Moon Express gets FAA 'approval' for Moon mission

Last week Moon Express, a contender for the Google Lunar X-Prize (GLXP), announced that the company had received interagency approval from the White House, Federal Aviation Administration (FAA), Department of State and other U.S. government agencies "for a maiden flight of its robotic spacecraft onto the Moon’s surface to make the first private landing on the Moon".

This heady announcement got a lot of press including this story I am linking to because it was in the New York Times, the USA’s so-called pape of record. If the Times writes "gets approval to put robotic lander on the Moon" it must be true. Only this story isn’t true. Yes, the FAA kinda-sorta gave Moon Express permission to land on the Moon. But by the same token, the FAA has no power to deny Moon Express -- or anyone -- the right to land on the Moon. It’s not in their jurisdiction.

Outsourced IT probably hurt Delta Airlines when its power went out

Delta Airlines last night suffered a major power outage at its data center in Atlanta that led to a systemwide shutdown of its computer network, stranding airliners and canceling flights all over the world. You already know that. What you may not know, however, is the likely role in the crisis of IT outsourcing and offshoring.

Whatever the cause of the Delta Airlines power outage, data center recovery pretty much follows the same routine I used 30 years ago when I had a PDP-8 minicomputer living in my basement and heating my house. First you crawl around and find the power shut-off and turn off the power. I know there is no power but the point is that when power returns we don’t want a surge damaging equipment. Then you crawl around some more and turn off power to every individual device. Wait in the dark for power to be restored, either by the utility or a generator. Once power has been restored turn the main power switch back on then crawl back to every device, turning them back on in a specific order that follows your emergency plan. You do have an emergency plan, right? In the case of the PDP-8, toggle in the code to launch the boot PROM loader (yes, I have done this is complete darkness). Reboot all equipment and check for errors. Once everything is working well together then reconnect data to the outside world.

Famous American blogger strikes back against China

A few weeks ago I published a column here about online journalism. You may remember it from the picture of Jerry Seinfeld which I am using again here. While I have many readers in China, my work isn’t normally distributed there so I was surprised when a reader told me that column had been translated almost in its entirety and republished on a Chinese web site. How should I feel about this?

I might be flattered or I might be angry. Certainly the translation was not authorized by me and I received no payment for it. It goes far beyond the 250 word excerpt that is the day-to-day definition of Fair Use so it is a copyright violation. But the worst part, if Google Translate is to be believed, is that it doesn’t represent very well the ideas I was trying to present. Yet, having used my name and attributed the work to me, they are claiming this is what I wrote.

Is anyone at Yahoo paying attention? Probably not

So Verizon is buying the heart of old Yahoo! I include the exclamation point because it was always there in the Yahoo! we knew back when the Internet was young. $4.83 billion in cash is a lot of cash, but for Verizon it’s a way of buying into the future while buying what to many of us seems to be the past.

So let’s get the business part out of the way: Verizon can see Yahoo! as a bargain because Yahoo! has nearly always been more profitable on a gross margin basis than Verizon, a phone company. Even Yahoo! in decline will pull Verizon up. But that’s not why I’m writing about Yahoo! I’m writing because a reader yesterday more or less suggested I do so. At the risk of my sounding like Donald Trump, the reader suggested I had been right all along about Yahoo!

Why SoftBank is paying $32 billion for ARM Holdings

SoftBank is buying ARM Holdings for $32 billion. Why would a company not presently in the semiconductor business spend 32 times sales to enter a new industry? By traditional measures it makes little sense. But for SoftBank it makes perfect sense, because here’s a company that has spent more than 30 years making high-risk bets on entering new businesses by apparently over-paying for assets. It’s the way they’ve always done it and it has nearly always worked. In this case SoftBank is paying a 43 percent premium over the recent ARM share price because that’s how much money it took to overcome the resistance of ARM management. And it’s just a guess on my part, but I’d say those very ARM managers are, for the most part, doomed. SoftBank isn’t buying ARM because Masayoshi Son is so impressed with ARM’s success: SoftBank is buying ARM because of what it can become.

The only way SoftBank can justify paying such a high price for ARM is if Mr. Son is about to change ARM’s business model.

