Apple holds on to U.S. Smartphone subscriber lead

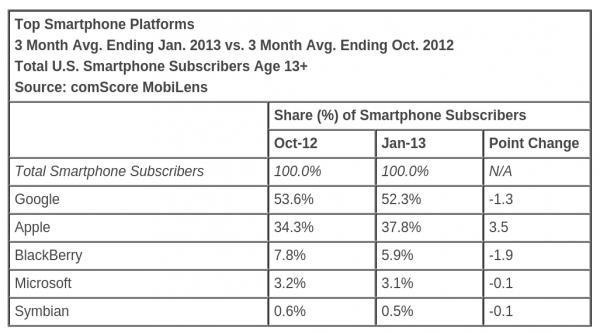

In the highly saturated U.S. smartphone market, Apple's dominance grew, while iPhone nipped upwards towards Android, for the three months ended in January, according to comScore. The analyst firm, unlike most of its competitors, measures actual subscriber share rather than number of units shipped. Like Gartner's counting actual sales, comScore gives a clearer view of real-world dynamics.

In the highly saturated U.S. smartphone market, Apple's dominance grew, while iPhone nipped upwards towards Android, for the three months ended in January, according to comScore. The analyst firm, unlike most of its competitors, measures actual subscriber share rather than number of units shipped. Like Gartner's counting actual sales, comScore gives a clearer view of real-world dynamics.

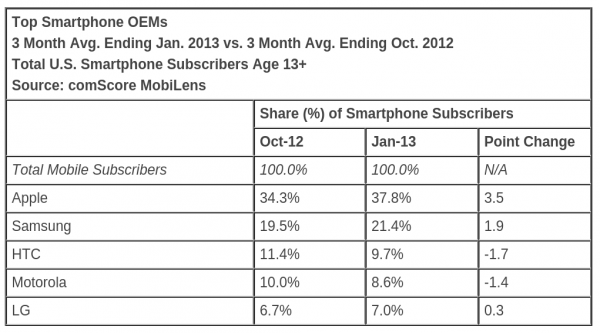

During iPhone 5's first full three months of sales, Apple's share reached 37.8 percent -- up from 36.3 percent in December and 34.3 percent in October. By comparison, second-place Samsung nudged up to 21.4 percent share, from 21 percent sequentially and 19.5 percent for the same three months. HTC, Motorola and LG followed, with respective shares of 9.7 percent, 8.6 percent and 7 percent. All three lost share from December, with LG up ever-so slightly from October. Motorola's loses strongly suggest that at Verizon, carrier with the highly-visible Droid line of smartphones, subscribers shift allegiance to other brands. Good thing Moto has a new evangelist.

The numbers, while meaningful, are far from perfect; comScore measures subscribers 13 and older, but counts primary phones only -- no secondary devices.

As the day moves along, you'll read longer versions of stories like this one, which puff Apple's feathers and lament stupid Wall Street for pulling down the company's share price. Sigh. Too many American bloggers and journalists have too little perspective about the great, big world outside of the United States -- where iPhone often isn't treasured and where the dominance of Android and Samsung are indisputable. They just don't get it.

Nor do they recognize, or simply refuse to acknowledge, that this country is no longer the largest market for smartphones, but is one rapidly saturating. For Apple that means Samsung isn't likely to catch up anytime soon, if ever, and Android will likely maintain a long subscriber share lead over iPhone short of some drastic maneuver -- like paying people to buy iPhones.

Don't snicker or dismiss the idea, because ISPs did just that at the turn of the Century. What? You're too young to remember free PCs with three-year ISP contracts? That is kind of the telco model today, given 2-year contracts, but is short of actually massively paying people to buy phones. But don't be surprised if pay-to-buy crops up in the future, as data's importance over voice as major revenue stream increases and saturation means people stop buying new smartphones every new release or so. If one carrier succeeds paying to purchase, others will follow.

Back to blind-to-the-world American bloggers and journalists, I weary of their ethnocentric arrogance. My perspective isn't often big enough either, seeing as I don't live somewhere else and don't directly see the circumstance in your country. But I try, when writing stories like this one: "Smartphone shipments surge ahead of lesser mobiles -- Brazil, China and India lead the way".

China is now the world's largest market for smartphones, which account for about two-thirds of new shipments there. In India, 80 percent of cellular mobile uses have feature phones, so there's nothing but upside selling smartphones -- as data infrastructure expands, device features increase and prices come down, according to IDC.

Globally in fourth quarter, based on actual sales, Android share significantly outpaced iPhone -- 69.7 percent to 20.7 percent, which is a 2.7 point decline from a year earlier, according to Gartner. The point: It's a big world, and the United States is a small part of it.

Photo Credit: Joe Wilcox