iPhone kills carrier profits

Second in a series. Two days ago, I established that iPhone's market share is heavily dependent on carrier subsidies. Now let's take a look how iPhone subsidies affect carriers and the potential impact this could have on Apple.

To Summarize, under iPhone's current subsidy structure, it is practically impossible for carriers to break-even. Even when factoring higher churn rate of other smartphones and lower cost of retaining iPhone users, Apple's device still costs carriers too much to be really profitable compared to other smartphones. Essentially, Android, BlackBerry and Windows Phone users subsidize iPhone owners. Carriers make more money from non-iPhone smartphone owners, while raising data and early-termination fees to offset iPhone costs.

Are iPhone Subsidies a Problem for Carriers?

Apple CEO Tim Cook had the following to say, to calm investors regarding any potential fears about carrier subsidies:

The most important thing by far is for Apple to continue making great products that customers want. And we are deeply committed to doing this and are innovating at a rate and pace that's unbelievable in this area. For -- from a carrier's perspective, I think it's important to remember that the subsidy is not large relative to the sum of the monthly payments across a 24-month contract period. And any delta between iPhone and maybe another phone is a -- an even smaller level of difference.

And iPhone has some distinct advantages for the carrier over competing smartphones. For example, many of the carrier executives have told me that churn from iPhone customers is the lowest of any phone they sell in their whole -- in all of the phones they carry. And that has a significant direct financial benefit to the carrier.

Also, our engineering teams work extremely hard to be efficient with data and differently than some others. And we believe that as a result of this, that iPhone has far better data efficiency compared to other smartphones that are using sort of an app-rich ecosystem.

Finally, we think that the -- and this is the most important, is that iPhone is the best smartphone on the planet to entice a customer who is currently using a traditional mobile phone to upgrade to a smartphone. This is by far the largest opportunity for Apple, for our carrier partners and is a great, fantastic experience to the customer. And so there's a win-win-win there.

While Tim Cook is one of the best CEOs in the world right now, I would rather not take his words at face value. So let's analyze his arguments and see if they hold any water.

I've focused on the US market, as these trends would most likely hold good across the globe. Analyzing figures from AT&T and Verizon, for the last four quarters, can give us great insight into the financial impact of iPhone. Since Sprint only began selling iPhone in Q4 2011, it has been excluded from this analysis.

Incremental Subsidy Costs

The primary reason for iPhone's dependence on carrier subsidies is that all models are high-priced, high-margin products for Apple. So even though a subscriber may get an iPhone 3GS for free or an iPhone 4 for $99 on a two year contract, carriers still have to pay Apple an average subsidy of roughly $400 - $450 per device. Meanwhile, Apple's competition is diversified across price points, receiving an average of $200-$300 in subsidies per device. On average, it is safe to assume that iPhone receives an incremental subsidy of $150 per device, when compared to the competition.

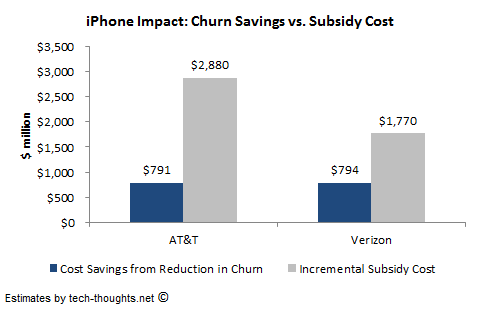

Based on the incremental subsidy per device and iPhone sales from AT&T and Verizon from Q2 2011 to Q1 2012, we can calculate the total incremental subsidy burden for these two carriers.

Subscriber Churn Savings

Cook may very well be right in his assertion that iPhone subscribers have a lower churn rate than those using competing smartphones. But according to Consumer Intelligence Research Partners (CIRP), the churn rate among iPhone subscribers is just 6-percent lower than other smartphone subscribers, which means the reduction in carriers' overall smartphone churn rate would be even lower. Now we need to understand the cost savings that carriers receive thanks to iPhone and compare that with the additional subsidy burden. To calculate these cost savings, I have actually assumed that the overall smartphone churn rate of carriers reduces by 6 perceent because of carrying iPhone, which implies the churn rate reduction among iPhone users is assumed to be around 10%. This assumption actually favors Apple's stance more than Consumer Intelligence's findings do.

There are numerous estimates of the cost of acquiring a wireless subscriber. According to one estimate, the cost of acquiring a wireless subscriber ranges from $300 to $400. Another estimate measures this cost at $250 to $300 per customer. A research report from 1998 also estimates this cost as $400. Since estimates seem to be fluctuating even over such a long time frame, we can make a safe assumption of the cost of acquiring a customer as the high end of the ranges mentioned here, i.e. $400. Most reports also mention that acquiring a new customer costs five times as much as retaining a current customer, i.e. $80. So, the incremental cost to replace a subscriber would be the difference of these two, i.e. $320.

Now, using the figures above, in conjunction with the number of postpaid smartphone subscribers for Verizon (47 percent of 88 million postpaid subscribers) and AT&T (41.2 million postpaid smartphone subscribers), we can estimate the total savings carriers have gained thanks to the reduction in churn rate, due to iPhone. The actual cost savings would be lower than this as the average size of the AT&T and Verizon subscriber base over the last four quarters would be lower than the size in the latest quarter.

