Netflix video games and other things to expect in the post-pandemic video streaming market

Despite all the unease and uncertainty of the past 18 months, it is comforting to know that there are some things you can rely on: like the billions of dollars in recurring credit card transactions that every media conglomerate has continued to rake in. From legacy names to brand new offerings that launched during the pandemic, the streaming video industry is one of the obvious winners in a world where people spend more time at home.

With that world starting to fade away, though, and as a year and a half of boredom slowly transforms into demand for outdoor and real-world activities, there is no way these services can keep up their record levels of growth and momentum. But that doesn't mean that they're not trying.

Case in point: Netflix is reportedly working on expanding its horizons into the video game market. According to information first published by Bloomberg, the company has hired Mike Verdu, a former Oculus executive who also used to work at Electronic Arts, as the head of its new gaming division.

Although details are scarce, Bloomberg suggests that the primary purpose of this new foray will be for Netflix to develop its own slate of video games, many of which will likely be marketed as extensions of its existing original TV shows and movies, which users will be able to play directly within the existing Netflix UI. There is no indication (at least not yet) that Netflix wants to bring in third-party games, so the likes of Google Stadia and Amazon Luna are probably safe for now.

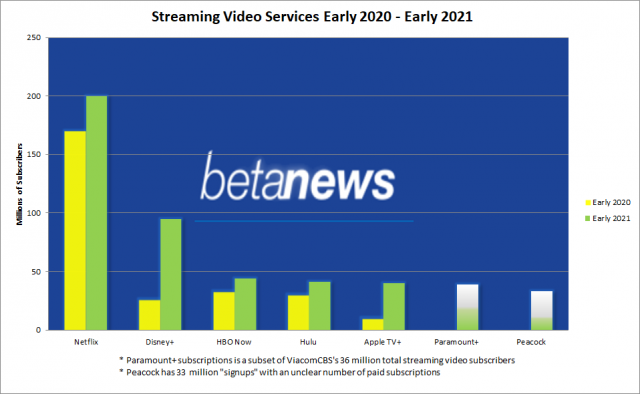

Depending on how heavily Netflix pushes the new offering, it could be the most significant change to the streaming company in years. And it's coming at a time when Netflix needs some new energy. By the summer of 2019, Netflix began losing subscribers in the US -- by the millions -- for the first time in its 12-year streaming history. Of course, those tides quickly changed in 2020, with stay-at-home orders (along with a quirky rural zoo owner named Joe) helping to catapult Netflix to over 200 million paying subscribers. But parts of the world are now starting to look like they did in the summer of 2019, and that's a place that Netflix doesn't necessarily want to be.

By introducing a completely new form of media, it will at least add some diversification to the platform. It's unlikely that Netflix is trying to become the next great game developer, and more likely that the goal is to keep users glued to their Netflix app just a little bit longer. After you finish binging the latest season of Stranger Things, for example, it might prompt you to play through a casual Stranger Things game. And from there, you might decide to jump over to another game that introduces you to another Netflix original series. Throw in a micro-transaction or two and Mike Verdu has done his job.

Indeed, wandering eyes are Netflix's biggest threat. It is far from the only player in this space to benefit from all the spare time consumers have had in the last 1.5 years, and users have now had more than enough opportunity to sample many other offerings. For example, Hulu added around 11 million new subscribers, a relatively tame number by comparison, but impressive in its own right as a 36 percent gain over the 30 million subscribers it had before the pandemic. However, Hulu does not seem to have any major plans in terms of expansion or differentiation. Its unique position in the market with its unmatched collection of media partnerships has taken Hulu into a niche that it's in no hurry to change.

What is perhaps more interesting are the new streaming services that popped up during or immediately before the craziness of 2020. Things seem to have worked out for Apple TV+, which launched on November 1, 2019 to lukewarm reception and slow subscriber growth at first. However, as people started looking around for new content last year, more than 40 million of them have found their way to Apple's venture into streaming media. Backed by top-name licenses and very high production values (Apple TV+ became the only major streaming provider to win a Primetime Emmy Award in its first year on the market), Apple has done what it does best and lurched its way right into the middle of this competitive landscape.

Originally designed to be locked down to the Apple ecosystem (as well as on web browsers for the few people who still stream content that way), the service is now available on PlayStation and Xbox consoles, and now even natively on select Google platforms -- including the ability to Chromecast Apple TV+ content. This shift toward more open availability is what has launched Apple TV+ as a serious player in this space in the last few months and also gives Apple TV+ the distinct advantage of still being able to expand even further. Simply releasing a fully dedicated app for Android, the Nintendo Switch, cable company boxes, Echo screen devices, etc, will grant exposure to millions more potential customers. That's a luxury most other streaming services don't have as they are already saturated across every app marketplace.

