Samsung Pay now available in the UK

The Galaxy S8 and Galaxy S8+ are two amazing flagships, and, if you're an UK owner, you will like Samsung's latest high-end smartphones even more, as Samsung Pay support is now available.

Samsung Pay arrives in the UK well after Android Pay, which Google introduced a year ago. But, as the saying goes, better late than never. The mobile payments service lets you "make purchases almost anywhere contactless debit cards or credit cards are accepted."

77 percent of British consumers have worries about new payment methods

This week South Korea takes the first steps towards becoming a coinless society as shoppers will be handed pre-paid cards instead of change in a country-wide trial. If the trial is successful, bank officials will allow change to be transferred straight into the shoppers' bank accounts by next year.

But a new report from global law firm Paul Hastings shows that security fears are preventing many British consumers embracing new payment technologies. The study of over 2,000 consumers finds 77 percent are worried about using new payment methods.

Security concerns hold back mobile payment adoption

Businesses and consumers recognize the benefits of mobile payments, but worries over security are holding back adoption according to a new report.

The study by Oxford Economics interviewed 2,000 consumers and 300 business executives and finds that 62 percent of consumers say mobile money enhances their buying experience, and 72 percent of executives say mobile payments can boost their sales.

Mobile app use could boost charity giving

We're all spending more and more via mobile apps, and giving to charity could be the next area to benefit from the shift to mobile payments.

A new study carried out by social payment app Moneymailme finds that 72 percent of 18-25 year-olds would give to charity via a mobile app if given the chance. 48 percent of this generation believe physical money will be obsolete within 20 years so the ability to donate via apps will become key.

Google brings Android Pay to Japan

Mobile payments could one day be the death of cash. While many people will surely be anxious regarding the disappearance of paper money, it is really not the question of "if", but "when". True, that takes away privacy, but it also limits the possibilities of secret transactions for things like illegal drugs or unregistered handguns. Not to mention, it is very convenient!

Android Pay is Google's smartphone-based mobile payment system, and it has been growing in popularity in the USA. Today, Android Pay comes to yet another country -- Japan.

What you need to know about mobile payments

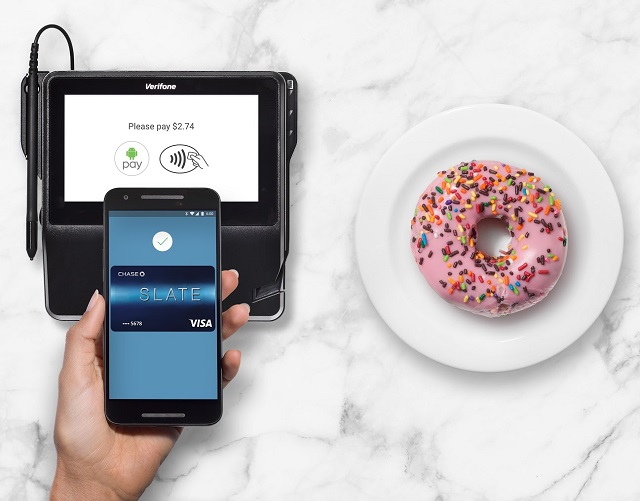

Mobile payments have actually been around for a few years now, but have only recently made the kind of impact that makes consumers and businesses take note. Unsurprisingly, mobile payments refer to financial transactions that are performed using a mobile device, most commonly a smartphone. As an alternative method of payment to debit cards or cash, mobile payments have gained in popularity all over the world, with businesses ranging from tech giants to independent startup all vying for market share in this fledgling industry.

As with any other new technological phenomenon, mobile payments are sure to create as many disruptions as opportunities, so it’s vital that businesses carefully manage the introduction of new payment platforms.

Mobile payments in high demand with consumers

Cash is overrated among businesses, a new study by NTT DATA suggests. Consumers don’t really use it that much, and expect the payment industry to move more towards digital wallets in the future. This is according to a new report, based on a poll of 2,000 consumers and 300 executives.

A third of consumers expect mobile money to dominate within a decade. But there is a strong discrepancy between executives and consumers -- 40 per cent of executives, in various industries, think people will pay the same for transactions in a decade than they do today. Among consumers just 27 percent expect transaction values to stay the same.

