Barclays will introduce Android mobile payment service

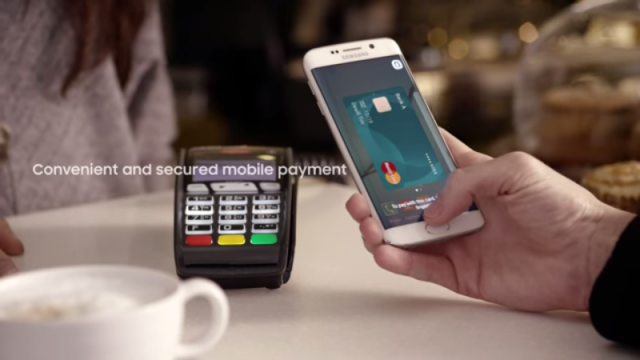

UK bank Barclays has announced it will soon roll out its own contactless payment service for its Android-using customers in the country. All Barclays customers with an NFC-enabled Android smartphone will be able to pay for things the same way they pay with a contactless card.

For purchases of up to £30, all they need to do is tap their smartphone at the payment terminal, the same way they’d tap a contactless card. For purchases of up to £100, customers would need to tap in their PIN code.

Contactless payments market to reach $95 billion by 2018

The global value of contactless payment market will reach almost $100 billion by 2018, a new study by market analysts Juniper Research says.

According to the research, entitled Contactless Payment: NFC Handsets, Wearables & Payment Cards 2016 - 2020, the market will hit $95 billion in two years, up from $35 billion in 2015.

How phone agnostic beacon technology will revolutionize mobile payments

Mobile payments are gaining momentum in the UK. Apply Pay has an initial monopoly, Google recently announced its UK launch and Samsung is planning to follow suit later this year. Countries across the globe are increasingly moving towards cashless societies thanks to advances in contactless payments. The UK is a leader in contactless payments and, thanks to technology such as Oyster cards, mobile payments are catching on quickly.

Instead of carrying a physical wallet with cash and bank cards, mobile wallets are becoming an increasingly popular method of payment.

Barclays announces Apple Pay support

Apple Pay is now available to Barclaycard and Barclays customers, the bank has announced. "We are passionate about helping customers access services and carry out their day to day transactions in the way that suits them", said Ashok Vaswani, CEO of Barclays UK.

"As part of this, we have developed a range of digital innovations that allow people to choose how, when and where they bank and make payments. Adding to the existing choice, from today both Barclays debit and Barclaycard credit card customers can use Apple Pay to make payments with their Apple device across the UK".

Samsung Pay arrives in China

Samsung Pay made its debut last year in South Korea in August and then launched in the US in September. At the end of 2015, the company announced that it was bringing its mobile payment service to China.

After a one month beta period, Samsung Pay is now available for local users with a Galaxy S6 edge Plus, Galaxy Note 5, Galaxy S7 or Galaxy S7 edge.

Contactless payments are starting to gain traction in Europe

The future of payments in Europe is contactless, a new survey suggests. According to the report by digital security firm Gemalto, 90 percent of business leaders in Europe have already invested in a contactless project. The other 10 percent are planning to do so.

Gemalto also says that in the next three years, 10 percent of all transactions in Europe will be made through contactless payment systems. Things will not be as straightforward, though, as there are multiple contactless payment systems, all battling for dominance.

Is MasterCard's 'selfie pay' too much of a security risk?

Biometrics were the talk of the town last month in Barcelona. As the world’s mobile technology companies gathered for their largest annual event, Mobile World Congress 2016, talk centered firmly around authentication and identity.

Whilst MasterCard announced it will accept selfie photographs and fingerprints as an alternative to passwords when verifying IDs for online payments, security company Vkansee was demonstrating how easy it was to create a spoof finger with clay and a pot of Play-Doh.

Walmart Pay takes a giant leap into the mobile payment industry

The upcoming launch of Walmart’s mobile payments service, Walmart Pay, is one of many signs that the mobile payments landscape is shifting in a curious direction. As one of the first US retailers to branch out on its own and create a merchant branded payment and loyalty application, Walmart is paving the way for other retailers to simplify payments and provide new ways of enhancing the consumer shopping experience. Following closely in Walmart’s footsteps is Target, with a recent speculation of a similar mobile wallet app in the works.

