Apple Q2 2013 by the numbers: $43.6B revenue, $10.06 EPS

Today's closing bell brings answer to a question oft-asked over the past two weeks: "Will Apple profits fall for the first time in about a decade?" Not since 2003, when the fruit-logo company recovered from economic woes that sapped global PC shipments everywhere, has profit receded. Now we know.

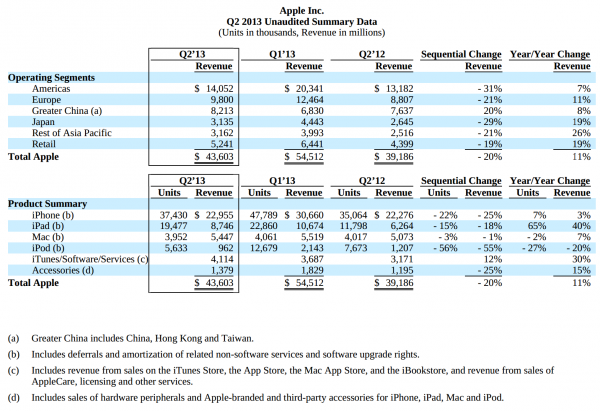

For fiscal Q2, Apple reported $43.6 billion revenue and net profits of $9.5 billion, or $10.06 a share. Gross margin: 37.5 percent. A year earlier, the company reported revenue of $39.2 billion and $11.6 billion net quarterly profit, or $12.30 per share.

Analyst consensus for the quarter was $42.49 billion, up 8.4 percent year over year, and EPS of $10.07. Revenue estimates ranged from $41.06 billion to $44.18 billion and $9.23 to $12 earnings per share.

Apple shipped 3.9 million Macs, 19.5 million iPads and 37.4 million iPhones during the quarter. Analyst consensus was around 4 million, 18 million and 36 million, respectively.

Apple ended the quarter with $144.7 billion in cash, up from 137.1 billion the previous quarter; $102 billion is offshore.

For fiscal third quarter, Apple expects revenue to be between $33.5 billion and $35.5 billion and operating margins between 36 percent and 37 percent.

In an unusual turn, Apple CEO Tim Cook began today's earnings conference call. He observes that during the first half of fiscal 2013, Apple generated $98 billion in revenue and $22 billion in profits. The company shipped 85 million iPhones and 42 million iPads during same time period.

"We know they didn't everyone's meet expectations", Cook says of the quarter. He acknowledges that Apple's growth is slowing and margins declining. But 2012 was a hugely successful year, and "That's making comparisons very difficult this year".

Profits and Profits

Apple is partly responsible for the recent profit furor, by changing forecast guidance metrics. Three months ago, the company told Wall Street to expect between $41 billion and $43 billion in revenue for fiscal 2013 second quarter, with gross margin between 37.5 percent and 38.5 percent. But in a radical departure, Apple didn't provide EPS guidance.

Apple's super secrecy and past practice of massaging news for most favorable public perception easily fed conspiracy theories about profits in decline. Otherwise, why would the company suddenly stop giving guidance? Then there are analyst numbers showing tablets, mainly iPad, sapping personal computer shipments, including Macs, and Apple's smaller mini also taking sales from the larger one. Gross margins were 47.4 percent in the year ago quarter. In context of Apple's guidance, and analyst data about PCs and tablets, Wall Street rightly worried about falling profits.

But how low really is too low. Apple is a massive money machine. For fiscal 2012, which closed end-of-September, Apple revenue reached $156.51 billion, up 140 percent from fiscal 2010. During the same time period, Apple's net income rose to $41.733 billion from $14.01 billion. No tech company comes close. Google and Microsoft combined generated less revenue for calendar Q1 (same as Apple fiscal second quarter) -- $34.46 billion.

Perception is the problem. Apple's stock price is in state of collapse. At market close today, shares were down about 42 percent from September's $705.07 all-time high. Today, Cook says that the recent stock decline "has been very frustrating to all of us".

The sell-off comes in part because of misguided perceptions that because the company hasn't recently released something dramatically new CEO Tim Cook somehow isn't as competent a leader as cofounder Steve Jobs. For irrational reasons that make no sense to me, analysts and investors are hung up on the something new, while ignoring key fundamentals. First: Apple's real, spectacular performance. Second: How the company historically launches products. The latter is crucial.

Apple typically announces category-creating or reinventing products then takes them to maturity over many years. Examples are everywhere. Among them:

- OS X (January 2001-present), there's still no OS XI

- Apple Store (May 2001-present)

- iPod (October 2001-present)

- iTunes Store (April 2003-present)

- iPhone (June 2007-present)

- App Store (July 2008-present)

- iPad (April 2010-present)

Few companies create more than one industry-changing product. None as many as Apple. So the market's expectations are unrealistic and ignore the fundamental stewardship inherited by current leadership.

