Enterprises plan to spend more on identity verification

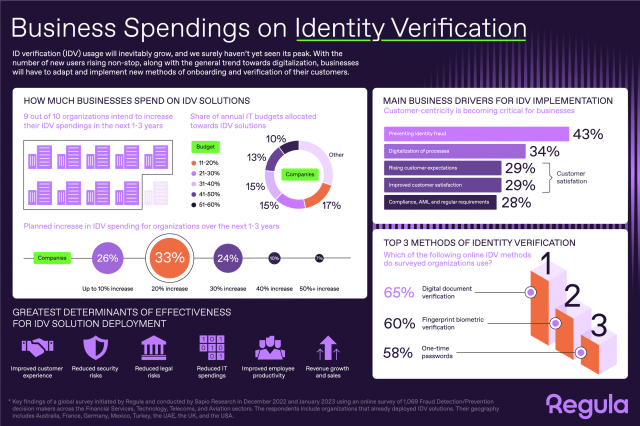

A new report shows that 91 percent of organizations in the financial services, technology, telecoms, and aviation sectors worldwide intend to increase their spending on identity verification solutions in the next one to three years.

The report from Regula says 17 percent of businesses intend is to dedicate 11-20 percent of their IT budget annually to IDV solutions, with 15 percent of businesses opting for 21-30 percent.

The most popular method chosen by organizations is digital document verification -- 65 percent of the surveyed companies use it in their work, particularly in the fintech sector (71 percent). Furthermore, 94 percent of those who do not currently utilize this method plan to do so in the coming year.

Fingerprint biometric verification is the second most popular identity verification method, used by 60 percent of organizations, particularly in the telecom and fintech industries. One-time passwords take third place (58 percent).

Henry Patishman, executive VP of identity verification solutions at Regula, says, "The IDV market will inevitably grow, and we surely haven’t yet seen its peak. With the number of new users rising non-stop, along with the general trend towards digitalization, businesses will have to adapt and implement new methods of onboarding and verification of their customers. It may sound like a challenge to embed a wide spectrum of various IDV solutions; however, the whole process can be easily organized with a single solution from one vendor whose comprehensive approach to IDV solution development makes it possible to cover all the steps in identity verification."

Preventing identity fraud is cited as the leading reason for implementing an IDV solution, with 43 percent of surveyed organizations choosing it. Digitalization of processes is the second most popular reason, with 34 percent of citing it.

When it comes to measuring the success of IDV implementations, 55 percent base this on improved customer experience stemming from faster and simpler onboarding processes. This is especially true for the Banking sector (61 percent). Also, 50 percent of organizations measure success according to reduced security risks by applying reliable fraud detection techniques, and 45 percent base their assessment on reduced legal risks by meeting anti-money laundering (AML) and compliance requirements.

You can see an overview of the findings in the infographic below.

Image credit: ekkasit919/depositphoto.com