Apple can't escape market realities

Apple's stock price tanked more than 12 percent the day after announcing fiscal 2013 first quarter earnings. Nine days later, shares are still down about 10 percent, in part because Q2 guidance came in below analyst consensus. The guidance, in particular, seems to have spooked investors as Apple announced its intentions to provide a realistic guidance, as compared to the usual "sandbagging". The company also warned of lower margins -- between 37.5 percent and 38.5 percent. In that context, let's look at the average selling price movement chart and benchmark our previous iPad Mini cannibalization estimate.

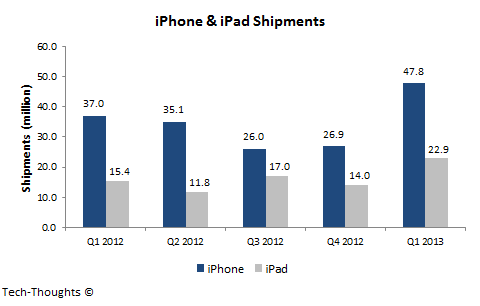

The shipment chart above clearly shows that iPhone growth has slowed during the current product cycle, thanks to market saturation. This should give Apple even more incentive to launch a cheaper iPhone. In contrast, the iPad has seen reasonably strong growth, but as I predicted, iPad Mini cannibalization seems to have pushed Q1 shipments below market expectations.

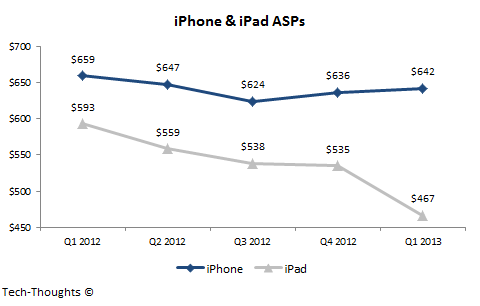

The iPhone's ASP has remained remarkably stable in Q1, given Apple's move to exclude accessory revenue (~$10-$15 per device) from product categories. On the other hand, the iPad's ASP took a nosedive because of the iPad Mini, especially compared to my ASP estimate of around $500 - the removal of accessory revenue doesn't explain this fall, but it is directly related to cannibalization:

Benchmarking iPad Mini Cannibalization

My iPad sales estimate ranged from 24.5-26.2 million units, with iPad Mini cannibalization in the 50-percent to 70-percent range. At this point, I'm virtually certain that the higher end of my iPad Mini cannibalization estimate was accurate, but I seem to have missed something. In light of the limited iPad Mini supply, I had applied my cannibalization estimate on just iPad Mini sales and not iPad Mini demand, i.e. I inherently assumed that the iPad brand would cause the potential "cannibalized" iPad Mini buyer, to buy an iPad 2/iPad 4 in case of short supply. In hindsight, that seems to have been a silly assumption.

It looks like those particular iPad Mini buyers either delayed their purchase or purchased a competing product (most likely a comparable & cheaper android tablet). Given my previous analysis, this is the only explanation I can think of for iPad sales coming in at 22.9 million.

Market share figures for this quarter and iPad shipments over the next quarter should shed more light on purchasing decisions. If a majority of potential iPad Mini buyers delayed their purchases, we should expect the iPad to hold a 50-percent to 55-percent market share and iPad sales should remain strong or post a modest decline in Apple's fiscal Q2. Today, IDC released tablet shipment estimates for calendar fourth quarter. Apple share fell to 43.6 percent, indicating a good many buyers chose not to wait for iPad mini. Combined share for ASUS and Samsung, which grew by several hundred present rose from 7.9 percent to 20.9 percent.

Reprinted with permission from Tech-Thoughts

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of Tech-Thoughts.

Sameer Singh is an M&A professional and business strategy consultant focusing on the mobile technology sector. He is founder and editor of Tech-Thoughts.