A PayPal mystery

A loyal reader of this column has come to me with a problem that I, in turn, am submitting to all of you. He sells downloadable software over the Internet but lately some customers have been ordering, paying, downloading, yet not requesting the required unlocking key to use their software. Money is piling-up in the reader’s PayPal account and he is starting to worry this is some kind of scam. But if it is, it’s a scam that’s new to me.

The first such order was placed on June 4th and there have been 20 such customers so far, though some of those customers have placed double orders so the total amount is $1,758. The reader is in the USA but the orders have come from Belgium, Norway, Switzerland, France, Germany, Austria, Sweden, Japan, and Israel. Nobody has requested an unlocking key and nobody has requested a refund.

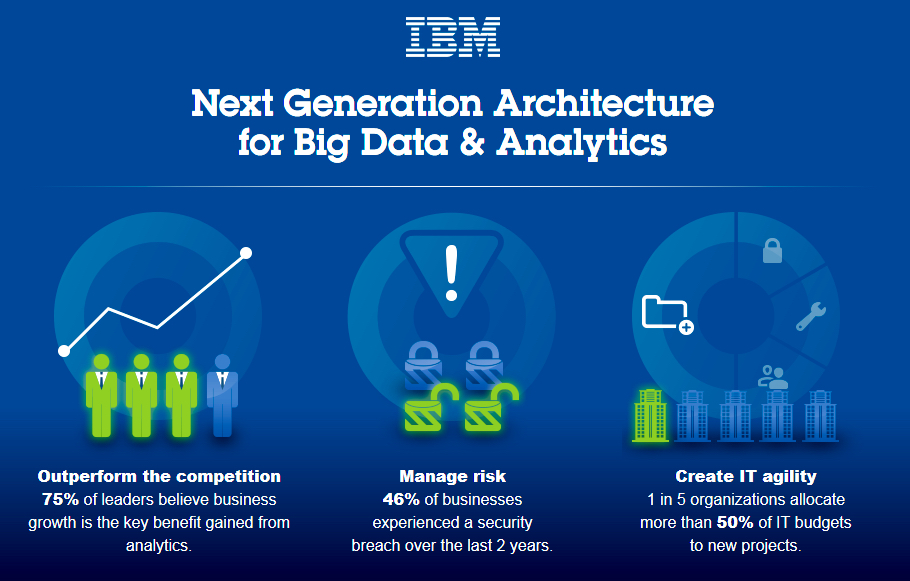

Thinking about Big Data -- Part three (the final and somewhat scary part)

In part one we learned about data and how it can be used to find knowledge or meaning. Part two explained the term Big Data and showed how it became an industry mainly in response to economic forces. This is part three, where it all has to fit together and make sense -- rueful, sometimes ironic, and occasionally frightening sense. You see our technological, business, and even social futures are being redefined right now by Big Data in ways we are only now coming to understand and may no longer be able to control.

Whether the analysis is done by a supercomputer or using a hand-written table compiled in 1665 from the Bills of Mortality, some aspects of Big Data have been with us far longer than we realize.

Thinking about Big Data -- Part two

In Part one of this series of columns we learned about data and how computers can be used for finding meaning in large data sets. We even saw a hint of what we might call Big Data at Amazon.com in the mid-1990s, as that company stretched technology to observe and record in real time everything its tens of thousands of simultaneous users were doing. Pretty impressive, but not really Big Data, more like Bigish Data.

The real Big Data of that era was already being gathered by outfits like the U.S. National Security Agency (NSA) and the UK Government Communications Headquarters (GCHQ) -- spy operations that were recording digital communications even though they had no easy way to decode and find meaning in it. Government tape libraries were being filled to overflowing with meaningless gibberish.

Thinking about Big Data -- Part one

Big Data is Big News, a Big Deal, and Big Business, but what is it, really? What does Big Data even mean? To those in the thick of it, Big Data is obvious and I’m stupid for even asking the question. But those in the thick of Big Data find most people stupid, don’t you? So just for a moment I’ll speak to those readers who are, like me, not in the thick of Big Data.

What does it mean? That’s what I am going to explore this week in what I am guessing will be three long columns.

