Stock market decimalization kills IPOs and ruins the economy

Second in a series. Well it took me more than the one day I predicted to finish this column, which purports to explain that dull feeling so many of us have in our hearts these days when we consider the US economy. Our entrepreneurial zeal is to some extent zapped. For a decade it seemed we needed to jump from bubble to bubble in order just to drive economic growth -- growth that ultimately didn’t last. What happened? Initial Public Offerings (IPOs) went away, that’s what happened.

I wrote several columns on job creation over the last year, columns that explained in great detail how new businesses, young businesses, and small businesses create jobs and big businesses destroy them. Big business grows by economies of scale, economies of scale are gained by increasing efficiency, and increased efficiency in big business always -- always -- means creating more economic output with fewer people.

Too Big to Survive

More economic output is good, but fewer people is bad if you need 100,000 new jobs per month just to provide for normal US population growth. This is the ultimate irony of policies that declare companies too big to fail when in fact they are more properly too big to survive.

Our policy obsession with helping big business no matter which party is in power has been a major factor in our own economic demise because it doesn’t create jobs. Our leaders and would-be leaders are really good at talking about the value of small-and-medium size businesses in America but really terrible about actually doing much to help.

Now here comes the important part: if small businesses, young businesses, new businesses create jobs, then Initial Public Offerings create wealth. Wealth creation is just as important as job creation in our economy but too many experts get it wrong when they think wealth creation and wealth preservation are the same things, because they aren’t.

Wealth creation is Steve Jobs going from being worth nothing at age 21, to $1 million at 22, $10 million at 23, $100 million at 24, to $9 billion at his death 30 years later and in the course of that career creating between Apple and Pixar 50,000 new jobs.

Wealth creation is not some third-generation scion of a wealthy family turning $4.5 billion into $9 billion over the same period of time, because that transformation inevitably involves a net loss of jobs.

The fundamental error of trickle-down (Supply Side) economics is that it is dependent on rich people spending money that they structurally can’t do fast enough to matter, and philosophically won’t do because their role in the food chain is about growth through accumulation, not through new production.

We Need More First-Generation Tycoons

New is the important word here because new jobs are created in inordinate numbers mainly by new (first generation) tycoons, not old ones or second- or third-generation ones. We need new tycoons and we make new tycoons almost exclusively by creating new public companies.

Take Ted Turner as an example. Turner created thousands of new jobs in his career but I’ll bet that he has added zero net new jobs since selling Turner Broadcasting to Time Warner in 1996. That’s not a bad thing, just an inevitable, and the lesson to be learned from it is that we need more young Ted Turners.

Every company that is today too big to fail was once small and literally awash in new jobs. We need more such companies to create more too big to fail enterprises, but without a lot of successful IPOs that isn’t going to happen. It hasn’t happened since the late 1990s and that’s what has sapped the mojo from our economy.

This lack of IPOs is what has also turned Venture Capital from an economic miracle into an embarrasment. Lord knows I’ve written enough about what’s wrong with VCs but until writing this column I never would have identified them as victims, but they actually are.

Venture returns are in the toilet over the last decade or more not just because VCs became inbred and lazy (my usual explanation), but also because the game changed on them almost without their knowing and IPOs went away as a result. They couldn’t get their money out of portfolio companies to reinvest and compound it and when they did get their money out it was through mergers or chickenshit acquisitions that didn’t yield the same multiples.

Not only did IPOs go away, the few that did happen more recently haven’t generally been as successful (Facebook, anyone? Zynga?). We just aren’t as good at creating wealth today as we used to be.

How can that be? Since the 1990s we’ve done nothing but reduce regulations to encourage economic growth. We’ve kept interest rates inordinately low for a decade, which should have given entrepreneurs all the capital they’d ever need to build new empires, but it didn’t happen. A lack of IPOs meant new companies were starved for the growth-capital they needed to take their businesses to the next level. Banks forgot how to make money by lending it to people who could actually use it and so they didn’t lend and entrepreneurs suffered from that, too.

The world is awash in money, but those who can actually use it can’t get any.