How mobile payment adoption can pick up speed

Despite the fact that consumer awareness of mobile wallets like Apple Pay and Samsung Pay is growing all the time, the use of mobile payment solutions in the United States and Canada has so far been low. In fact, in both markets mobile payments account for only 3 percent of all transactions.

While the two payment landscapes are very different, there are similar reasons why the result has been largely the same. By the same token, there are also common factors that could see mobile payments explode in both markets sooner rather than later.

How incentives are key to driving mobile wallet use

Mobile wallets are gaining in popularity, according to a new survey by loyalty platform Points almost 64 percent of consumers say they've used a mobile wallet in the past year.

However, some consumers are still reluctant to make mobile payments for a variety of reasons. 47 percent are concerned about security and privacy, 45 percent say that credit and debit cards and/or cash are enough, and 20 percent say it’s too complicated.

Mastercard rolls out biometric payments in Europe

MasterCard has just rolled out a new feature that should simplify online shopping, without making any compromises in security. The feature, called Identity Check Mobile, allows users to use biometrics like fingerprint scanning or facial recognition to verify their identity before making a purchase, eliminating the need for passwords or PIN codes.

At the moment, the technology is being introduced in 12 European countries: the UK, Austria, Belgium, Czech Republic, Denmark, Finland, Germany, Hungary, the Netherlands, Norway, Spain, and Sweden. Worldwide rollout is expected next year, although no specific dates have been given.

9 best practices for accepting payments via mobile device and mPOS

Is your business accepting payments on mobile devices, or considering it? If so, you are in good company. Large retailers, such as Nordstrom’s, have seen increased sales after integrating an mPOS (mobile point of sale) solution. Major restaurant chains, including McDonald’s and Olive Garden, are using it, too. In fact, a report by 451 Research projected that by 2019, the global mPOS installed base will reach 54 million units, which is quadruple the number from 2015.

According to a Juniper Research report, by 2021, more than one in three POS systems will be mobile. It’s no wonder mPOS solutions are catching on. They are not only convenient, but also provide tangible benefits to both merchants and customers. Shortened transaction time, elimination of lines, scalability capability, and less reliance on cash all increase sales and heighten customer satisfaction. But any data transfer comes with risk. To ensure a safe and secure mPOS experience, follow these best practices:

Android Pay now supports Google Chrome, Chase cards, and Uber Payment Rewards

Cash is dumb. No, I do not necessarily mean stupid; I mean it is not "smart" from a technology standpoint. Understandably, some folks like the idea of paper money as it allows their honest transactions to occur below the radar, and for a privacy standpoint, I understand that. However, cash also assists people that commit crimes, such as drug dealers -- and that is not cool. Once all monetary transactions are digital, and cash no longer exists, law enforcement will have an easier time tracking illegal transactions, while honest folks can more easily track and budget their finances.

Digital payment systems, such as Samsung Pay and Apple Pay are paving the way for a cashless society. Google's Android pay is also part of the push, and today, it is getting even better. Not only is it adding many new banks to the program, such as Chase, but it is also adding support for mobile Google Chrome and Uber's Payment Rewards program.

Samsung Pay vulnerability can enable fraudulent payments

During the recent Defcon hacking conference, held last week in Paris, a hacker demonstrated how he could make fraudulent payments through Samsung Pay.

Samsung says it knew of this and considers it an acceptable risk. It claims the method is almost too difficult to pull off, and no different than fraud methods we see today with credit cards.

Apple Pay struggling outside of US

Apple Pay may be doing well in the US, but a new report from Reuters suggests that Apple’s mobile contactless payment service has not seen the same success rate outside of its home territory.

The service became available for US consumers in October 2014 and has since gained a great deal of traction and users in its home country. Outside of the US, Apple Pay is currently available in the UK, Canada, Australia, Singapore and China. However in these countries technical issues, resistance from banks, and consumer indifference have plagued the service from the start.

Samsung Pay makes its European debut

Samsung Pay is nearly nine months old at this point yet it is only available in a handful of markets across the globe. That does not include Europe, though Samsung earlier this year announced that it would bring its mobile payments service to more countries in 2016.

The company is keeping its promise, as, after launching Samsung Pay in South Korea, US and China, it is now introducing the service in the first European market -- Spain. Here is what you need to know.