The introduction of Walmart Pay is significant to the payments market as it sends the message that Walmart is seemingly departing from the Merchant Customer Exchange (MCX) consortium and its pending CurrentC mobile payment platform, which has been plagued by numerous delays and concerns over the underlying technology platform. While Walmart will still continue its partnership with MCX, Walmart Pay will be the company’s main focus. This could mark the beginning of the end for CurrentC, an industry-wide payment system that was created for MCX restaurants and retailers, including Walmart, to utilize as a single payment solution.

Popular mobile payment apps leave consumers and businesses exposed

It's likely that this year's holiday season will mark the first time that online purchases made on mobile devices will overtake those on desktop systems.

This makes mobile payment systems a prime source of risk and a new study by mobile app security company Bluebox Security highlights poor security across consumer mobile payment apps, including some of the most popular solutions for both Android and iOS.

LG announces its own mobile payments service

Korean tech giant LG has announced it will soon be launching its own mobile payment service. The service, which will be a direct competitor to Apple Pay, Samsung Pay, Android Pay and other mobile payment systems, will be available in South Korea and the US, for starters.

According to IB Times, LG has registered the trademark LG Pay in South Korea and United States, so it’s very likely that will be the service’s name.

Chase Pay mobile payments service arriving in 2016

JP Morgan Chase announced its own smartphone payment platform on Tuesday, called Chase Pay. The platform, due to make its debut mid-2016, will be a direct competitor to the likes of Apple, Google and Samsung.

Chase Pay is built upon the Current C, a retailer-led mobile payment system that has largely been written off by Silicon Valley techies for its reliance on barcodes rather than the more sophisticated NFC (near-field communications) technology adopted by its competitors.

Why you shouldn't embrace contactless payments on your phone

Changes in the payments industry are intrinsically tied to consumer behavior. How people pay, where they pay, and what they pay with, is determined by convenience.

As smartphones increasingly dominate the lives of consumers -- from how they search the internet to how they shop -- it is unsurprising that the next frontiers for payment innovation are widely anticipated to be within mobile commerce (m-commerce).

Just one percent of retail payments is made with a smartphone, and iPhone users buy more and spend more

Do you pay for goods in stores with your smartphone? If so, you’re in the minority. According to Javelin Strategy & Research’s new Mobile Proximity Payments Forecast 2015 report, while 9 percent of online transactions are currently made on a smartphone, mobile proximity payments -- that is using your smartphone to buy something in a brick and mortar store -- account for just 1 percent of all retail transactions.

Apple users lead the way when it comes to mobile proximity payments, with almost 16 percent having made at least one purchase in a month. That’s nearly double the rate of Android smartphone owners.

The greatest innovator in mobile payments isn't Apple

Every week the technology world holds its breath with anticipation as the latest tech giants make new strides into the mobile payments sector. After years of low consumer take-up of services like Google Wallet and Square, the launch of Apple Pay last year was hailed as a pivotal moment, signaling the time when mobile payments would finally go mainstream.

With mega players like Facebook and Microsoft now joining the peer-to-peer money sending and digital payments fray, even sceptics are wondering if 2015 might truly be "The Year of Mobile Payments". Yet what many don’t realize is that these services are already lagging 10 years behind. The rest of the world is paying attention to a different mobile payments phenomenon -- one that’s been taking place thousands of miles away. Last month, global telecoms body GSMA revealed that the number of active users of Mobile Money -- a service which enables users to send and receive money from basic mobile phones without requiring a bank account or payment card -- had doubled from 2013 to reach 103 million globally.

Jawbone's new UP4 range-topper activity tracker lets you make NFC payments

Wearables company Jawbone now has a new flagship activity tracker. Called UP4, it is the company's first offering to come with NFC payments support. Also announced is a new mid-range activity tracker, called UP2, which is touted to be an "elegant replacement" for the aging UP24.

To enable NFC payments in UP4, Jawbone has teamed up with American Express. To pay, UP4 wearers will simply have to attach their Amex card to their Jawbone account. This can be done straight from the Android or iOS mobile app.