iPad accounted for 12 percent of global mobile PC shipments in Q4 2010

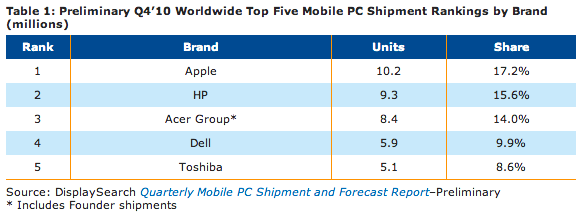

NPD's DisplaySearch has joined Canalys as labeling iPad as PC, pushing Apple to the top spot in global mobile PC shipments during fourth-quarter 2010. According to DisplaySearch, Apple shipped 10.2 million mobile PCs, including iPad, compared to second-ranked HP's 9.3 million. Apple's market share: 17.2 percent. It's noteworthy that Apple shipped considerably more smartphones, exceeding 16 million units, during the same quarter.

The findings pit Canalys and DisplaySearch against Gartner and IDC, which categorize iPad as a media tablet. IDC makes puzzling demarcation: Media tablets range in size from 5 inches to as much as 14 inches and run so-called lightweight operating systems, such as Apple's iOS and Google's Android OS, on ARM processors. However, IDC classifies tablets running Windows on x86 processors as PCs.

I first raised the "Is iPad a PC?" question in August and October 2010 posts, and it's a question with increasingly broader significance, given some of the multi-core Android tablets introduced over the last six weeks, such as the HTC Flyer, Motorola XOOM and Samsung Galaxy Tab 10.1.

"While we anticipate increased competition in the tablet PC market later this year with the introduction of Android Honeycomb-based tablets, Apple's iPad business is complementing a notebook line whose shipments widely exceed the industry average growth rate," Richard Shim, DisplaySearch senior analyst, said in a statement. "Apple is currently benefiting from significant and comprehensive growth from both sectors of the mobile PC spectrum, notebooks and tablet PCs."

The larger question: Will iPad cannibalize mobile PC shipments? "Cannibalization seems limited at this point," Shim said. However, Gartner and IDC both reported that in fourth quarter iPad did cannibalize netbook sales at the least. It's a fundamental reason often overlooked in explaining why so many manufacturers are suddenly so hot for tablets. Sure, Apple blew open the category last year, shipping 14.8 million units in the first nine months, generating $10 billion in fresh revenue. More broadly, there is the inevitable shift to smaller more portable devices, a longstanding trend tablets are accelerating. PC OEMs need to worry as much, if not more, about shifting existing lines of their PC business to tablets as competing with upstart Apple.

Last week I asserted that "the PC era is over," as cloud-connected devices, including smartphones and tablets, take on more computing and informational relevance to businesses and the consumer mass-market. From that perspective, DisplaySearch's lumping tablets in with notebook PCs is sensible.

DisplaySearch offered up mobile PC shipment data with and without tablets, which indicates future growth trends and how the market is changing (and it sure looks like there is cannibalization to me). OEMs shipped 59.6 million mobile PCs, including tablets, in fourth quarter 2010, up 17 percent year over year and 8 percent sequentially -- the highest growth rates since DisplaySearch started tracking the market in 1999. Without tablets, shipments grew only 4 percent year over year and an anemic 1 percent sequential growth. The sequential figure, going into the big holiday sales quarter, foreshadows increased cannibalization -- that's my assertion, not DisplaySearch's.

Looking at the numbers differently, iPad accounted for about 12 percent of global mobile PC shipments, including tablets, during fourth quarter 2010.