Why blockchain is the real star of the cryptocurrency boom

Bitcoin remains one of the hottest financial topics of the last several years. The digital currency grew from less than $1,000 per coin at the start of 2017, to nearly $20,000 by the end of the year.

The buzz around Bitcoin continues to grow despite high volatility -- including a 50 percent drop between December and January -- and condemnation from figures like Warren Buffet who call it a "fraud." But how is it being used? And most important, what value does it really hold as an investment?

What’s Behind the Bitcoin Boom?

Bitcoin is just one of hundreds of cryptocurrencies currently floating around the internet. Some, like Ethereum and Neo, are created to serve specified technological issues like monetizing digital goods or enabling fast and free P2P payments. Many of these assets that came after Bitcoin are technologically superior, allowing for faster and less-intensive transactions. Now, Bitcoin is primarily used as a store of value; its status as the first cryptocurrency keeps it holding on as the standard-bearer for the market.

Excitement over the many projects in development has played a part in Bitcoin’s dramatic growth, but an even larger part has been speculation and the fear of missing out.

People are looking at Bitcoin and saying, "why didn’t I invest when it was $100?" They don’t want to be in the same position if Bitcoin takes-off again and fulfills some crypto-enthusiasts’ projections of $100,000 by 2020. Of course, that’s exactly what makes so many industry leaders leery of bitcoin -- in their eyes, it’s a speculation-fueled commodity bubble.

Is It Really All Smoke & Mirrors?

Some cryptocurrencies will probably survive and thrive as part of the digital economy once the market starts to stabilize and become more concise. But I think the real value in Bitcoin isn’t in the coin itself; to me, Bitcoin was a proof-of-concept. The value is in the blockchain technology that powers Bitcoin.

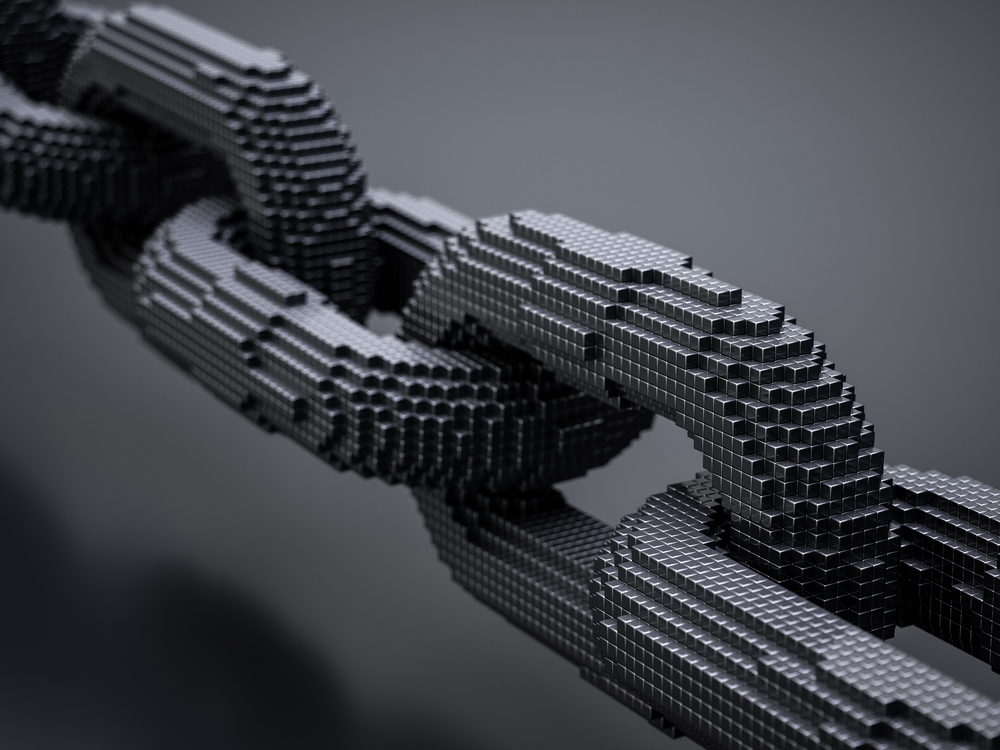

Think of the blockchain as a shared ledger, like a Google Sheet. The blockchain records every transaction involving that currency, and stores them as recorded "blocks," with the information distributed across thousands of participating computers. There is no centralized record, meaning that no one can simply hack a system and falsify the record, and there is no single point of failure that could take down the system.

While we’re already starting to explore blockchain as a tool for the payments and finance industries, this technology could revolutionize how countless different fields operate:

- Healthcare: Storing records in the blockchain eliminates the possibility of vital medical information getting lost, and allows doctors anywhere to provide consistent, informed care.

- Retail: Blockchain can simplify supply chain management and inventory, reducing costs and manpower required for these processes.

- Government: Voter information can be stored in a blockchain, eliminating concerns about voter fraud or tampering with results.

- Rentals: Blockchain allows for consistent, error-free recordkeeping, so owners always know the exact status of their property.

These are just a few examples. Blockchain technology has applications for real estate records, insurance information, legal contracts, digital licensing, and much more.

Blockchain is Not Invincible

Of course, the decentralized model isn’t perfect. Hackers can still manage to pull-off attacks, and because there is no central record, there is no way to recover anything that’s stolen.

Two of the biggest security concerns regarding blockchain are the "Eclipse" attack and the "51 percent" attack. With the former, a hacker would attempt to disable part of the blockchain network to interrupt communications between different nodes. In a 51 percent attack, though, the hacker’s goal is to gain control of a majority of those nodes to force an override of the blockchain record.

I should also point out that blockchain’s association with Bitcoin results in something of an image problem. Though the two are not the same, people’s impressions of blockchain technology can be colored by their impressions of Bitcoin, as well as its reputation for illicit activity.

What’s on the Horizon for Blockchain

Regardless of how things go for the cryptocurrency market in the coming months, I’m confident we’re going to see further adoption of blockchain technology. The opportunity to dramatically increase efficiencies, simplify processes, and free-up funds currently being wasted in complicated and redundant processes is just too great to pass-up.

Banks are already exploring the idea of storing and payment information in a blockchain, as opposed to traditional automated clearinghouse (ACH) payments. Travel industry leaders are pushing for more exploration of blockchain’s opportunities in security, identification, and more.

Once its advantages are demonstrated by early adopters, institutions are going to start jumping on to blockchain models left and right. I wouldn’t be surprised if blockchain models expand throughout the industries I mentioned earlier, and many more in the next 5-10 years.

Photo Credit: dencg/Shutterstock

Monica Eaton-Cardone is an entrepreneur and business leader with expertise in technology, e-Commerce, risk relativity and payment-processing solutions. She is COO of Chargebacks911 and CIO of its parent company Global Risk Technologies.

Monica Eaton-Cardone is an entrepreneur and business leader with expertise in technology, e-Commerce, risk relativity and payment-processing solutions. She is COO of Chargebacks911 and CIO of its parent company Global Risk Technologies.