What's the deal with online journalism?

Not very long ago I started answering questions on Quora, the question-and-answer site. My answers are mainly about aviation because that’s my great hobby and one of the few things besides high tech that I really know a lot about. But there was a question last week about Internet news coverage that I felt deserved better answers than it was getting.

So I contributed an answer that has been read, so far, only 388 times. I don’t like making a real effort that is so sparsely read. So here, with a little mild editing, is my answer to "What are the flaws in online journalism and media today?" And "How can they be addressed?"

LinkedIn gets lucky

Several readers have asked for my take on Microsoft’s purchase last week of LinkedIn for $26.2 billion -- a figure some think is too high and others think is a steal. I think there is generally more here than meets the eye.

Microsoft definitely needed more presence in social media if it wants to be seen as a legit competitor to Google and Facebook. Yammer wasn’t big enough. LinkedIn fits Redmond’s business orientation and was big enough to show that Satya Nadella isn’t afraid to open up the BIG CHECKBOOK.

The mainframe is dead... Long live the mainframe!

Rumors are flying within IBM this week that the z Systems (mainframe) division is up for sale with the most likely buyer being Hitachi. It’s all a big secret, of course, because IBM management doesn’t tell IBM workers anything, but the idea is certainly consistent with Big Blue’s determination to cut costs and raise cash for more share buybacks. And the murmurs are simply too loud to be meaningless. Think of this news in terms of a statement made last week by an IBM senior executive: "In a world of Cloud Computing, it does not matter what equipment or whose hardware the cloud runs on. We are a Cloud company…"

This move by IBM would not surprise me in a bit. It is my guess IBM wants someone else to make and support the hardware. They’ll be happy to sell time sharing services, AKA cloud services. They’ll be happy to let someone else sell and maintain systems.

What does Bill Gates know about raising chickens?

Bill Gates is a blogger, did you know that? His blog is called Gates Notes and generally covers areas of interest not only to Bill but also to the Bill and Melinda Gates Foundation, which means there’s more coverage of malaria than Microsoft. His latest post that a reader pointed out to me today is about raising chickens, which Bill says he’d do if he was a poor woman in Africa.

I’ll wait while you follow the link to read the post, just don’t forget to come back. And while you are there be sure to watch the video…

The problem with analytics

There is a difference between knowledge and understanding. Knowledge typically comes down to knowing facts while understanding is the application of knowledge to the mastery of systems. You can know a lot while understanding very little. Just as an example, IBM’s Watson artificial intelligence system that defeated the TV Jeopardy champs a few years ago knew all there was to know about Jeopardy questions but didn’t really understand anything. Ask Watson to apply to removing your appendix its knowledge of hundreds of medical questions and you’d be disappointed and probably dead. That’s the problem with most analytics, which is why it can be a hard sell.

The answer to this problem, we’re told, is not just machine learning but Deep Machine Learning, the difference between the two being that plain old machine learning is a statistical process that could be (and used to be) replicated by hand, while the deeper variety looks several generations deep in a longitudinal analysis that quickly grows too big for mere mortals to comprehend. Deep machine learning will, theoretically, find all the interconnections and dependencies that until now we’ve had to rely on domain experts to provide, yet even then it can only happen if you happen to be gathering the right data.

Apple and Didi is about foreign cash and the future of motoring

Apple this week invested $1 billion in Xiaoju Kuaizhi Inc. -- known as Didi -- by far the dominant car-hailing service in China with 300 million customers. While Apple has long admitted being interested in car technology and has deals to put Apple technology into many car lines, this particular investment seems to have been a surprise to most everyone. Analysts and pundits are seeing the investment as a way for Apple to get automotive metadata or even to please the Chinese government. I think it’s more than that. I think it is a potential answer to Apple’s huge problem of foreign cash and a grab for leadership in what may well be the second automotive age.

Apple has about $200 billion in offshore investments. That number is continuing to grow yet making very little return compared to Apple’s phone and computer businesses. As I’ve written before Apple has been very good at leveraging its cash to get better terms from suppliers but that game isn’t going to be getting any better (or worse) and the cash continues to pile up.