And of course, some streaming services came out right in the middle of the pandemic. NBC marketing materials have boasted 33 million "signups" to its Peacock platform since it debuted in April 2020, although the company has not disclosed how many of those are paid subscriptions. A website called The Information, which focuses on the streaming industry, looked at that number with skepticism and reported that only 11.3 million users are "actively" using the service -- a small number in the context of all the other behemoths mentioned so far, but definitely enough to justify continuing to build out the platform and the brand.

To date, Peacock's main selling point has been that it's now the exclusive streaming subscription platform for The Office -- a show that has been off the air for eight years (although that move alone reportedly cost NBC $500 million to appease the cast and creators over any royalty concerns). And this seems to be the extent of NBC's strategy for now: relying on its existing content as valuable enough to garner customer subscriptions. A similar deal was made for Parks and Recreation, and earlier this month it announced it was nixing a long-running partnership with HBO to instead release future Universal movies on Peacock. While there is minimal original content mostly around news and sports programming, Peacock does not appear to be interested in investing heavily in that arena.

NBC's network rival CBS also upped its game in the last few months as parent company ViacomCBS converted CBS All Access into the newly minted Paramount+. The company has not reported specific subscription numbers -- saying only that around 6 million people have signed up since the official launch of the service, and that it has a total of 36 million subscribers across all its streaming platforms (including BET+, Showtime, as well as legacy CBS All Access subscribers who were converted to the new Paramount-branded product). But to grow Paramount+ into something that belongs in the same conversation as the other streaming giants (even the ones without a "+" sign in their name), it needs a hook.

The platform got a fair amount of recognition recently when it began offering A Quiet Place Part II, which is still playing in theaters. The horror movie sequel had been available for purchase on on-demand video platforms, but making it available in a subscription streaming product undoubtedly caused some users to give Paramount+ a second (or first) look. It remains to be seen if releasing theatrical films on this platform will create enough of a marketing push, though. Despite ViacomCBS having a treasure trove of content, its only fully owned major movie studio is the namesake Paramount Pictures, which is probably not enough to compete with some of the other major players. So unlike NBC's Peacock, CBS's Paramount+ will focus significantly on original programming -- continuing CBS All Access series such as Star Trek: Discovery and The Good Fight, along with upcoming destination shows like a Frasier reboot and a live-action sci-fi show set in the Halo video game universe. All in all, at least a dozen new series are already slated for Paramount+ in the coming months.

Oh, and then there was the scrappy little upstart out of South Buena Vista Street in Burbank, which launched just a couple months prior to all the global shutdowns. When it rolled out in late 2019, analysts and pundits called it a huge risk, openly opined about what would happen if it failed, and discussed how much of a loss the company would need to endure before its new service would be able to turn a profit. That service was called…Disney+.

It is almost comical to look back on the overly skeptical coverage of the launch of Disney+. In just over a year, it skyrocketed to more than 100 million paying subscribers -- a feat that took Netflix more than a decade and which has vaulted it beyond every other non-Netflix service. And that doesn't even consider the millions of dollars Disney+ pulled in from charging extra to stream premium theatrical (or intended-to-be theatrical) releases. In fact, some estimates have Disney+ overtaking Netflix in the next 4-5 years. That is, unless Netflix does something dramatic… like, perhaps, creating its own series of video games.

Because one thing is clear: as the world emerges into whatever the new normal will be, the battle for video streaming dominance will not be won with content alone. There are too many choices and too much intellectual property spread across different conglomerates for any service to become the one with "the best content" -- despite all the varying strategies around producing original content versus promoting existing content, or having free versus paid subscriptions, or how big of a draw it is to offer in-theater movies. At the end of the day, with so many options available, people will need something more to respond to.

Again, the Netflix game-streaming news is not really about video games. It's about branding. At the end of the day, after all that happened in this industry in 2020, the top-line battle in this competition is now Netflix vs Disney. And content aside, the area where Disney is able to thrive and Netflix is not is the branding game. When Disney launches a new movie or franchise on Disney+, it can cross-pollinate with attractions at Disney World, promotions at its retail stores, new theming on cruises, and some day in the future maybe even Broadway shows -- all of which are destinations that restless post-pandemic folks will be heading to.

It is this ability to stay attached to characters and franchises that will win the streaming wars. Netflix doesn't have theme parks or mall space, but all it needs to do is to keep you interested in its properties after you've finished watching a movie or TV season. While there are no details at all on what kinds of games to expect on Netflix, it would not be surprising to see them follow the standard mobile gaming mold: get players to log in every day and play for a half hour or so. It wants you to be reminded of Ozark, or BoJack Horseman, or Stranger Things, or The Witcher, every time you open your Netflix app -- not just when there is a new season. That is the gamble that it's taking to try to solidify viewer loyalty and stay at the top of the pack for as long as possible. We'll see if it works. For everyone not named Disney or Netflix, there are enough scraps to go around.

Image Credit: Sanzhar Murzin / Shutterstock