Sadly, Money in Excel is not the rebirth of the beloved Microsoft Money

More than a decade ago, we learned Microsoft Money was being canceled. At the time, I worked in banking and many of my clients were upset about it. Believe it or not, many people really depended on Microsoft's financial organization software. It was truly beloved. Why the company canceled it I don't know for sure, but I'd guess the Windows-maker saw the writing on the wall -- the future of money management was mobile apps and web-based account aggregation services, such as Mint.com. Financial software that you install to a PC's storage disk, such as Microsoft Money, was on borrowed time.

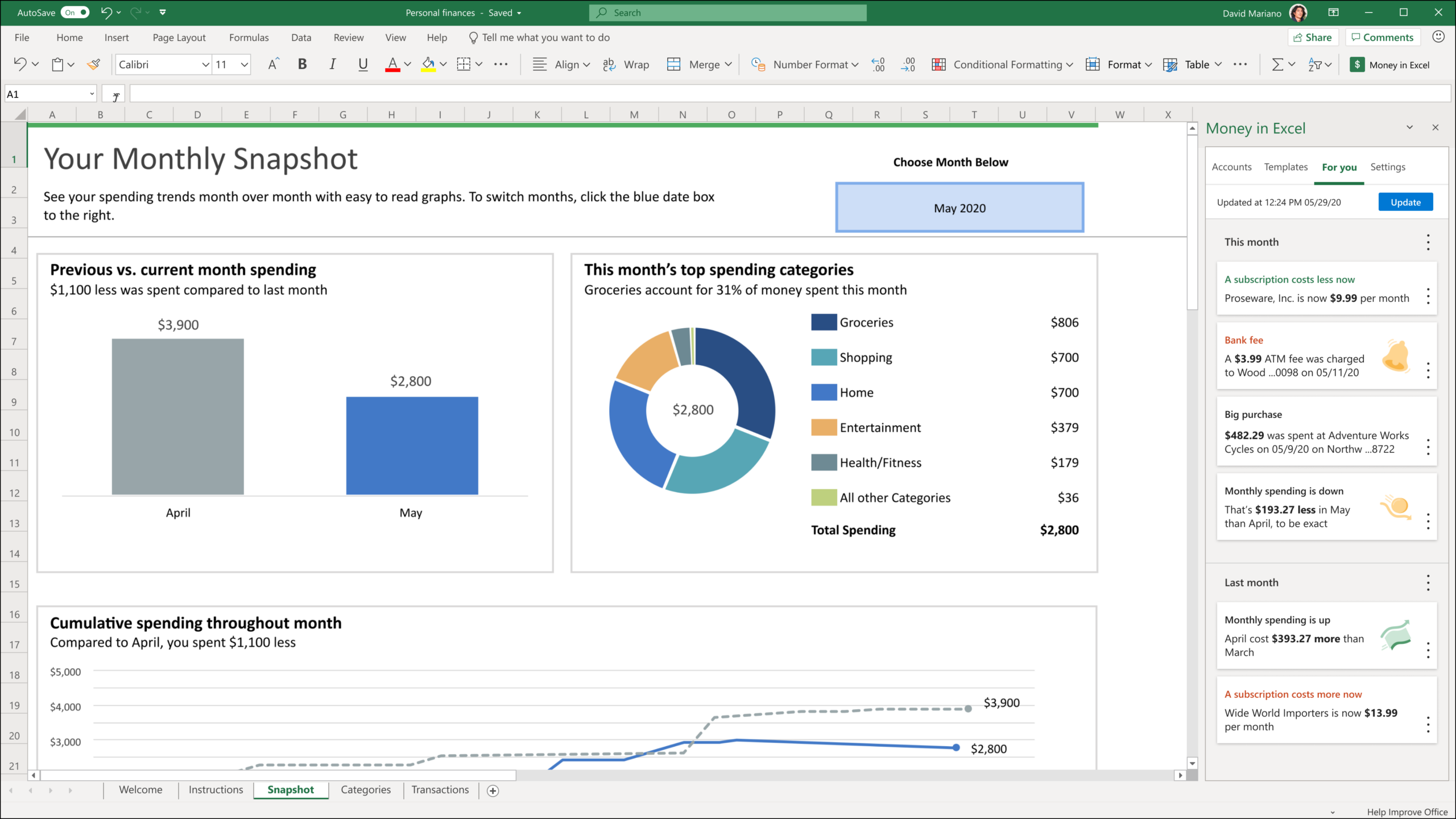

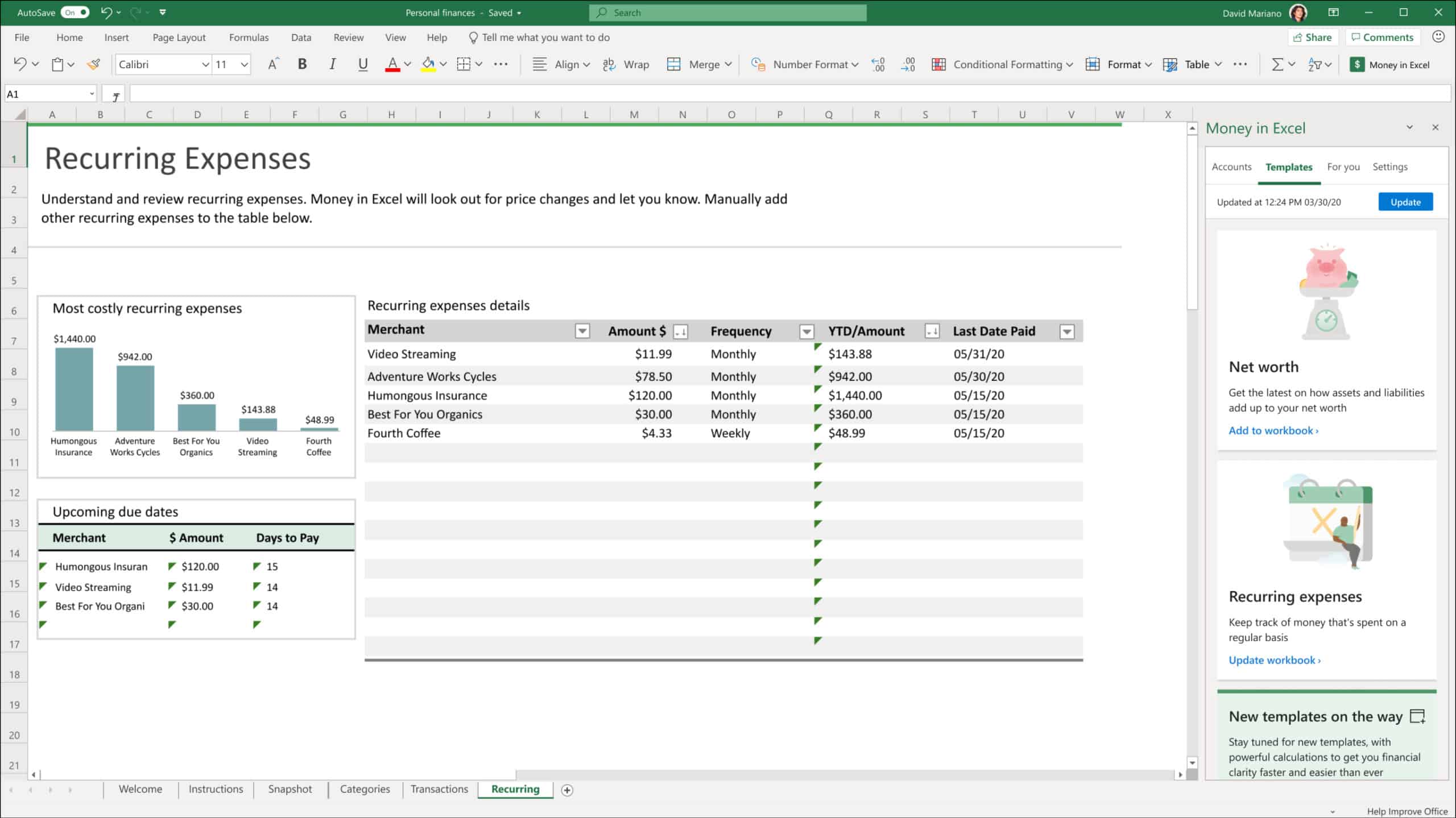

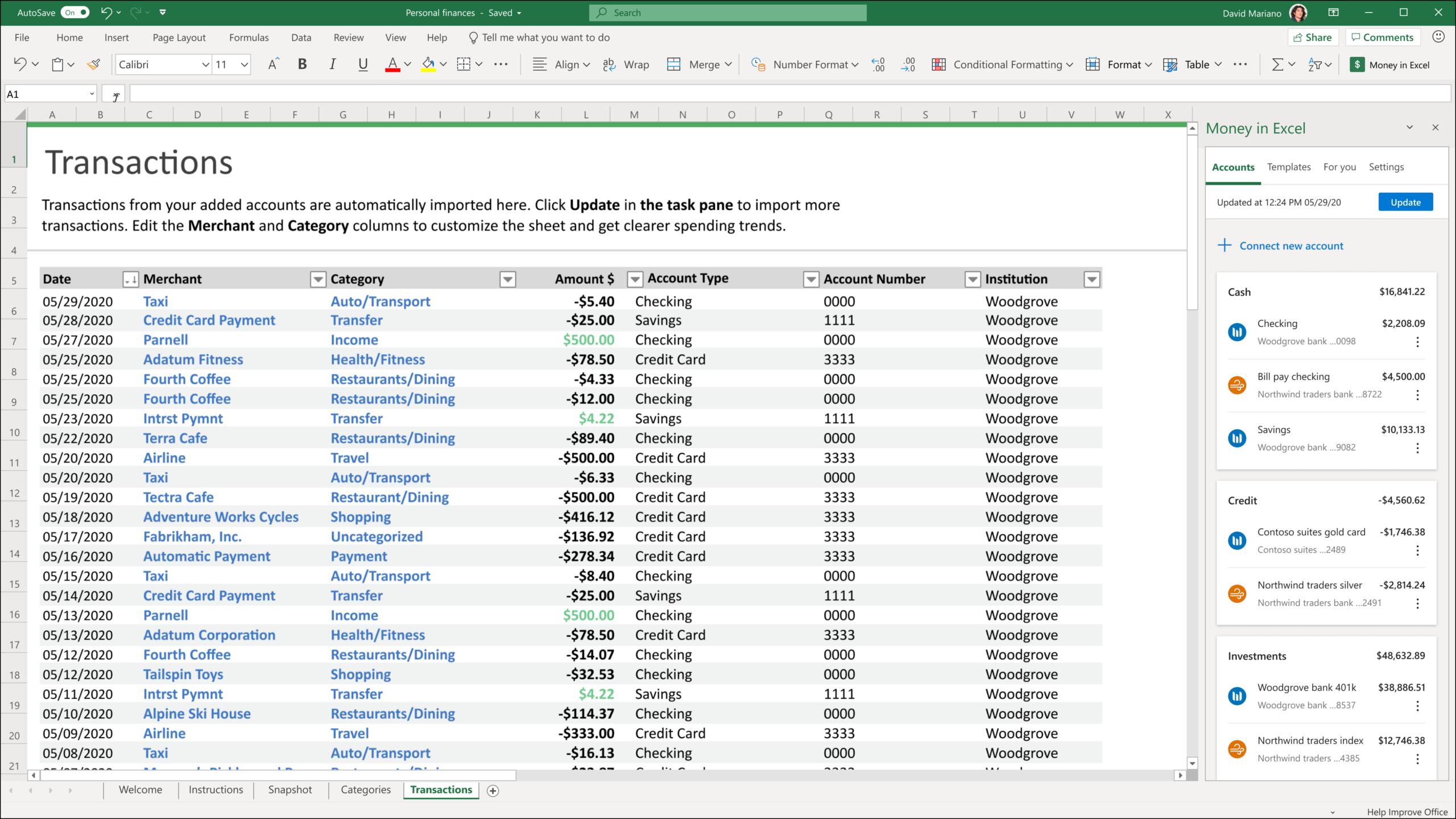

Fast forward to 2020, and today, Microsoft announces a new way to manage your money using a PC -- Money in Excel. Sadly, this is not the rebirth of Microsoft Money, but instead, a plugin/template for Excel that allows you to easily import your financial information. This is not really a Microsoft service, either. The Windows-maker has tapped Plaid.com to perform the actual aggregation. Once imported, you can then track your spending, including viewing graphical charts to better understand both where your money is and where it is going.

