AMD's bid for server redemption: 45 nm high-perf, low-power Opterons

In the second phase of its effort to put the disappointment of Barcelona behind it, AMD yesterday launched its low-power and high-performance versions of its 45 nm server processors.

For a market that had already once declared "the death of frequency" in determining a processor's relative value, AMD suffered a huge psychological hit by not having 65 nm "Barcelona" architecture CPUs that performed to expectations. The embarrassment of the December 2007 erratum aside, the company ended up never having a model that it trusted to be clocked at 3.0 GHz.

At the time, the company tried mitigating customers' negative concerns, at one point claiming that "real performance" was something that a customer should feel rather than calculate using a benchmark. But that set of excuses has now been cast aside for the 45 nm quad-core Shanghai era, and AMD has regained the confidence it's been needing to push a 3.0 GHz Opteron for corporate data centers.

It will need all the confidence it can muster.

AMD's newest power-saving quad-core Opteron HE processors promise to run about 26% cooler than their mainstream counterparts, partly by being turned down to as low as 2.1 GHz. (Still, that's higher than the 1.7 GHz that the 65 nm generation Opteron HE started at.) At the opposite extreme, the latest additions to the Opteron SE product line will feature 2.8 GHz as a starting point now, with intentions to produce a 3.0 GHz model in the second quarter of this year.

"There's a lot of uncertainty in the market around what people are doing from their financial [standpoint], and what kinds of investments they're going to be making," mentioned Burke Banda, AMD's product marketing manager for server and workstation products, in an interview with Betanews. "One of the things that customers have been especially grateful to us for is having a long lifecycle roadmap, where they can go ahead and drop product from generation to generation into the same socket."

That's the Socket-F platform, where Barcelona series CPUs fit now. AMD is realizing that some customers may already be ready and willing to replace their Barcelona-era Opterons, so it's working to make that solution easier to achieve. The low-power editions start at $316 for the two-socket (2P) 2372 HE in 1,000-unit quantities, working up to $1,514 for the 8376 SE in 4P and 8P configurations (per 1,000 units). That's still something of a premium, but AMD is promising at least 25% better performance overall, compared to the 65 nm generation.

We asked Banda how a customer what AMD's current customers, such as OEMs, are asking for in terms of performance, and how are they asking for it? Granted, this is AMD's optimum customer we're talking about -- the one they're looking for and want to see more of, and we knew that when we posed the question.

"In the past...originally, people looked at a performance number. Then they started looking at performance-per-watt; I think they've come around to looking at performance-per-watt-per-dollar. I think now, what you're ending up getting is...A lot of benchmarks that are out there are valuable in their own right, when it comes down to getting you some relative performance. What we're finding and what we're seeing from customers (we don't profess to have an equation that you drop in, like these five factors, and you come out with an answer) is that folks are going out and looking at both performance-per-watt, performance-per-watt-per-dollar, and then they layer in certain types of applications to give them representative data.

"It reminds me of the old utility model, and that's kind of what I've called it, where folks are saying, 'I have these five to six applications, and I need to show I have a performance of x level' -- a bar for themselves, when it comes to floating point or Exchange performance, database performance. Then, 'I need a virtualization platform that can manage this at, say, 80% [utilization], so that I don't end up having a great performing database that doesn't sit on a really good virtualization system."'

Performance per watt, per dollar, per application...Is that all? Apparently not, Banda said. "It's an American thing," he remarked, where US customers in particular are adding "per square foot" or "per cubic foot" to iron out the comparison even more.

"The thing is, understanding [customers'] footprint and their power requirements, and then being able to figure out what applications they're using, and then from that you can essentially calculate out towards [something like] if you have x wattage and y space, and you're running this application, here's the maximum compute [capability] you can put in there."

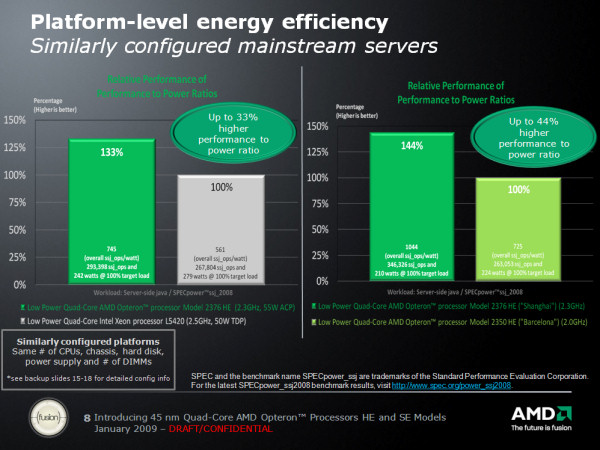

AMD has recently gained a reputation for changing the game in a more literal sense -- specifically, averting customers' attention away from potentially weaker factors in a comparison by changing the language of the comparison. That's how many interpreted the company's decision, after its Barcelona launch, to measure its power envelope using a new metric, while comparing it to Intel's using its older metric. This trend is continued this week as AMD compares its new 2.3 GHz low-power model at 55 W ACP (AMD's metric) against Intel's 2.5 GHz low-power Xeon at 50 W TDP (Intel's metric) -- there, AMD claims a 33% performance-to-power ratio advantage.

But the opposite end of the scale is the new HE models at what AMD itself admits is a "niche market segment." In both 2P and 4P/8P configurations, AMD unveiled 2.8 GHz models there last week, with intent to release higher performers by the end of June. The 2P 2386 SE will sell for $1,165 (in 1,000-unit quantities), while the 4P/8P 8386 SE will sell for $2,649.

While AMD's consumer desktops begin their embrace of DDR3 memory, in the Opteron field, AMD continues to cling to DDR2 even with these new models. Banda told us that 2010 may be the year when DDR3 finally really makes headway, which is an indication that the company still foresees its next architecture to be ramped up within the next 12 months. Given wave after wave of painful layoffs, with the result being only intensified public scrutiny, AMD has no more opportunities left to divert attention from its more sensitive areas. It has to deliver now, and these new Shanghais appear ready for the challenge.