Emerging technology is creating new fraud risks, but consumer distrust in AI protection grows

ComplyAdvantage has released its annual report, "The State of Financial Crime 2024," focusing on the rising trend of artificial intelligence being exploited for fraudulent activities. The report also reveals that, despite consumer apprehension about AI, many financial institutions are investing in technology to tackle this emerging threat.

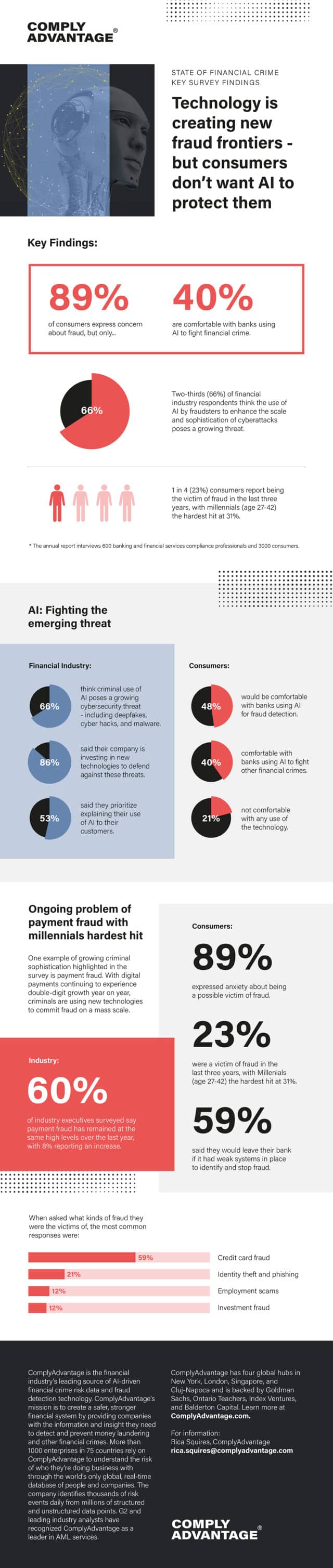

According to the report, 66 percent of financial industry respondents view the criminal use of AI as a growing cybersecurity threat, with risks ranging from deepfakes to advanced cyber hacks and AI-generated malware. In response, 86 percent of respondents reported that their companies are investing in new technologies. However, only 53 percent prioritized explaining their AI usage to customers.

"AI is being utilized by both criminals -- who are using it as new ways to defraud customers -- and institutions, who are using it to stay ahead of fraudsters and defend their customers," said Vatsa Narasimha, CEO of ComplyAdvantage. The report suggests that AI technologies have significant potential to bolster defenses against financial crime, but also highlights the need for banks to reassure customers about their usage.

Narasimha further emphasized the importance of explainability in AI models, suggesting that banks should lead in this trend. Narasimha noted that 65 percent of consumers said they would be willing to share transactional details with other banks to help identify fraud patterns, indicating a readiness for innovative approaches to combating financial crime.

The report also highlights the persistence of payment fraud, with digital payments being a prime target for criminals. Sixty percent of industry executives surveyed reported that payment fraud levels remained high over the past year, with 8 percent noting an increase. The survey revealed that millennials, who are more likely to use digital payments and mobile banking, are particularly vulnerable, with 31 percent falling victim to fraud.

The most common types of fraud reported by consumers were credit card fraud (59 percent), identity theft and phishing (21 percent), employment scams (12 percent), and investment fraud (10 percent).

The report also shed light on the phenomenon of "friendly fraud," with one in five consumers admitting to behaviors such as disputing legitimate payments or claiming refunds without returning items.

"The surprisingly high level of ‘friendly fraud’ uncovered in our survey shows just how widespread and complex fighting fraud can be when consumers can -- even inadvertently -- commit behavior that may raise a red flag with their bank," said Iain Armstrong, Regulatory Affairs Practice Lead for ComplyAdvantage.