Apple might offer peer to peer money transfers

Apple is looking to add peer-to-peer money transfer to its Apple Pay service and hopes it might help it take off.

According to a recent report by The Wall Street Journal, Apple believes adding the peer-to-peer money transfer would interest millennials, and it’s been talking to a number of banks about it.

Banks don't want you to share Apple Pay-enabled iPhones, iPads

Banks are warning iPhone users that if they store more than one set fingerprints on the device, they will treat them as if they had failed to keep their personal data safe. They are equalizing multiple fingerprint storing to sharing a PIN code.

Apple’s iPhone device allows up to ten fingerprints to be stored. The company designed it so to make it easier for multiple family members to use the Apple Pay service for contactless payments.

Apple Pay in UK: The story so far

On 14 July 2015, Apple’s mobile payments system Apple Pay was finally launched in the UK after a huge amount of build-up and excitement. At the time of launch, Apple Pay was supported by several of the UK’s biggest financial institutions -- including Royal Bank of Scotland, Santander, Natwest and Nationwide -- along with thousands of supermarkets, restaurants, hotels and retailers.

Initial reviews were largely positive and industry professionals were understandably excited about Apple Pay’s potential as it rode the crest of a growing mobile payments wave. Mix this in with Apple’s loyal fan base and its power in the consumer market and it’s easy to see why its competitors might struggle to keep up.

Apple Pay to arrive in Australia, Canada this year

Apple Pay is set to expand beyond the US and the UK, and before the end of 2015. The news was confirmed during the presentation of Apple’s fiscal results, by the company’s CEO, Tim Cook.

However you’ll need a particular card in order for the service to work.

Accept Apple Pay and Android Pay with the new PayPal Chip Card Reader

PayPal Here users will be able to use the new PayPal Chip Card Reader to accept payments via Apple Pay and Android Pay, in addition to the more familiar credit and debit card options. The new reader launches in the US on 30 September, before spreading to the UK and Australia further down the line.

The updated card reader features a display to guide users through the process of making a payment, but it is the addition of contactless payment that is the key new feature. The PayPal Chip Card Reader has a price tag of $149, but some people will be able to get hold of it for $49.

Most Apple Watch users embrace Apple Pay

New research has found that almost 80 percent of Apple Watch owners are using the tech giant’s contactless payment system, Apple Pay.

The research was carried out by Wristly, which is an independent research platform. It asked 1,000 people whether they were using Apple Pay or not and almost 80 percent of them answered affirmatively. Nine percent said that they preferred to pay through their iPhone 6 or iPhone 6 Plus (these are the only two compatible iPhones as of now).

Apple Pay users could be fined if their battery runs out on the train

Apple Pay caused ripples of excitement when it was announced, and just the other day it found its way across the ocean to the UK. The contactless payment method transforms iPhones and Apple Watches into cardless way to pay for low-cost items with little more than a tap.

But if you plan to use Apple Pay to pay for travel by bus, tram, or train in London, it may not all be plain sailing. Using a phone or watch to make a payment is supposed to make life easier, but it could also result in a fine. Transport for London has issued a warning to travelers pointing out that if their battery dies, their journey could prove expensive.

In-depth analysis of Apple Pay in UK

There’s no possible way it could have happened (unless you have been living under a rock) but if you have missed the news that Apple Pay was just launched in the UK, don’t panic, we can help.

This article provides the ultimate Apple Pay analysis from industry professionals, giving you a comprehensive overview of Apple’s attempts to rule the digital payments industry.

HSBC prematurely announcing Apple Pay in the UK causes Apple stock to rocket

It’s not exactly insider trading, but if you want to make money on the stock market, monitoring social media in real time could help give you the edge.

On Sunday 12 July, HSBC tweeted a reply to a follower confirming that Apple Pay was due to launch in the UK on Tuesday 14th, beating Apple to the announcement. As a result, investors rushed to buy Apple Stock, causing a sizable spike in interest.

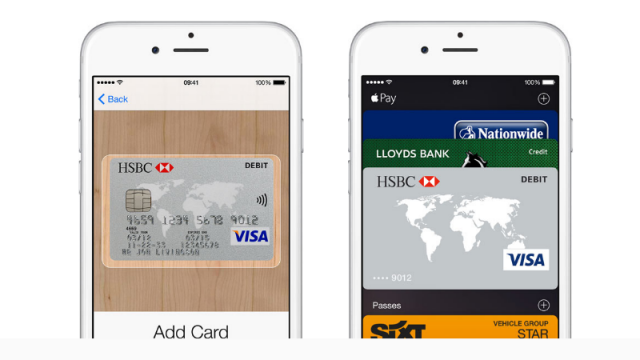

Apple Pay arrives in the UK -- Here's how to use it

While Apple Pay has been available in the US for a while now, the tap-and-pay service finally launches in the UK today. It works in the same way as contactless cards -- you just tap your iPhone 6, 6 Plus, or Apple Watch on a payment terminal to make a payment.

It’s very easy to use, secure, and has a maximum purchase limit of £20 per transaction (rising to £30 in September). This is what you need to do to use it.

Why you shouldn't embrace contactless payments on your phone

Changes in the payments industry are intrinsically tied to consumer behavior. How people pay, where they pay, and what they pay with, is determined by convenience.

As smartphones increasingly dominate the lives of consumers -- from how they search the internet to how they shop -- it is unsurprising that the next frontiers for payment innovation are widely anticipated to be within mobile commerce (m-commerce).

Apple Pay comes to UK next month

As expected at this year’s WWDC, Apple has revealed that the Apple Pay payment system is coming to the UK in July. As revealed by Jennifer Bailey, Apple Pay chief (and a woman!), it will be accepted at over 250,000 UK merchant locations including Marks and Spender, Costa, Waitrose, Boots, and MacDonald’s.

That’s quite a bit shy of the million plus locations now accepted in the US, but it’s still a good start.

Apple Pay to launch in Europe this summer

Apple Pay is still a US-only service, despite it being available for seven months, but the European launch is reportedly coming as soon as this summer.

That’s according to Belgium’s KBC Bank, confirming on Twitter that Apple Pay support will be available this summer. Even though KBC Bank removed the tweet after a few hours, it suggests that the Apple Pay European launch is coming sooner than expected.

Consumers are still waiting for a secure trusted mobile payment method

Mobile and digital payment systems may be on the rise but according to a new report eight out of 10 consumers still have doubts about the technology.

The Future of Retail report from PR company Walker Sands points to a major player being able to take the lead in digital payments if they’re able to connect with what consumers want.

Electronic payments coming to Facebook Messenger

Facebook is introducing support for sending and receiving money through Messenger. Starting in the US in the next few months, users of the social network will be able to make electronic payments free of charge. While this is not a service that will rival the likes of Apple Pay or PayPal, it provides a way to quickly send money to a friend.

This is not a payment system that has been completely built from the ground up. It's based on the same backbone that's used to process payments for gamers and advertisers. Security is understandably of paramount importance, and Facebook stresses that as well as encryption and PIN protection for all, iOS users will also be able to take advantage of Touch ID.