Apple Q4 2011 by the numbers: $28.27B revenue, $6.62B profit -- misses Wall Street consensus

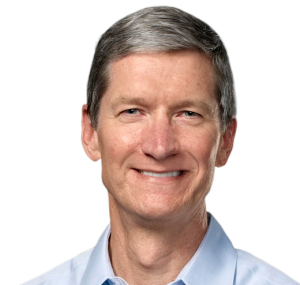

Today, after the closing bell, Apple announced another blow-out quarter -- and the first with Tim Cook officially as CEO. The Cupertino, Calif.-based company also closed fiscal 2011. While Wall Street waited with interest for today's results, fiscal Q1 2012 may be more interesting -- Cook's first full quarter as chief executive and when Apple launched iPhone 4S.

Today, after the closing bell, Apple announced another blow-out quarter -- and the first with Tim Cook officially as CEO. The Cupertino, Calif.-based company also closed fiscal 2011. While Wall Street waited with interest for today's results, fiscal Q1 2012 may be more interesting -- Cook's first full quarter as chief executive and when Apple launched iPhone 4S.

The quarter broke a longstanding trend of Apple beating Wall Street's over-inflated estimates, not just revenue and earnings but also for numbers of prominent products shipped. Only Macs exceeded analyst projections among the top-tier products.

The market reacted harshly and immediately to the rare earnings miss -- the first of post-Steve Jobs Apple. Between the earnings announcement and start of Apple's conference call with analysts, shares dropped by nearly 5.82 percent. After hours, Apple traded at $397.67 at 5 pm EDT, off the day's close of $422.24. Thirty minutes into the call, the sell-off intensified, rather than abated. Shares were down 6.63 percent then. When the call ended around 6 pm, shares were down 6.69 percent.

Apple shipped, 4.89 million Macs, 11.12 million iPads and 17.07 million iPhones during fiscal Q4. Analyst consensus was around 4.2 million, 11.5 million and 20 million, respectively.

For fiscal fourth quarter, Apple reported $28.27 billion revenue and net profits of $6.62 billion, or $7.03 a share. A year earlier, the company reported revenue of $20.34 billion and $4.31 billion net quarterly profit, or $4.64 per share. Apple announced fiscal Q4 results after the market closed today.

Three months ago, Apple forecast $25 billion in revenue with earnings per share of $5.50. Analyst average estimates were higher than Apple guidance: $29.45 billion revenue and $7.28 earnings per share.

"We are thrilled with the very strong finish of an outstanding fiscal 2011, growing annual revenue to $108 billion and growing earnings to $26 billion", Cook says in a statement. "Customer response to iPhone 4S has been fantastic, we have strong momentum going into the holiday season, and we remain really enthusiastic about our product pipeline".

Gross margins were 40.3 percent. Apple had forecast 38 percent.

International sales accounted for 63 percent of revenues. China was phenomenal. The country accounted for just 2 percent of Apple revenues in fiscal 2009, Cook told financial analysts today. China accounted for 12 percent of revenues for fiscal 2011 and 16 percent for the quarter. By the way, Cook, as COO, has long participated in the earnings conference call, something he continued today as chief executive -- unlike Jobs when he was CEO.

Apple ended the quarter with $81.6 billion in cash and securities, up from $76.2 billion three months earlier.

Looking ahead, Apple forecasts $37 billion in revenue for fiscal 2012 first quarter, with earnings per share of $9.30. Apple CFO Peter Oppenheimer offered guidance during today's conference call. Analyst consensus before Apple issued guidance: $36.63 revenue and $8.98 EPS.

Q4 2011 Revenue by Product

- Desktops: $1.69 billion, up 1 percent from $1.68 billion a year earlier.

- Portables: $4.59 billion, up 44 percent from $3.19 billion a year earlier.

- iPod: $1.1 billion, down 25 percent from $1.48 billion a year earlier.

- Music: $1.68 billion, up 35 percent from $1.24 billion a year earlier.

- iPhone: $10.99 billion, up 24 percent from $8.82 billion a year earlier.

- iPad: $6.87 billion, up 146 percent from $2.8 billion a year earlier.

- Peripherals: $640 million, up 34 percent from $477 million a year earlier.

- Software & Services: $729 million, up 10 percent from $662 million a year earlier.

iPhone. Apple shipped 17.07 million iPhones worldwide during fiscal fourth quarter, up from 14.1 million iPhones a year earlier. That's a 27 percent increase, year over year. Wall Street analyst average estimate was about 20 million units. Apple counts shipments into the channel, typically making them several million units higher than numbers released by Gartner, which measures actual sales.

Oppenheimer told analysts today that iPhone sales fell off during the last half of the quarter, citing the "rumor of the day" about iPhone 4S.

Sales in Asia more than doubled. Apple ended the quarter with 5.75 million iPhones in inventory.

With the iPhone 4S launch, the handset is available from 230 carriers in 105 countries.

