If Congress passes Internet sales tax legislation, you lose

It's almost as if some in Congress forget that we've been down this path before. Garbage legislation, now under the moniker of the Marketplace Fairness Act, has been discussed in various guises and masks over the last 20 years or so. Streamlined Sales Tax. Remote Sales Tax. Distant Sales Tax. They've been tried, debated and debunked each time before.

But it's funny how larger than ever state budget deficits perk up the ears of slimy congressmen on the umpteenth attempt at an Internet sales tax. While proponents like J Marra, writing for BetaNews this week, are in favor of this bill, I stand tall against it, without hesitation.

Speaking from Experience

As a small business owner myself, already reeling in yearly time wasted in wading red tape, I have full right to be fired up about this new effort. Even though my business only does taxable commerce in Illinois, I have numerous colleagues in the IT industry who would be affected by this legislation. Any time government tries to impose new taxes and says that it is merely filling in the gaps is cause for alarm.

Remember when big government lied to us and claimed that Obamacare would save money for everyone across the board? It's the same flawed thinking that leads some to estimate costs rising for individual plan claims up to 32 percent under the massive legislation. Rule of thumb: the more government gets involved, the worse off we generally are.

Just about 20 years ago, the Supreme Court made a landmark ruling in Quill v. North Dakota that set an important precedent in today's debates. In that case, the court said, rightfully so, that obligating businesses to collect taxes on behalf of jurisdictions which they have no presence was too burdensome to enforce and expect of them.

Yes, you can say that the case was pitted in the discussion surrounding mail order catalogs and their sales across state lines, but the basis for argument is the same. Should businesses large and small be held liable for collecting taxes on any number of items they may sell to any person online in the vast United States?

Small Business Nightmare

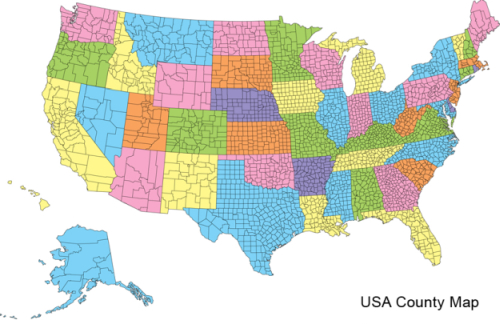

If this junk legislation passes, it means that businesses with online sales across state lines will be liable for tax collection across roughly 9,600 different jurisdictions in the country. As if small business owners didn't have enough paperwork and red tape to wade through already to keep their businesses legal.

Proponents of this smelly pile refute the tax liability mess by claiming simplified "tax calculation software" will be available to affected merchants in efforts to simplify tax liabilities. Reality to Congress: QuickBooks has been around for over 20 years now, and taxes have not gotten any easier for US small businesses. I'm not sure how another band aid to a broken, over-complicated tax system is going to make life any easier or the burden any less troublesome.

One of the bills sponsors, web giant Amazon, has come out in favor of the legislation. Not surprisingly, Amazon already has the vast, expensive technical infrastructure in place to handle such broad tax collections. So much so that it's even offering expertise in the form of tax compliance services to other businesses. The online retailer has got more to gain financially from this bill passing than just "leveling the playing field" as it claims publicly.

The 3,007 counties of the USA, as shown above, are just a sliver of the jurisdictions that small businesses would be liable in collecting taxes if this legislation passed. All because they survive by selling across state lines. Whatever politicians calls the legislation, it's the same tax increase that has failed time and time again in congress. (Image courtesy of: mapsfordesign.com)

It's also interesting to note that this bill has zero language addressing how States would force brick and mortars to collect taxes for purchases made in person by out-of-town residents. After all, the name of this bill is the Marketplace Fairness Act, and in the interest of fairness, shouldn't brick and mortars be held to the same legislation that is burdening their out-of-state competitors?

Five states do not collect any form of state sales tax, including Alaska, Delaware, Montana, New Hampshire, and Oregon. So if I were a Washington resident I could make the short trek into Oregon and get away without paying any sales taxes. Yet sitting back in my recliner, ordering from the same vendor in the comfort of my home, would yield a fully taxable purchase. That's fairness? Depends on who you ask, I guess.

Bill sponsors claim that the reason brick and mortars cannot be held to the same standard is because, presumably, it would be too difficult to impose questions upon each buyer about what state and county they come from. But hypocritically, they agree, that imposing the same burden on online retailers is justifiable because they can wrangle in some legal language providing cost-effective tax calculation software that will make the process seamless.

No Silver Bullet

If there's one thing I know as a small business owner, it's that nothing surrounding government legislation is as easy as it's portrayed. I don't care how much software you toss my way.

Here's a suggestion to a Congress hell-bent on raising taxes: how about focusing efforts on cleaning up our broken tax code instead? It's already been proven that Americans as a whole waste 6.1 billion hours annually merely complying with federal tax laws. That's the equivalent labor time of 2.1 million full time workers! Talk about waste to the nth degree.

While there has been no silver bullet plan as of yet, the attention Herman Cain received for his (flawed, but commendable) 9-9-9 flat tax plan was a step in the right direction, at least as food for thought. If Congress was discussing ways to reduce tax loopholes and administrative overhead/complexity, we wouldn't have talk about ways to raise taxes on Americans to fill budget deficits.

While the Senate tries its best to ram through the Marketplace Fairness Act as fast as possible, I urge all commonsense Americans to not only sign the public eBay petition against this grimy monstrosity, but also reach out to their representatives and tell them why you are opposed to any new tax increases of this nature.

Legislation supporters claim this is out of fairness to the mom and pops losing money due to online retailers, yet the very ones that will be hurt most are the small-timers selling on the web who will be burdened with more red tape, overhead, and administrative waste.

Fix the glaring mess we already have, Congress -- then perhaps we can discuss just cause for more taxation.

Photo Credit: Jane0606/Shutterstock