows more people are turning to mobile apps to manage their money.

The report analyzed 22 billion ad impressions across 382 million clicks, seven million app installs, and five million first-time events in 117 apps for the full calendar year 2019. It shows that the self-reliant nature of contemporary fintech apps has taken precedence over legacy banking apps, a trend that is likely to continue in the current economic climate.

Fintech firm Curve launches numberless cards for investors in Europe

Curve, the UK-based fintech company, has announced that European investors from its crowdfunding round will be among the first to received more secure numberless payment cards.

The cards do not feature primary account numbers (PAN) on their face to improve security. The cards' chips have the data stored on them so they can be used for contactless payments, chip and PIN transactions or in machines, and card details can only be accessed from within the Curve mobile app.

Zoom CEO and other executives offloaded millions of dollars of shares before privacy and security scandals

Zoom has had something of a rocky ride in recent weeks and months, enjoying a surge in popularity due to increased homeworking. But there have also been controversies with numerous privacy and security issues leading to some users choosing to jump ship to alternative platforms such as Microsoft Teams.

Filings with the SEC show that executives at Zoom Video Communications offloaded millions of dollars' worth of shares before the controversies started to upset users.

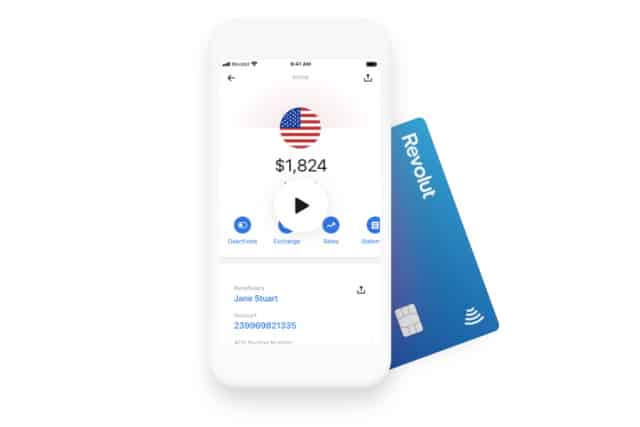

UK fintech Revolut officially launches its banking app in the US

Having amassed millions of customers in Europe, the British fintech Revolut is bringing its banking app and debit cards to the US.

The official launch comes after nine months of beta testing and has been facilitated by Revolut's partnership with Metropolitan Commercial Bank (MCB). While Revolut is not a bank, it offers many services including the ability to receive salary payments to your account, fee-free currency exchange, and a polished mobile app for easy money management.