AI photography drives trend toward fewer smartphone cameras

How many cameras does your smartphone have? My iPhone 16 Pro, like the Google Pixel 10 pictured above, has four, which is above the current average according to new data from Omdia’s Smartphone Model Market Tracker 2Q25 which shows that the number of cameras in smartphones is falling.

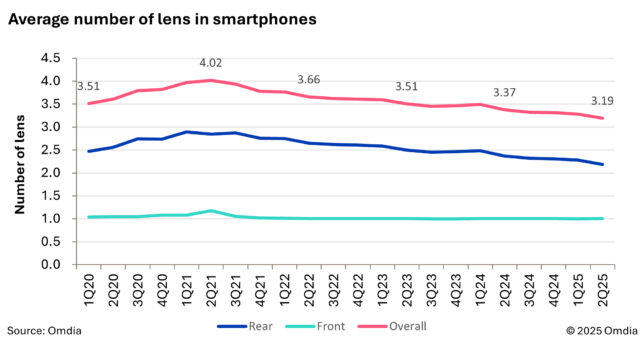

Smartphones that shipped in the second quarter of 2025 had (on average) 3.19 lenses, which is down from 3.37 during the same period last year.

This number covers both rear and front cameras, and as most phones still only have one on the front, the drop is driven mainly by fewer rear cameras.

The average rear camera count is now 2.18, compared to 2.37 last year. The figure has been falling for 13 consecutive quarters after reaching a peak of 2.89 in the first quarter of 2021.

“The reduction in camera lenses not only lowers costs but also frees up space for larger batteries,” said Jusy Hong, Senior Research Manager at Omdia.

By shipment share, dual rear-camera models made up 41 percent of the market in 2Q25, while triple-camera devices accounted for 36 percent. Smartphones with a single rear camera increased their share to 21 percent, helped by launches such as Apple’s iPhone 16e and Samsung’s Galaxy S25 Edge.

As lens counts are falling, so sensor resolution is rising, with 50MP-class cameras making up 58 percent of shipments in 2Q25 and sensors above 100MP hitting 9 percent. Lower resolution cameras have quickly fallen out of favor, with cameras under 15MP dropping to just 12 percent, compared with 54 percent just five years ago.

“With advances in AI-driven photography, the number of lenses will continue to decline,” Hong added.

Focus for cameras is changing

Omdia’s report suggests manufacturers are moving away from how many lenses a smartphone has, instead focusing on how capable each sensor is, with greater attention given to computational photography, image quality, and energy efficiency.

For manufacturers, fewer lenses also simplify design and allow more room inside the phone for larger batteries or other components.

The move has implications for suppliers as well. Reflecting the reduced need for lenses, Omdia forecasts global demand for smartphone CMOS image sensors (CIS) will fall 4.3 percent year on year in 2025, reaching 4.19 billion units.

The market for smartphone photography hardware is clearly entering a new phase. While multi-camera setups once dominated marketing campaigns, the balance is moving toward fewer but higher quality sensors, with AI inevitably taking on a larger role in enhancing photography.

What do you think about fewer smartphone cameras but higher resolutions? Let us know in the comments.