Apple is better off without Steve Jobs

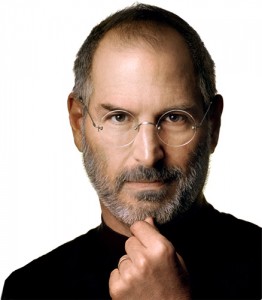

For all practical purposes, Tim Cook has run Apple since cofounder, and then CEO, Steve Jobs' January 2009 medical leave. Sure Jobs returned six months later and continued his micromanaging ways, but Cook, as COO, continued responsibility for day-to-day operations. He already had distinguished himself as a logistics genius, at Compaq and for a decade at Apple, before assuming Jobs' daily role -- and becoming CEO in August 2011. Cook's influence on the current state of Apple cannot be understated.

For all practical purposes, Tim Cook has run Apple since cofounder, and then CEO, Steve Jobs' January 2009 medical leave. Sure Jobs returned six months later and continued his micromanaging ways, but Cook, as COO, continued responsibility for day-to-day operations. He already had distinguished himself as a logistics genius, at Compaq and for a decade at Apple, before assuming Jobs' daily role -- and becoming CEO in August 2011. Cook's influence on the current state of Apple cannot be understated.

As I write Apple shares are up, following yesterday's stunning fiscal 2012 second quarter earnings results; net income rose a stunning 94 percent year over year. The stock closed down 2 percent yesterday, but shot up more than 7 percent in after-hours trading. Apple closed at $560.28 yesterday and opened at $615.99 today. But the measure of Cook's success, and why he is the better man to run Apple, is much more than rising share price. It's really about performance.

Dollars and Sense

During fiscal first quarter 2012 (synchronous with calendar Q4 2011) Apple generated more revenue ($46.33 billion) than all fiscal 2009 ($42.9 billion). During the first half of fiscal 2012, Apple generated more revenue ($85.83 billion) than all fiscal 2010 ($65.23 billion). If Apple meets or surpasses targets for fiscal third quarter, revenue for the first nine months will top all of fiscal 2011 ($108.25 billion).

Looked at differently, Apple's net income for the first fiscal half of 2012 ($24.12 billion) exceeds that of fiscal 2009 and 2010 combined ($22.25 billion) and is surprisingly close to all of fiscal 2011 ($25.9 billion). This all happened effectively on Cook's watch and is measure of his influence and performance long before officially becoming Apple CEO last summer.

Finally, under Cook, Apple delivers performance that meets Jobs' hype and the reality distortion field that long kept interest in the company, its products and stock. Effectively, Apple has traded reality distortion for reality -- and unequivocally Cook deserves more credit than Jobs. It's one thing to design pretty products and something altogether different to sell them. There Cook's manufacturing and distribution genius has proved greater than Apple cofounder's.

These numbers speak for themselves, as do milestones like: May 2010, Apple market capitalization tops Microsoft, to become world's most valuable tech company; August 2011, Apple's market capitalization passed Exxon to become world's most valuable company.

The Devices' Story

Then there are the hard device numbers. Jobs may have had the vision with iPhone, which launched in June 2007, but Cook executed on it, particularly in 2010 and 2011, with launches of iPad and iPad 2 and iPhone 4 and 4S.

At the end of calendar 2011, Apple had 315 million cumulative iOS device sales. The 55 million iPads sold to then accounted for 17 percent of the total and iPhone, with 175 million sold, 56 percent.

But 2011 was the break-out year for iOS devices -- 156 million, according to Asymco's calculations. So Apple sold 49.5 percent of all iOS devices in a single year, which indicates considerable accelerated momentum.

According to company financial filings, for calendar 2011, Apple sold 92.95 million iPhones and 40.45 million iPads -- generating $61 billion and $24.95 billion revenue, respectively. For all calendar 2011, all Apple generated $127.84 billion revenue. The two products accounted for 67 percent of the company's sales for the year (again referring to calendar and not Apple's fiscal year).

Three months later, end of first calendar quarter 2012 (and Apple's fiscal second) and cumulative iOS device sales are 365 million, as stated during yesterday's earnings call. Apple sold 50 million iOS devices in the quarter, generating $29.8 billion revenue, or 76 percent of the total.

Measuring the Men

I proposed this story to my BetaNews colleagues more than a month ago and planned on writing it since mid-February. But I kept holding back and decided to wait until Apple announced fiscal Q2 earnings. That was wise, considering how strongly the first two quarters compare to everything else and demonstrate the wisdom of decisions Cook made years ago, which Jobs obviously supported. Recent results derive from plans in motion long before Cook took the chief executive's chair.

There's something else, which must be stated but unfortunately will draw fire from the Apple faithful: Jobs' ego hindered Cook's genius. For years before Job's 2009 medical leave, the company made asinine distribution decisions that courted to his need for attention. Apple kept products secret, so that showman Jobs could bask before the attention of "one more thing" unveilings.

Practically, such approach is manufacturing and distribution lunacy. Rather than have products in channel to sell, Apple had to hold back -- sometimes even production -- leading to delayed distribution and shortages. The strategy also cut into margins, as Apple had to assume heavier costs ramping up production and rapidly shipping to customers.

Something's different now: I preordered iPhone 4 in 2010 and it shipped FedEx from China. This year, my family preordered the new iPad and it shipped from California, which suggests, as rumored, that Apple prepped the channel -- something that would have been harder under Jobs' leadership.

Perhaps Apple gross margins reflects some of the sanity returning to manufacturing distribution. In fiscal second quarter, they rose 6 points year over year to 47.4 percent.

I've been writing about Apple product shortages for more than a decade. What differentiates now and then is reality distortion vs. reality. In the early 2000s, Apple suffered from supply-side problems. More recently, shortages are all about overwhelming demand.

Cook understands this newer supply problem is all about distribution logistics, that's why he repeatedly turned to the topic during yesterday's earnings call. For example, going on at length about China:

We have expanded point of sales. On a year-over-year basis Mac is up 70 percent, but still only 1,800 [outlets] for all of greater China. Obviously there is a lot more opportunity there. iPhone we're up over 11,000, which is up 138 percent. But 11,000 is a much smaller than the number we have in the US. Obviously China in the next few years will be a bigger opportunity. iPad is only in 2,500 points of sale. Yes, we've expanded, expanded a lot. However, there is a lot of headroom here in our view.

During the quarter, Asia-Pacific region passed Europe to become second largest in revenue. If the trend continues China may exceed all of Europe in a couple quarters. During fiscal Q2, China generated $7.9 billion compared to $8.8 billion for Europe. Distribution is the key, something Cook understands. He visited China this month. Would Jobs have?

Cook has done for Apple, what Jobs couldn't. Make reality distortion a reality. Make Apple the most successful technology company on the planet.

Vision is one thing. Execution is another.