It's not IF but WHEN Verizon and AT&T follow T-Mobile's subsidy-free plans

Verizon and AT&T are closely watching how consumers respond to T-Mobile's move to end smartphone subsidies. However, a look at their comments gives me the impression that they haven't had a detailed look at T-Mobile's value plans.

In recent comments, CEOs of both companies stated that they were ready to follow T-Mobile and offer non-subsidized plans if they prove popular with consumers. However, both CEOs caution that consumers don't "like paying upfront for the phone" and are used to getting "low-cost phones". Based on these comments, I'd have to believe they were misquoted in some way because I find it hard to believe that the CEOs of the two biggest carriers in the United States could be so misinformed.

T-Mobile's value plans don't subsidize devices, but finance them. This way consumers pay for devices in monthly installments so that the upfront cost remains comparable to subsidized plans and device costs become transparent. More importantly, the data plans themselves have lower margins and therefore, the monthly amount a consumer pays also remains comparable to subsidized plans until the device is fully paid for. Once the device is paid for, a value plan becomes far cheaper than a comparable subsidized plan. This gives consumers an incentive to hold on to his device for a longer time period, thereby extending the handset replacement cycle, as I showed earlier.

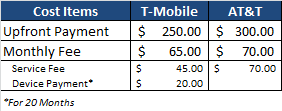

Let's use this illustration by Jared Newman to demonstrate. If a consumer were to buy a Galaxy Note 2, on a two-year contract (on comparable data plans), from AT&T and T-Mobile (on a value plan), he would incur the following costs:

In this case, if the consumer were to opt for an unsubsidized value plan over AT&T's subsidized plan, he would save $50 on upfront costs and save $5 every month. If the consumer opts to keep the same device while renewing the contract, his monthly expenses come down by $25.

From the carrier's perspective, the plan is financially neutral for the duration of the contract (as the reduction in subsidies matches the reduction in monthly revenue). After the contract expires, the consumer has a considerable financial incentive to hold on to his device, as it reduces his monthly cost, while putting no financial burden on the carrier. By comparison, smartphone upgrades offered to consumers, under subsidized plans, put a huge subsidy burden on the carrier. In addition, unsubsidized plans also vastly bring down the cost of acquiring smartphone subscribers, i.e. costs associated with churn rate.

At the end of the day, I still believe the most crucial factor will be the impact of T-Mobile's value plans on their competitors' churn rates. If churn rates at Verizon and AT&T increase (based on the illustration above, that seems to be a certainty), then they will make immediate moves to incorporate unsubsidized value plans into their offerings and complete the transition by the time their contracts (stipulating subsidy terms) with Apple run out. If that happens, OEMs (especially Apple) should see a fairly sharp decline in smartphone sales and average selling prices in the U.S. market.

Reprinted with permission from Tech-Thoughts

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of Tech-Thoughts.

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of Tech-Thoughts.