Digital bank Monzo gains a full European banking licence

UK-based digital bank Monzo is ready to expand into Europe. The fintech has acquired a full banking licence from the Central Bank in Ireland, as well as from the European Central Bank.

Monzo has gone from strength to strength since it launched back in 2015. Now the company’s European headquarters will be in Dublin, where it will be regulated by the Central Bank of Ireland.

Financial sector ups investment in ID verification tech

Banks, fintechs, and crypto platforms are ramping up investment in fraud prevention and identity verification (IDV), positioning it as the next layer of cyber defense, according to a new survey.

The study from Regula shows banks are leading this trend: the share of institutions intending to increase IDV budgets by more than 50 percent is nearly tripling -- from 4.4 percent to 15 percent in just two years.

82 percent of finserv organizations suffered a data breach in the last year

A new report, based on a global survey of 250 decision makers at large financial services organizations of over 5,000 employees, shows that 82 percent have suffered a data breach via cyberattack, or a data leak, an unintentional exposure of sensitive data, in the past year.

The report from Blancco Technology Group finds 43 percent of breaches or leaks were attributed to stolen devices and drives.

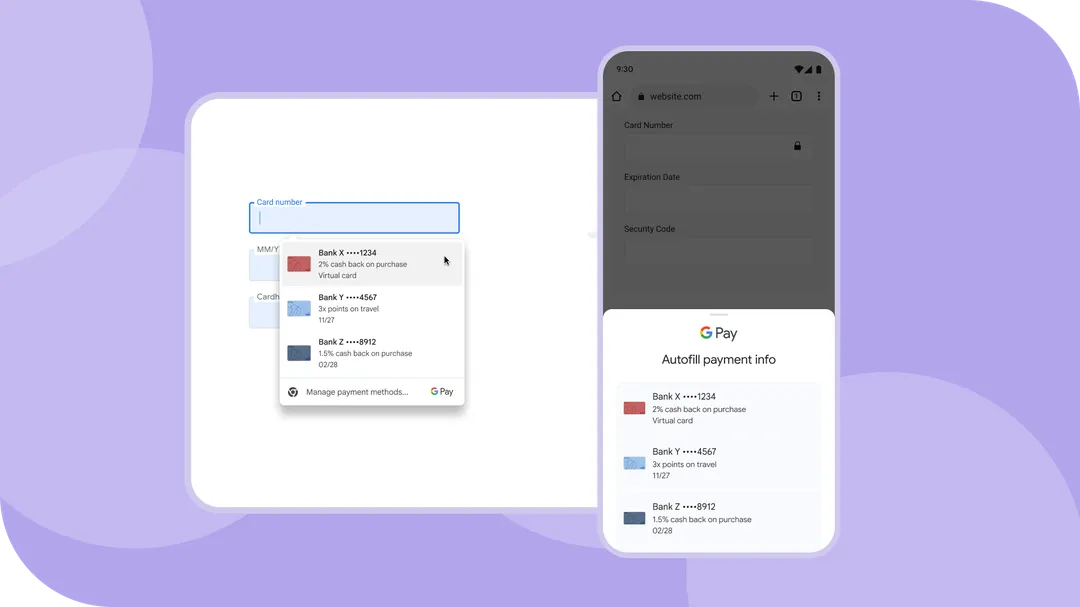

Google Pay adds new ways to make web payments easier

Google Pay has announced three new features which it says will make online payments simpler and more flexible for shoppers. The update focuses on providing more choice, convenience and value, and covers both everyday purchases and larger transactions, as well as international money transfers.

For US buyers, Chrome’s autofill feature will now display reward details for over 100 credit cards, expanding from the smaller set previously supported. This addition makes it easier to see which card offers the best benefits for a specific purchase before checkout.

Visa turns to AI to help cut fraud

With fraud on the increase and more sophisticated attack methods being used, payments company Visa is turning to AI to help businesses and financial institutions fight back.

It's introducing ARIC Risk Hub, developed by Featurespace -- a company recently acquired by Visa -- which uses adaptive AI to build profiles around genuine customer activity making it easier to spot suspicious actions.

Trust in digital services in decline

A new survey of over 14,000 consumers across 14 countries finds that most industries experienced a decline in consumer trust compared to last year.

