Data security is key for customer retention

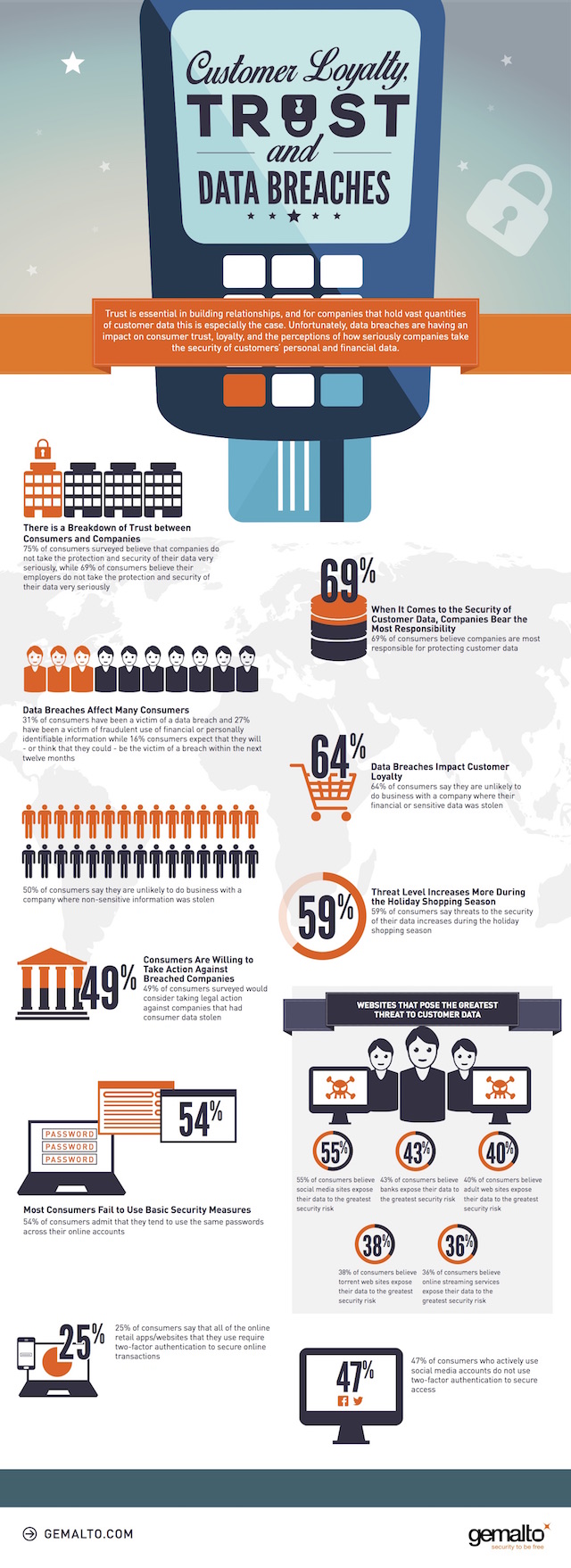

Nearly two-thirds (64 percent) of consumers worldwide say they are unlikely to shop or do business again with a company that had experienced a breach where financial information was stolen, and almost half (49 percent) had the same opinion when it came to data breaches where personal information was stolen.

This is according to a recent global survey by Gemalto, titled Broken Trust: 'Tis the Season to Be Wary, which surveyed 5,750 consumers in Australia, Brazil, France, Germany, Japan, United Kingdom and United States.

Six in ten people (59 percent) believe that threats to their personal information increases during the festive season, and two in ten (18 percent) believe that they are likely to be a victim of a breach during the holiday season.

Only a quarter (25 percent) of all respondents feel that companies take the protection and security of customer data very seriously. More than twice as many respondents feel that the responsibility of protecting and securing customer data falls on the company (69 percent) versus the customer (31 percent). Of the employed respondents, only around two fifths (38 percent) feel that their employer takes the protection and security of employee data very seriously.

The survey revealed that 31 percent of consumers have already been affected by a data breach in the past. Around four in ten state the most likely causes for being a victim of a breach are visiting a fraudulent website (42 percent), phishing attacks (40 percent) or clicking a fraudulent web link (37 percent). The emotional impact of data breaches has also created apprehensive feelings towards businesses with nearly one fifth (19 percent) feeling they are likely to be a victim of one within twelve months to three years.

Ninety percent of surveyed consumers feel that there are apps and websites that pose significant risks to the protection and security of their personal information. Fifty-five percent believe that social media sites expose them to the greatest risk, and around two in five consumers believe adult content and torrent apps/websites carry the greatest risk to the security of personal information.

Around a quarter (23 percent) of respondents who have been a victim of a data breach, either have, or would, consider taking legal action against the breached company involved in exposing their personal information. Almost half (49 percent) of respondents said they would take or would consider taking legal action against any of the parties involved in exposing their personal information.

However, the consumer is not completely absolved of responsibility. Despite the many risks involved, the survey also found that a majority (54 percent) of respondents are using the same password for all or some of their online accounts. Of the respondents who actively use social media accounts, only a quarter (25 percent) use two-factor authentication to secure all of their social media accounts.

Of the respondents who actively use online/mobile banking, around three fifths (58 percent) say that all of their banks use two-factor authentication to secure their internet banking. This isn’t as widespread amongst retailers, however.

Of the respondents who actively use online retail accounts, one in four (25 percent) state that all of the online retail apps/websites they use, require two-factor authentication to secure online transactions.

Published under license from ITProPortal.com, a Net Communities Ltd Publication. All rights reserved.

Photo credit: wk1003mike / Shutterstock