Do autonomous cars mean insurance is obsolete?

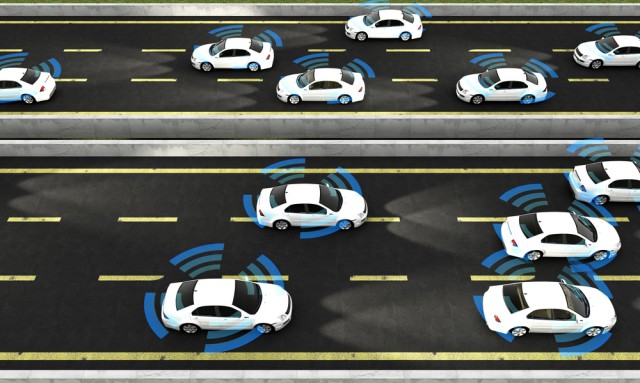

According to Business Insider, fully autonomous vehicles -- those that can drive from point A to point B without driver interaction -- will debut as soon as 2019. And these autos will be only a fraction of the 10 million self-driving cars BI Intelligence estimates will hit the road by 2020.

According to Elon Musk, "in the distant future, people may outlaw driven cars because it’s too dangerous." This might sound outlandish, but it does line up with car safety statistics. With more than 90 percent of accidents caused by driver error, "there is every reason to believe that self-driving cars will reduce frequency and severity of accidents," says Professor Robert W. Peterson of Santa Clara University’s Center for Insurance Law and Regulation.

Though there’s still a lot left to be determined (recent problem’s with Tesla’s autopilot suggest we still have a way to go), if AI-powered self-driving cars surpass our ability to drive safely, it makes sense that laws would be put in place to avoid obstacles and accidents. But if driver error is all but removed from the equation, will there be any need for insurance?

The End of Auto Insurance?

It seems logical: fewer humans driving means less driver error, leading to fewer accidents and injuries. (It also means fewer speeding tickets and likely a drop in driving glove sales. Sorry haberdashers.) Getting rid of the driver could also eliminate the need for private insurance. What does this mean? Well, in addition to lower accident liabilities, traditional insurers would likely lose a large portion of their personal auto premiums -- an industry worth an estimated $200 billion!

But we probably won’t be getting rid of auto insurance altogether; accident liability may simply be transferred to another party like the car’s manufacturer, the autonomous capability software designer, or another third party.

And underwriting is also likely to change.

As Michael Barry of the Insurance Information Institute explains, removing driver error won’t eliminate every potential vehicle danger. "Cars can still get flooded, damaged or stolen," said Barry. "But this technology will have a dramatic impact on underwriting. A lot of traditional underwriting criteria will be upended."

Scott McLaren is CMO for Fortegra Financial Corporation (a Tiptree Inc. company). Fortegra and its subsidiaries comprise a single-source insurance services provider that offers a range of consumer protection options including warranty solutions, credit insurance, and specialty underwriting programs. Delivering multifaceted coverage with an unmatched service experience for both partners and their customers, Fortegra solves immediate, everyday needs, empowering consumers to worry less and Experience More.

Scott McLaren is CMO for Fortegra Financial Corporation (a Tiptree Inc. company). Fortegra and its subsidiaries comprise a single-source insurance services provider that offers a range of consumer protection options including warranty solutions, credit insurance, and specialty underwriting programs. Delivering multifaceted coverage with an unmatched service experience for both partners and their customers, Fortegra solves immediate, everyday needs, empowering consumers to worry less and Experience More.