News Corp. has an 'other' problem

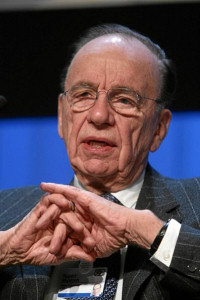

Rupert Murdoch's empire is sprawling, varied and, as everyone saw in yesterday's News Corp earnings report, hurting in the current economy. What does that mean for MySpace and the company's IGN Entertainment properties?

Rupert Murdoch's empire is sprawling, varied and, as everyone saw in yesterday's News Corp earnings report, hurting in the current economy. What does that mean for MySpace and the company's IGN Entertainment properties?

News Corp. files its Fox Interactive Media endeavors, which include all of those properties along with Photobucket, Hulu, Beliefnet and many more, in the "other" segment of its quarterly earnings reports. And Thursday's report was not cheerful; "other" reported a Q2 2009 adjusted operating loss of $38 million, down from a $23 million profit in Q2 2008 -- most of it due to weakness at IGN and News Digital Media (which operates mainly in Australia and has since been taken private by the company).

That Q2'08 profit, by the way, looks like a bit of an anomaly if you step back and examine more numbers. The "other" category is the only one of either at News Corp. (filmed entertainment, television, cable network programming, direct broadcast satellite television, magazines and inserts, newspapers and information services, book publishing, other) to report any income losses in FY 2008. (Interactive's numbers are especially stunning when you think about the well-publicized meltdown of the newspaper business; some of Murdoch's properties there, such as the New York Post, haven't turned a profit in years.)

The segment lost $139 million over the first half of fiscal year 2009 ($101 million for Q1 2009, in fact). The segment recorded a $42 million profit for FY 2008, preceded by a $193 million deficit for FY 2007...shall we continue? A $150 million loss in FY 2006, and a $177 million loss in FY 2005, the fiscal year in which Fox Interactive Media was founded.

According to the report, losses at Fox Interactive Media have a variety of causes, including the expensive process of growing unique users, lower subscription revenues at IGN, expansion expenses. But MySpace merited special mention in the report, specifically the launch of MySpace Music -- an expensive proposition, even without the cultural surge away from MySpace and toward rival Facebook.

Murdoch is not a foolish man -- and he's not hasty. Ironically, if anything seems clear from the earnings report, it's that MySpace is not in danger...now. News Corp is in for the long haul, and though the company may find it vexing that economic troubles hit just as the segment was pulling itself into the black, Murdoch's longtime support of the Post and his willingness to sink money into The Wall Street Journal indicate that a prestige property gets a lot of leeway, even in an economic climate that Murdoch himself described yesterday as the worst he'd seen since News Corp's founding.

However, if anyone at MySpace has an idea about how to monetize the site's millions of views per day, this would be a good time to speak up.