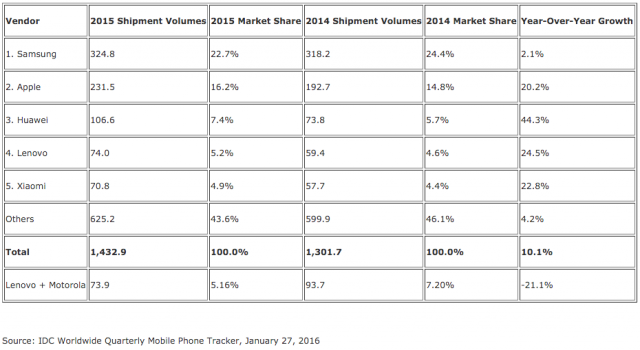

Smartphone shipments reach 1.43 billion units, setting new record

IDC has released its report on smartphone shipments in 2015, revealing record numbers for both Q4 and the whole year. In the last three months of 2015, vendors moved just shy of 400 million units, out of a total of 1.43 billion units. Samsung and Apple lead the pack, but rivals like Huawei, Lenovo and Xiaomi are coming strong from behind.

"Usually the conversation in the smartphone market revolves around Samsung and Apple, but Huawei's strong showing for both the quarter and the year speak to how much it has grown as an international brand", says IDC senior research manager Melissa Chau. "While there is a lot of uncertainty around the economic slowdown in China, Huawei is one of the few brands from China that has successfully diversified worldwide, with almost half of its shipments going outside of China. Huawei is poised to be in a good position to hold onto a strong number three over the next year".

Huawei posted the highest year-over-year growth of all the major vendors in 2015, as it saw its shipments increase by 44.3 percent to 106.6 million units from 73.8 million units a year prior. It is followed by Lenovo with a 24.5 percent year-over-year growth in shipments, to 74 million units from 59.4 million units.

Xiaomi has the third-highest year-over-year growth, with shipments rising to 70.8 million units in 2015 from 57.7 million units in 2014. Apple, which has a comfortable lead over the aforementioned three players, also performed well last year, as its iPhone shipments rose by 20.2 percent to 231.5 million units from 192.7 million units a year prior.

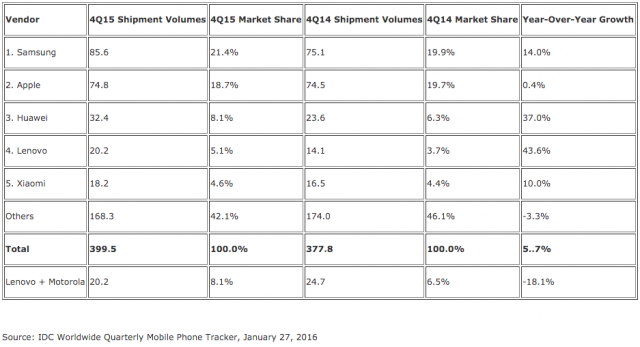

Samsung, which remains the undisputed leader, only managed a mere 2.1 percent increase in year-over-year shipments last year, moving 324.8 million units compared to 318.2 million units in 2014. At least these are the results for the whole year, because if we look at the last quarter we see Lenovo leading in year-over-year growth, followed by Huawei and Samsung. Xiaomi comes ahead of Apple.

Samsung shipped 85.6 million units in Q4 2015, up 14 percent year-over-year from 75.1 million units. Apple with its 74.8 million units saw a modest 0.4 percent growth year-over-year from the 74.5 million iPhones it shipped a year prior. Huawei, the last player on the podium, shipped 32.4 million units, up 37 percent from 23.6 million units in Q4 2014. Lenovo takes the cake, however, with a 43.6 percent year-over-year growth, to 20.2 million units from 14.1 million units (however, with Motorola added to its numbers, things are not looking so good as its year-over-year growth would be negative). Xiaomi, the last vendor in the top five, shipped 18.2 million units, up 10 percent from 16.5 million units in Q4 2014.

Samsung seems to have recovered slightly in Q4, if we look at that solid growth, but its year-over-year results suggest that 2016 will likely be another year of modest growth, shipments-wise. The vendor is seeing pressure from Apple in the high-end segment and Chinese makers like Huawei and Xiaomi in the mid-range and low-end categories.

Apple's numbers for Q4 are probably the most disappointing, as the company's strong growth in year-over-year shipments has come to an (apparent) end. Its strong performance for the whole of 2015 is supported by the other three quarters, when it shipped a considerable number of iPhones compared to the respective periods from 2014. Apple forecasts the first year-over-year decrease in shipments in Q1 2016, which suggests that this year its shipments might not increase (if at all) as much as they did in 2015.

As far as the other three major vendors are concerned, Huawei is best-positioned to rival Apple. Lenovo seems to be having some problems following its acquisition of Motorola, as its combined shipments are not as impressive (as I mentioned above; the year-over-year growth in 2015 would be -21.1 percent for the two brands, combined).

Meanwhile, Xiaomi is very dependent upon shipments in China, which represent 90 percent of its total shipments. An international expansion and stronger presence in foreign markets, while problematic, should help it move more devices, and become a stronger player as a result.

IDC notes that we are looking at preliminary data for both sets of numbers. However, given the difference in shipments between all of the five major vendors, the landscape would not change much following an update. We can expect to see a similar report, on smartphone operating systems, coming up soon.

Photo Credit: suphakit73/Shutterstock