Churn Savings vs. Subsidy Cost

As the chart clearly shows, costs savings due to reduced churn is only 27 percent of incremental subsidy cost for AT&T and 45 percent for Verizon. This means AT&T is actually losing a net figure of more than $2 billion, while Verizon is losing nearly $1 billion, due to high iPhone subsidies. Verizon's gap is lower because it sold fewer iPhones than AT&T. This gap is so large that any realistic change in inputs would not affect the outcome by much. And the really scary part for carriers is that incremental subsidy costs would continue to outgrow cost savings as iPhone sales increase.

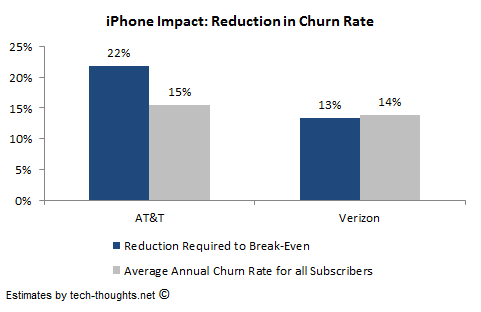

We can also estimate the cost savings and the corresponding reduction churn rate required to break even on iPhone's incremental subsidy costs. Using average monthly churn figures for AT&T and Verizon from Q2 2011 to Q1 2012, we can calculate the also average annual churn rate for these carriers and compare these figures with the required reduction in churn rate:

Does anybody else see a problem here? The required reduction in churn rate to break even on the subsidies is actually higher at AT&T and nearly equal at Verizon, when compared to the average annual churn rate for all subscribers (smartphones & feature phones). Given that both Verizon and AT&T have a monthly churn rate in the range of 1-1.5 percent for smartphone subscribers, the average annual churn rate for smartphone subscribers would be in the same range as in the chart above. Given these figures, it is practically impossible to achieve break-even under iPhone's current subsidy structure.

This analysis does not even take into account the fact that Android smartphones consume nearly 20 percent more data than iPhones (this seems to hold true even with iCloud and Siri). In the absence of "all-you-can-eat" data plans, which is where carriers seem to be moving, this would translate into a much higher average revenue per user (ARPU) figure from Android smartphone subscribers as compared to iPhone subscribers. Clearly, there is no incremental ARPU gained from iPhone subscribers that can even begin to balance out the incremental subsidy costs.

Based on the analysis above, it is clear that Cook's comments do not mean much from a carrier's perspective and that iPhone's current subsidy level is unsustainable. The only positive is that iPhones use less data and hence, place less load on network infrastructure, but that results in lower ARPU as well.

Can Carriers Really Reduce Subsidies on iPhone?

Carriers have already begun their efforts to reduce the impact of subsidies on their financials:

1. The push started with US carriers increasing upgrade fees for customers who wanted to switch phones and increasing data subscription charges.

2. Verizon has told its subscribers that their current unlimited data plans will only remain available for customers who buy phones at full retail price, i.e. with zero subsidies.

3. AT&T made the boldest move, by announcing its intention to limit 2011 smartphone sales to 2012 levels, and most importantly push to reduce subsidies on phones it currently sells. Given that iPhone accounted for 78 percent of AT&Ts Q1 2012 smartphone sales, that push is obviously going to be against Apple.

CLSA has argued that the presence of most favored nation (MFN) clauses in all of Apple's contracts with US carriers would mean that "US carriers would need permission from Apple to alter subsidy levels". To be honest, this argument doesn't make much sense. CLSA admits that the presence of a MFN clause implies that any offering to one carrier has to necessarily be offered to another. An MFN clause, by definition, ensures that if one carrier is able to negotiate better terms with Apple when their contract runs out, those terms are applicable to the existing contracts of the other carriers as well. The MFN clause in no way implies that you need permission to implement the clause. Therefore, with AT&T's contract set to run out first, it would also be beneficial for Verizon and Sprint if AT&T was able to negotiate lower carrier subsidies from Apple.

AT&T is very clear that it intends to reduce iPhone's subsidy burden. Since AT&T is the responsible for the highest number of iPhone sales in the country and iPhones comprise a majority of AT&T's smartphone sales, neither AT&T nor Apple would consider walking away from each other. My guess is that both sides play hardball and eventually come to a compromise, resulting in a reduction of iPhone subsidies across all US carriers to a more manageable level.

Apple's carrier subsidy reduction could either be implemented by allowing carriers to increase contract prices or by reducing margins on iPhone. Cook's decision could boil down to a classic volumes vs. margins debate.

Conclusion: From the analysis above, it is clear iPhone subsidies are not beneficial to carriers and seem to be unsustainable. Since the massive margins and volumes on iPhone are the biggest reason driving Apple's high gross margins on a consolidated basis, any reduction could negatively affect Apple's stock price.

Reprinted with permission.

Photo Credit: Lou Oates/Shutterstock

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of tech-thoughts.net.