The latest Digital Trust Index from Thales shows banking tops the index for the second year in a row, but levels of trust have fallen among Gen Z customers.

Financial sector faces increased cybersecurity threats

A new survey reveals that the financial industry has faced a surge in attacks, with 64 percent of respondents reporting cybersecurity incidents in the past 12 months.

The study from Contrast Security finds 71 percent of respondents reported zero-day attacks as the key concern to safeguarding applications and APIs, followed by dwell time (43 percent) and lack of visibility into the application layer (38 percent).

Nearly half of UK financial businesses not ready for a date with DORA

The EU's Digital Operational Resilience Act (DORA) comes into force tomorrow (Jan 17th) but new research shows that 43 percent of the UK's financial organizations are set to miss the deadline for compliance, with 20 percent expecting to do so by at least four months.

Although the UK is outside the EU its strong financial ties with Europe mean firms operating in or interacting with EU markets will need to align with DORA standards to continue their business relationships.

97 percent of banks hit by third-party data breaches

New analysis released by SecurityScorecard reveals that 97 percent of the top 100 US banks have experienced a third-party data breach in the past year.

As banks increasingly rely on third-party vendors for core functions, their exposure to supply chain vulnerabilities increases. Using the largest proprietary risk and threat intelligence dataset, SecurityScorecard's experts analyzed how third-party breaches impact the banking sector.

AI boosts rise in phishing and spoofing attacks on banks

The US banking industry has seen a significant uptick in cyberattacks, particularly in phishing and spoofing, and tactics are becoming increasingly advanced due to AI.

New research from BforeAI analyzed 62,074 domains registered between January and June 2024 with finance-related keywords. Of those registered domains, 62 percent were found to be involved in phishing attacks targeting legitimate entities via spoofing websites.

New nation-state campaigns target government, banking and healthcare

Researchers at secure browser company Menlo Security have uncovered three new nation-state campaigns employing highly evasive and adaptive threat (HEAT) attack techniques.

In a 90-day period, the campaigns -- LegalQloud, Eqooqp, and Boomer -- compromised at least 40,000 high-value users, including C-suite executives from major banking institutions, financial powerhouses, insurance giants, legal firms, government agencies, and healthcare providers.

Most consumers ready to switch banks over fraud protection measures

A new study reveals growing anxiety among consumers that weaknesses in their banks' fraud-protection measures could leave them exposed to scammers, this would result in the vast majority (75 percent) switching providers.

For the report from Jumio sampled the views of more than 8,000 adult consumers, split evenly across the UK, US, Singapore, and Mexico, with research carried out by Censuswide.

Why the financial services industry has to start future-proofing their operations

The digital revolution continues at pace. Yet, whilst many industries are looking to harness the transformative impact of AI and other innovative tech, there are many firms in financial services that are simply unprepared and unable to capitalize on the latest advancements.

A reliance on legacy systems and the use of paper-based forms of communication and record-keeping is holding the sector back. Now is the time for the industry to fully embrace digital transformation strategies or risk being left behind. The benefits of going digital for businesses in the financial services industry are huge, encompassing benefits from streamlining operations and cutting costs, to improving customer experience and overall functionality. Whilst adopting new technologies undoubtedly comes with risks, the sector can ill-afford to stand still in the face of such a rapidly changing world.

Almost a quarter of consumers consider cybersecurity when choosing a bank

What factors do you take into account when choosing a bank? How good the interest they offer on your savings is perhaps? Whether there's a convenient branch nearby? How easy the website is to navigate? A new study shows that 23 percent of US and UK consumers say that a bank's approach to cybersecurity is a factor when they consider opening an account.

The research from CybSafe finds that 85 percent of customers feel it important that their bank offers training about staying safe online and avoiding scams to those who want it, with 42 percent of respondents stating that such measures are 'very important'.

PSD3, Banking-as-a-Service and fewer passwords -- fintech predictions for 2024

In recent years, the financial sector has seen some of the biggest changes in the way technology is used. New regulations and disruptive technologies like blockchain, along with the rise of open banking, have seen traditional players scrambling to keep up with more agile newcomers.

So what does the fintech sector have in store in 2024? Here are the views of some industry experts.