Bing gains show why Microsoft-Yahoo search deal is a dumb idea

One of Microsoft's major justifications for the Yahoo search deal is scale. CEO Steve Ballmer has repeatedly asserted that greater scale would allow Microsoft to improve search accuracy. Just last week he told Search Marketing Expo West attendees: "The ability to put together Yahoo's volumes and Microsoft's volumes and use that in a way that improves the experience more, let's call it all involved parties, we think is absolutely fantastic."

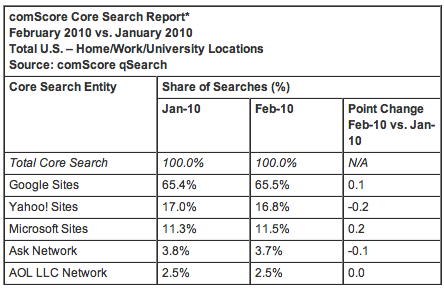

But the scale argument presumes that Microsoft and Yahoo would combine search share. The deal is in place but not fully implemented, and already Microsoft's Bing is taking away search share from Yahoo -- not Google. In February, Bing's US search share reached 11.5 percent, up from 11.3 percent month over month, according to ComScore. Yahoo share declined to 16.8 percent from 17 percent during the same time period. In June 2009 -- the month before announcing their search deal -- Yahoo search share was 19.6 percent and Microsoft 8.4 percent. But Microsoft already was rising, because of the Bing launch and millions of dollars in supporting advertising. For perspective, Google search share was 65.5 percent in February and 65 percent in June 2009.

The Microsoft-Yahoo search deal is a dumb idea, for three main reasons:

1) Microsoft's marketing push behind Bing shows that share can be gained organically, without taking on the expense or logistical hassle of managing Yahoo's search business.

2) Microsoft search share gains foreshadow the inevitable: Microsoft-Yahoo combined search share will diminish rather than aggregate. Combined share would have been 28 percent in June 2009; 28.3 percent in February. At first blush, the numbers might seem encouraging for aggregated share but the cost is declining Yahoo share. Cannibalization is inevitable.

Also the ComScore share data is for search engines and doesn't include heavily searched cross-domains like YouTube. Americans conducted 9.9 billion searches at Google in February, 2.496 billion at Yahoo and 1.498 billion at Bing. YouTube (and a few other Google sites): 3.553 billion or about 30 percent more than Yahoo. If ComScore ranked YouTube like Google, Yahoo would be No. 3 in search share.

I first warned about flawed combined search share math about a year before (May 2007) Microsoft gave up its hostile Yahoo takeover: "There is no guarantee a Microsoft-Yahoo could successfully aggregate search share." Bing is more likely to cannibalize Yahoo share than combine with it over the next 12 months. In July 2009 I predicted: "Combined Microsoft-Yahoo share will be less than 20 percent within 12 months of the deal's closing." We'll see.

3) Search is -- or was -- Yahoo's crown jewel. Yahoo started as a search engine and remained a contender even as Google gained share. As I asserted in May 2008: "Removing search would be akin to lobotomizing Yahoo." That's essentially what the Microsoft search deal will do to Yahoo.

Yahoo's banner advertising business is still big, but its future is uncertain during the Microsoft search-take-over transition. Meanwhile, Google has added banner ads to YouTube and to mobile search.

Yahoo is little more than a beloved brand without search, particularly with CEO Carol Bartz dismantling the company's other prized assets. You know, little things like disbanding the mobile group earlier this week. Would someone please take away the axe from that woman!

So what do you think? Should Microsoft and Yahoo have cut that search deal? Please answer in comments.