What the heck is happening at Apple?

"What the heck is happening at Apple?" people ask me. "Has the company lost its mojo?" "Why no new product categories?" "Why didn’t Apple, instead of AT&T, buy Time Warner?" And "Why are the new MacBook Pros so darned expensive?"

After first getting out of the way the fact that Apple is still the richest public company in the history of public companies, let’s take these questions in reverse order beginning with the MacBook Pros. In addition to their nifty OLED finger bar above the keyboard, these new Macs seem to have gained an average of $200 over the preceding models of the same size. What makes Apple think it can get away with that?

Apple can get away with that because it always has gotten away with it. Apple has always prided itself on high profit margins and really socking it to the customer when a new product is released is a tradition in Cupertino dating back to the Apple III. Remember the original 128K Macintosh cost more than $2400 and it was close to useless.

High prices not only mean high margins, they also act to control demand, making it somewhat easier to handle problems that come with any truly new model. And those who are willing to pay more are often more understanding, too. Apple fanboys are proud to be the first and proud to have spent so much. It’s a luxury thing, I suppose.

What we can count on is that MacBook Pro prices won’t get any higher for many years and these models will decrease in price as production ramps up (expect $100 off just before and after Christmas) and especially when they are replaced by subsequent models with more powerful processors.

And as IBM reported a couple weeks ago, even at higher prices, Macs tend to be cheaper to own. I’m writing this on a mid-2010 non-Retina 13-inch MacBook Pro I bought six years ago last June. Yes, over time I increased the memory to from 4GB to 16GB, took the hard drive up from 240GB to a 1TB Fusion drive, replaced both the battery and the keyboard when they wore out, but that still puts me only about $1,600 into this device with which I have so far generated well over $1 million in revenue. I have no plans to replace it.

In the same period I have also gone through three Windows notebooks from Toshiba, Acer and HP.

This very durability presents a problem for Apple that they’ve tried to deal with by eventually stopping software support for older machines. That’s why the Mac Minis of my kids now run Ubuntu. Old Macs get handed down or sold on Craigslist and that’s a problem for Apple, but not nearly as big a problem as the fact that pretty much everyone who wants a smart phone now has one.

Yes, Apple has a problem -- a problem most other companies would love to have: customers like the products too much so the market is becoming saturated.

All Apple needs is a new product category, right? Another iMac, iPod, iPhone, iPad will do nicely. Where is it?

It isn’t anywhere and in that sense Apple has lost its mojo.

Apple has a problem of big numbers: unless a new product category can produce $5-10 billion in revenue its first year it almost isn’t worth doing. And Apple has such new products -- headphones and Apple Music primarily -- but those just don’t seem like much when Amazon -- Amazon -- seems to be inventing new categories all the time. But Amazon’s requirements for success are much lower than Apple’s and its tolerance for failure (Amazon Fire phone anyone?) are higher.

Apple, whether it admits so or not, has to live with the memory of Steve Jobs.

And so Apple is both paralyzed and isolated. These two characteristics have to be considered together to understand where the company stands. While I doubt that Apple is out of good ideas I also don’t doubt that the company is close to being incapable of seriously committing to any of the ones it has. What would Steve do? And the absence of Steve Jobs is made even worse by the fact that Apple generally stands apart from the rest of the industries in which it competes. Where is Apple at industry conferences, for example? With the exception of technical standards bodies, where Apple shines, the company just isn’t out there. Rather than holding up a finger to test the wind Apple’s tendency is to examine its own navel because great ideas are supposed to, well, just appear.

Except great ideas don’t just appear. As Steve Jobs (and Picasso) said, they are stolen. And to my knowledge nobody from Apple has been out stealing anything for a long time.

So Goldman Sachs is upset that Apple didn’t at least bid for Time Warner. I’m pretty sure Apple didn’t even know Time Warner was for sale.

The basic problem here is that Apple insists on "thinking different" when in fact there’s not much real thinking happening there at all -- just waiting for something to percolate.

And when it percolates, that something still has to not only be different, it can’t put a hurt on Apple’s sacrosanct margins, which means almost no new ideas qualify no matter how well they have been perked.

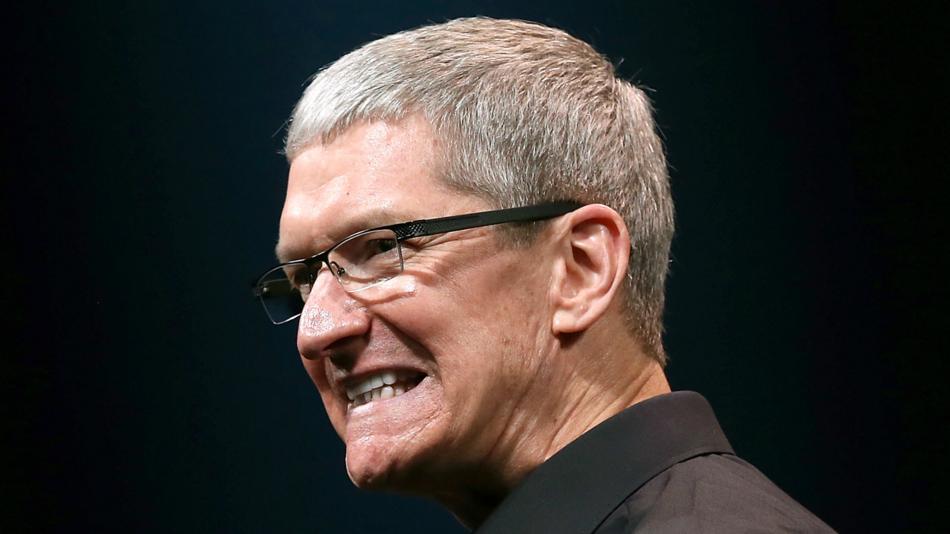

Leave it to me, then, to tell Apple how to get its mojo back. I have two ideas right now that qualify but I’ll only give one here. If Apple wants to hear the other (even bigger) one, Tim Cook will have to give me a call.

Apple doesn’t need to buy Time Warner to dominate the TV and movie businesses. Apple doesn’t have to create a studio, either. Nor does it have to even enter the content creation business in the same sense that Amazon and Netflix have.

All Apple has to do is control the writers.

Nearly all original ideas in Hollywood, and anywhere else visual entertainment is made, begin in the mind of a writer. Yet writers, like most actors, are notoriously underpaid. Apple just needs to create a welfare state for writers.

What Apple needs is an option for the online rights to every writer’s work. There are probably 10,000 "writers" in the entertainment business earning anywhere from $5,000 to $5 million per year. I want Apple to put under contract every writer who has ever written anything that’s been produced, paying them each a guaranteed baseline of $40,000 per year (that’s $400 million annually) with an additional $600 million going to writers whose work is actually produced. Let’s say there are 2,000 films and TV shows produced per year so that would be, say, $500,000 per movie and $50K per series episode.

These amounts are substantially above Writers Guild rates and what they’d buy is a streaming option. Apple gets its pick of everything.

The industry wouldn’t know what hit them as Apple steals the idea stream at its source. Apple would have to negotiate the deal with the Writers Guild, which would love it. Producers would hate it but would learn to love it because Apple would end up financing many of their productions.

Now that’s fundamentally different.