"Once your financial accounts are connected, Money in Excel will automatically import your transaction information from all your accounts into one workbook. You no longer need to spend hours manually setting up a personal finance spreadsheet from scratch; Money in Excel does it for you in just a few seconds. And every time you want to update the workbook with the latest transactions, just click the Update button and get the latest snapshot of your transactions and accounts without ever leaving Excel," says Arjun Tomar, Product Marketing Manager, Microsoft 365.

Tomar further says, "We know people often choose Excel to manage their finances because it allows them to take a more personalized approach. With this in mind, we designed Money in Excel to be easily customizable to suit your needs and goals. For example, if a certain transaction does not fall within an existing spending category, you can simply add your own. If you want to perform a quick custom analysis, you can copy the relevant transactions into a new Excel sheet and use any of your favorite Excel features to do quick calculations. And while Money in Excel already comes with charts that have been created based on your transaction information -- such as one for your recurring expenses -- you can always create your own charts and tables and add them to the workbook."

While this is certainly cool and worth a look, it absolutely isn't magic. These financial aggregator services have a tendency to break regularly, as banks are constantly making front end changes. It isn't uncommon to find out an account has simply stopped updating without warning. You are then at the mercy of Microsoft (Plaid, really) to fix the connection. The more accounts you have, the more likely you are to experience issues too. This is particularly true if you deal with many small local banks or credit unions. When it works it is magical, but when connections break it can be maddening.

If you want to try Money in Excel, you can grab the template here. There is one big caveat, though -- you must be a Microsoft 365 Family or Personal subscriber to take advantage. Are you the type of person that buys Office once (ie. Office 2019) rather than go the subscription route? Sorry, you are apparently out of luck. Also, as of now, it is only available to folks in the USA.

Image Credit: Roman Samborskyi / Shutterstock