Bing overtakes Yahoo, and that's not a good thing

Short-sighted armchair analysts, pundits and Microsoft managers will rejoice in Bing snatching the No. 2 spot from Yahoo in U.S. search share. Everyone should cool their jets. Yahoo's losses are Microsoft's losses. The only gain that matters: Search share taken from Google, which isn't giving up much of anything to either Microsoft or Yahoo.

The problem: With Microsoft now serving up Yahoo search, the two are really one from a share perspective. Bing is starting to cannibalize Yahoo search, which simply isn't good for Microsoft.

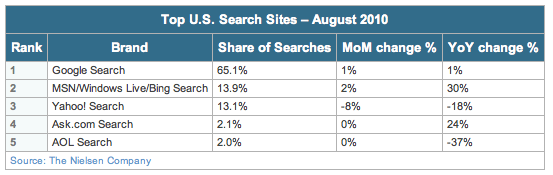

According to data that Nielsen released today, Microsoft search share was 13.9 percent in August, slightly ahead of Yahoo's 13.1 percent. Google stoutly remains above 65 percent. Bing search share is up an astounding 30 percent year over year, which I still largely credit to clever branding and marketing. By comparison, Yahoo search is down 18 percent year over year and 8 percent from July.

"If we combined Bing-powered search in August pro-forma, it would represent a 26 percent share of search," according to the Nielsen Wire blog. In the month before Microsoft and Yahoo announced their search deal, June 2009, combined share was 25.1 percent -- on a strictly added and not pro-forma basis. From that perspective, Microsoft-Yahoo have gained search share as a combined entity. However, a review of Nielsen's month-to-month data reveals little change in combined share throughout most of 2010, with Yahoo consistently losing share to Bing gains throughout the middle part of the year.

Microsoft started serving up Yahoo search in late August, so the first telling search share numbers will be September's. Trend to date: Since its launch, Bing has taken search share from most every other provider but Google. Granted, Google search share is down from 66.1 percent in June 2009 but from July 2010 up 1 percent year over year and month over month to 65.1 percent. Bing taking share from Yahoo is a more recent trend but consistent over the early spring and summer 2010 months, according to Nielsen data.

Fourteen months ago I blogged that "Microsoft-Yahoo search deal is Google's Christmas-in-July present." I asserted:

Cannibalization is inevitable, and there is likely to be heaps of it. Matters would have been worse had Microsoft bought Yahoo and consolidated all search under a single brand. My prediction: Combined Microsoft-Yahoo share will be less than 20 percent within 12 months of the deal's closing -- and that's my being somewhat generous so that I don't get totally flamed in comments.

Microsoft serving up Yahoo search most certainly closes the deal. The clock is ticking. Will Bing take away more share from Yahoo? I'll either be right or wrong in 12 months.

The larger question: What about everyone else? Microsoft can only take so much share from smaller providers, which is one reason for it now bleeding searches from Yahoo. But it's not that simple. Microsoft is aggressively marketing Bing as a brand, while Yahoo has all but pulled back its search branding push. Why not, with Microsoft running the shop? But there is still share Microsoft can take -- and is taking -- from other search providers. For example, AOL search is down 37 percent year over year. AOL's search share was 2 percent in August, down from 3 percent in June 2009 -- the month before Microsoft and Yahoo reached their search deal. Since Google powers AOL search, it could be reasonably argued that perhaps Microsoft is serpentiously taking share from the search giant.

Still, Microsoft gets bragging rights for claiming the No. 2 spot, if taking it from a coveted partner is what executives really want to boast about.

The significance isn't position but gains. Microsoft search share was 8.9 percent in June 2009, the first full month of Bing's operation. Fourteen months later, Bing search has consistently grown, reaching the aforementioned 13.9 percent share. Bing is on an unequivocal roll. It's no longer a question of whether or not Bing will continue to grow share but one of where will future growth come from. Microsoft loses by taking share from Yahoo. The gains that matter must come from Google.