Right now, Cook's charge is managing two relatively new product lines, which make up the bulk of profits. During fiscal Q1, iOS devices represented close to three-quarters of all revenue. His first responsibility is to manage these maturing businesses before committing Apple to some new or redefining category. But investors want the feel-good thing that creates allusions, perhaps illusions, about Apple as sitting-at-the-right-hand-of-God innovator. Some people may think that's a position where Jobs is today. Perhaps they should lower such esteem about him and raise that of Cook, whose task is harder, for how much bigger is the Apple crop today than three years ago.

Results by Category

As a journalist, I dislike how Apple releases results. Google and Microsoft report minutes after the market closes. The fruit-logo company waits, and particularly long time today. Now for the numbers breakdown.

iPhone. Increased demand for lower-cost models -- iPhone 4 (free), 4S ($99) -- is a concern. Average selling price declined about $20 sequentially -- "driven primarily by mix", mainly iPhone 4, Apple CFO Peter Oppenheimer says.

Apple shipped 37.4 million iPhones worldwide during fiscal first quarter, up from 35.07 million a year earlier. That's a 7 percent increase, year over year. However, shipments fell 22 percent sequentially.

Revenue reached $22.96 billion, up 3 percent year over year from $22.3 billion. Sales slumped 25 percent from third quarter.

During today's conference call, Oppenheimer says 30,000 businesses are developing iOS apps.

Apple ended the quarter with 4-to-6 weeks of iPhone inventory, which is typical level.

With competitors shipping smartphones with larger displays, it's unsurprising someone asks what Apple will do. Cook claims that the smaller screen offers better everything, such as viewability and longevity, for example, while competitors make sacrifices. "We would not ship a larger display iPhone while these trade-offs exist", Cook says.

iPad. Apple tablets are cause for consternation coming to today's earnings report. Last month, NPD DisplaySearch followed up a January tablet forecast that shifts the market from 9.7-inch and 10.1-inch display models to those with 7-7.9 inches this year. Small tabs are predicted to make up 45 percent of shipments, while iPad's size drops to 17 percent. The change potentially means a big shift downward in Apple tablet margins.

"Apple had planned to sell 40 million iPad minis (7.9 inches) and 60 million iPads (9.7 inches) in 2013", David Hsieh, NPD vice president, says. "However, the reality seems to be the reverse, as the iPad mini has been more popular than the iPad. We now understand that Apple may be planning to sell 55 million iPad minis and 33 million iPads in 2013". DisplaySearch predicts global tablet shipments will reach 240 million this year. Assuming Apple does 88 million, that's 36.7 percent. But most of the growth is iPad mini.

Apple shipped 19.5 million iPads globally during the quarter, that's up from 11.8 million -- a 65 percent increase -- a year earlier. Revenue rose 40 percent to $8.75 billion. Sequentially, units fell by 15 percent and sales by 18 percent.

Oppenheimer says that all the growth came from iPad mini. He acknowledges that tablets contributed to margins coming in at the "low end of the range". However, the margin pull wasn't disastrous. ASP was $449, down from $467 a quarter earlier.

Apple ended the quarter with 4-to-6 weeks of inventory.

Macs. Computers is a category closely watched coming into today's results -- that's because globally shipments collapsed during calendar first quarter to historical lows. IDC says the decline, 13.9 percent, is the worst ever. Gartner: Down 11.2 percent. For the United States, respectively: -12.7 percent and -9.6 percent.

The analysts couldn't agree on Macs. IDC reports U.S. shipments falling 7.5 percent year over year, while Gartner sees them increasing by 7.4 percent. As such, market share estimates don't jive either -- 11.6 percent (Gartner) and 10 percent (IDC). Fifteen points separate growth estimates, which is huge.

Apple shipped 3.95 million Macs, down 2 percent from 4 million a year earlier. However revenue climbed 7 percent to $5.07 billion.

"The market for PCs is incredibly weak", Cook says. "Some of those iPads cannibalized some of those Macs". He believes the PC market "has a lot of life left in it". Ultimately, the chief executive sees iPad benefitting Mac sales, and at expense of Windows machines.

There were 4-to-5 weeks of inventory at end of the quarter.

iPod. Apple shipped 5.6 million iPods during fiscal second quarter, down from 7.7 million a year earlier, or 27 percent. Revenue fell 20 percent, from $1.21 billion to $962 million.

Software/Services. Music, apps and services revenue exceeded $4 billion, up 30 percent year over year. About $2.4 billion came from iTunes.

Around the world, there are now 155 Apple App Stores and 110 iTunes Stores. Payments to developers for their apps now runs $1 billion per quarter.

Retail. Revenue from Apple Store rose 19 percent year over year to $5.2 billion, from $4.4 billion, with an average 401 stores open. Average revenue per store was $13.1 million, up from $12.2 million a year earlier. Number of visitors rose to 91 million from 85 million, annually, or 17,500 per store.

There are now 402 stores, 151 outside the United States.

Geographies. Greater China revenue rose 8 percent year over year to $8.2 billion. iPad grew by 137 percent, in the country. Revenues from the Americas climbed less, 7 percent, to $14.05 billion. Europe; $9.8 billion, up 11 percent. Japan: $3.14 billion, up 19 percent. Sales for the rest of Asia rose 26 percent, to $3.16 billion.

Photo Credit: Lucia Pitter/Shutterstock