Apple pushes into global phone shipments top 5

Apple is now No. 4 in global handset shipments -- not smartphones, but all mobiles. The share gains also put Apple ahead of Research in Motion in third-quarter data that IDC released late yesterday (presumably while I covered Microsoft earnings). Apple's ascension pushed Sony Ericsson out of the top 5 for the first time since IDC started tabulating mobile shipments six years ago. The top 5 achievement is huge validation for Apple, which before the June 2007 release of the original iPhone had no presence in the global handset market.

However, the more significant measure is yet to come, and it might explain comments CEO Steve Jobs made during last week's Apple earnings conference call. Jobs expressed displeasure about how some analyst firms count phones. "Unfortunately there is no solid data on how many Android phones are shipped each quarter," he asserted. "We hope that manufacturers will soon start reporting the number of Android handsets that they ship each quarter. But today that just isn't the case. Gartner reported that around 10 million Android phones were shipped in the June quarter, and we await to see if iPhone or Android was the winner in this most recent quarter."

Whether or not intended, Jobs' assertion is misdirection. Based on these comments and others made on the conference call, he is dissatisfied with how Gartner tabulates its numbers. IDC measures manufacturer shipments, while Gartner measures actual phone sales. As such, Gartner's figures tend to be much lower than either Apple's or IDC's. By sales reckoning, iPhone might not rank as high, because of the difference between units in inventory and those actually sold.

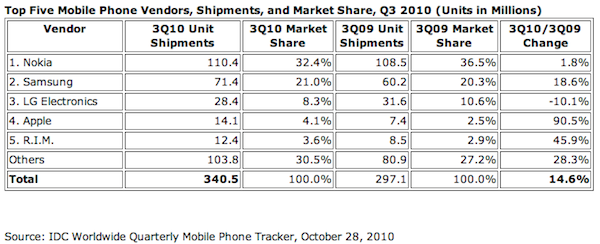

Still, No. 4 is no small achievement. Before today's announcement, Apple ranked in the top 3 based on smartphone shipments. Global handsets is a significantly larger category. During third quarter, manufacturers shipped 340.5 million phones, according to IDC. Shipments grew by 14.6 percent year over year. Apple, RIM and Samsung shipments all grew considerably faster than the broader handset market -- 90.5 percent, 45.9 percent and 18.6 percent, respectively. While Apple executives may gloat over passing RIM -- as Jobs did on last week's Apple earnings call -- BlackBerry was no laggard, growing nearly three times as fast as the broader handset market. RIM also shipped a record number of BlackBerries during third quarter. RIM shipped 12.4 million handsets compared to 14.1 million for Apple.

"The entrance of Apple to the top 5 vendor ranking underscores the increased importance of smartphones to the overall market," Kevin Restivo, IDC senior research analyst, said in a statement. "The smartphone is becoming the focal point of the personal communications experience. As a result, new market growth will be increasingly generated by smartphones. This year, we are expecting the smartphone sub-market to grow 55 percent year over year."

Still, IDC's manufacturer shipment data gives an incomplete picture of the broader handset market, and Jobs was right to wonder about those numbers. Competitively, mobile OS shipments will put Apple's iOS in perspective of other mobile operating systems -- Android in particular. There, Apple may find itself the one running behind instead of ahead with respect to RIM.