"I'm confident we'll have strong supply", Cook assured analysts today, regarding Apple having enough iPhone 4Ses to sell during the holidays. He went on to predict "an all-time record" for iPhone sales.

Q4 2011 Unit Shipments by Product

- Desktops: 1.28 million units, up 3 percent from 1 .24 million units a year earlier.

- Portables: 3.62 million units, up 37 percent from 2.64 million units a year earlier.

- iPod: 6.62 million units, down 27 percent from 9.05 million units a year earlier.

- iPhone: 17.07 million units, up 21 percent from 14.1 million units a year earlier.

- iPad: 11.1 million units, up 166 percent from 4.19 million units a year earlier.

iPad. Apple shipped 11.12 million iPads globally during the quarter -- that's up from 4.19 million -- a 166 percent -- a year earlier. The tablet was available in 90 countries at end of quarter, when Apple had 2.5 million units in channel inventory.

The media tablet is one of the most successful new products ever. In this quarter alone, iPad added $6.87 billion revenue to Apple's bottom line. According to Gartner, iPad leads the market segment, currently with 73.4 percent market share, and will continue to do so at least through 2015.

iPad is leading the charge of devices hampering PC sales. Regarding third calendar quarter (Apple's fiscal fourth): "The popularity of non-PC devices, including media tablets, such as the iPad and smartphones, took consumers' spending away from PC", Mikako Kitagawa, Principal Gartner analyst, says. "The PC industry has been performing below normal seasonality. As expected, back-to-school PC sales were disappointing in mature markets, confirming that the consumer PC market continues to be weak".

"I do believe we're seeing some cannibalization", Cook admitted today. He acknowledged that some people are buying iPads instead of Macs, but many more are displacing PC sales. "Cannibalization like this -- I hope it continues".

Apple is a major player in the two most disruptive technologies affecting PCs today -- media tablets and smartphones. "By 2015, mobile application development projects targeting smartphones and tablets will outnumber PC projects by 4 to 1", Hung LeHong, Gartner research vice president, says. "The PC is no longer king".

Gartner predicts that media tablet sales will reach 900 million by 2016, up from 17.6 million last year. For perspective, that's more than 2.5 times the current rate for PCs and nearly as much as the entire Windows PC install base.

"The tablet market will be bigger than the PC", Cook told analysts today. "It's a huge opportunity for Apple across time".

Q4 2011 Revenue by Geography

- Americas: $9.65 billion, up 34 percent from $7.19 billion a year earlier.

- Europe: $7.4 billion, up 36 percent from $5.46 billion a year earlier.

- Japan: $1.2 billion, down 21 percent from $1.4 billion a year earlier.

- Asia Pacific: $6.5 billion, up 139 percent from $2.7 million a year earlier.

- Retail: $3.58 billion, up 1 percent from $3.57 billion a year earlier.

Computers. Mac shipments soared during fiscal fourth quarter. Apple sold -- what company executives really mean by shipped -- 4.89 million Macs during the quarter, up from 3.89 million units from fiscal Q4 2010; growth was 26 percent year over year. Wall Street consensus was about 4.2 million units worldwide. Apple ended the quarter with 3 to 4 weeks of inventory in channel.

Last week, Gartner and IDC released calendar third quarter 2011 preliminary PC shipments. Apple was a star performer, establishing an uncontested third place in the United States. By Gartner's reckoning, Apple's percentage of US PC shipments during the quarter was a stunning 12.9 percent, a solid and unchallenged third place. Fourth-ranked Toshiba had 8.4 percent share. IDC's numbers weren't as magnanimous -- 11.3 percent -- but still better than Apple has had in nearly two decades.

In the United States, Apple outpaced the broader PC market -- with 21.5 percent growth, according to Gartner, and 8.3 percent growth by IDC's reckoning. By comparison, the overall US PC market grew 1.1 percent and 0.1 percent according to Gartner and IDC, respectively.

Q4 2011 Unit Shipments by Geography

- Americas: 1.7 million units, up 18 percent from 1.5 million units a year earlier.

- Europe: 1.2 million units, up 20 percent from 978,000 units a year earlier.

- Japan: 175,000 units, up 48 percent from 118,000 units a year earlier.

- Asia Pacific: 731,000 units, up 61 percent from 455,000 units a year earlier.

- Retail: 1.1 million units, up 25 percent from 874,000 units a year earlier.

iPod. Apple shipped 6.62 million iPods during fiscal fourth quarter, down from 9.05 million a year earlier -- a 27 percent decline. Apple ended the quarter with 4 to 6 weeks channel inventory.

Retail. Revenue from Apple Store rose just 1 percent year over year to $3.58 billion -- that's from an average 336 retail shops. Unit sales increased 25 percent -- to 1.07 million from 874,000 a year earlier. Apple opened 30 new stores during the quarter -- 21 outside the united States and 7 during last week of the quarter. Apple ended Q4 with 357 stores.

During fiscal 2012, Apple will "focus on international expansion" -- 40 new stores -- "with three-quarters outside the United States", Oppenheimer told financial analysts.