Harbinger of Death

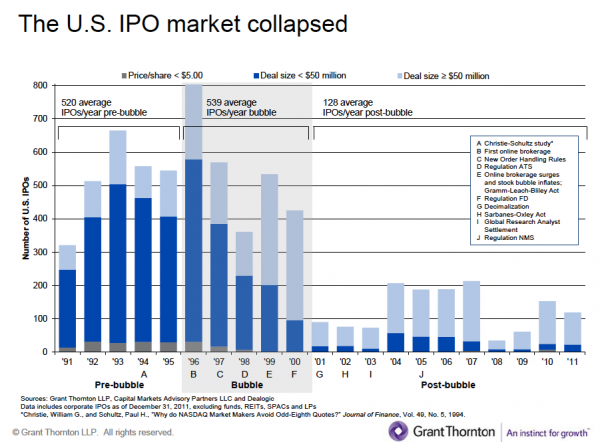

So what caused the death of IPOs? It starts with stock market decimalization.

Here I have to give credit to David Weild a senior advisor at Grant Thornton Capital Markets, who made a fabulous presentation on exactly this topic a couple weeks ago at a crowd-funding seminar in Atlanta. You’ll find his entire presentation here. The charts included with this column were mainly taken from Weild.

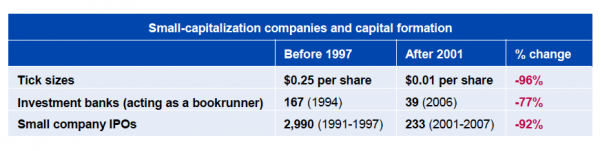

Stock market decimalization came along in 2000 with the idea that it would bring US markets into alignment with global share pricing standards and (here’s the harder to buy one, folks) decimalization would help small investors by marginally reducing the size of broker commissions. With stock-tick intervals set at a penny rather than at a sixteenth of a dollar (an eighth of a dollar prior to 1997), it was argued, commissions could be more accurately calculated.

Perhaps, but at what cost?

Here’s how decimalization was described by Arthur Levitt, the Fed Chairman in 2000 who has since recanted these words: "The theory is straightforward: As prices are quoted in smaller and smaller increments, there are more opportunities and less costs for dealers and investors to improve the bid or offer on a security. As more competitive bidding ensues, naturally the spread becomes smaller. And this means better, more efficient prices for investors".

Decimalization made High Frequency (automated) Trading possible -- a business tailor-made for trading large capital companies at the expense of small caps and IPOs. Add to this the rise of index and Exchange Traded Funds and all the action was soon in large cap stocks. Market makers were no longer supporting small caps by being a willing buyer to every seller. Big IPOs like General Motors flourished while little Silicon Valley IPOs dramatically declined.

Nothing but Devastation

There are 40 percent fewer US public companies now than in 1997 (55 percent fewer by share of GDP) and twice as many companies are being delisted each year as newly listed. Computers are trading big cap shares like crazy, extracting profits from nothing while smaller companies have sharply reduced access to growth capital, forcing them at best into hasty mergers.

Yes, commissions are smaller with decimalization but it turns out that inside that extra $0.0525 of the old one-sixteenth stock tick lay enough profit to make it worthwhile trading broadly those smaller shares.

Decimalization pulled liquidity out of the market, especially for small-cap companies, hurting them in the process. Markets and market makers consolidated, which also proved bad for small caps and their IPOs. Wall Street consolidation was good for big banks but bad for everyone else.

Now why doesn’t that surprise me?

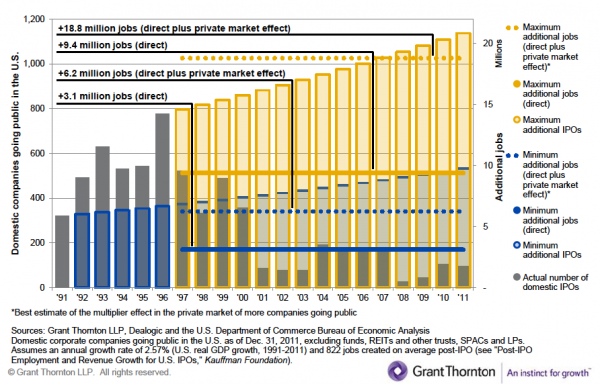

The dot-com bubble was a bubble, we all sort of knew, so it would have burst inevitably, but decimalization made it so bad that whole markets died, leaving us with our present situation. Here’s a chart suggesting we’d be 18.8 million jobs ahead if decimalization hadn’t happened. That’s 14.8 million jobs more than we have today and the difference between economic stagnation and boom.

But we can’t just go back to the old ways, can we?

That’s what my next column will be about.

Photo Credit: lev radin/Shutterstock