Walmart introduces its own payment app for Android and iOS

Android Pay, Apple Pay, Samsung Pay -- it seems to be the latest trend in mobile devices. Each wants you to use its service and, in some cases all will work at a particular retailer. But, instead of accepting the existing ones, Walmart has decided to launch its own rival to them.

The giant retail chain is announcing Walmart Pay with the good news being that it isn't launching its own phone that you need to purchase first. It will work with both iOS and Android; Windows Phone users once again get left out. Walmart is the first retailer to launch its own payment service.

Yahoo will keep Alibaba stake under its name

Yahoo has decided against selling off its $32 billion stake in the Chinese e-commerce company Alibaba. Instead the company will shift its focus towards creating deals centered around its core business.

Originally the company had planned to place its 15 percent share of Alibaba into a separate company named Aabaco. Yahoo’s desire to spin-off its stake in Alibaba stemmed from the idea that this move would unlock shareholder value and increase the company’s business. Uncertainty over a possibly massive tax bill might have also influenced Yahoo’s decision to abandon its former plan.

Earn yourself spendable Bitwalking dollars with your daily perambulations

Ordinarily, if you want to receive money just for walking you'd need to do a sponsored walk -- and that money's supposed to go to charity -- or get yourself a job as a dog walker. But how does the idea of getting paid just for the walking you do each and every day sound? That's exactly what Bitwalking promises.

With a name clearly inspired by the Bitcoin cryptocurrency, Bitwalking works in a couple of ways. Walkers can earn 1 Bitwalking dollar (BW$) for every 10,000 steps they take, and these can be spent in an online store, or converted into cash. The system uses a smartphone to count steps, but there are also plans to produce a wristband.

LG announces its own mobile payments service

Korean tech giant LG has announced it will soon be launching its own mobile payment service. The service, which will be a direct competitor to Apple Pay, Samsung Pay, Android Pay and other mobile payment systems, will be available in South Korea and the US, for starters.

According to IB Times, LG has registered the trademark LG Pay in South Korea and United States, so it’s very likely that will be the service’s name.

The real legacy of Apple Pay

The concept of mobile retail payments is fundamentally sound. It’s a very natural expectation that a smartphone, that is both very powerful and very personal, should be used to facilitate payments while on the move.

However, whilst all the components to make mobile retail payments a reality have been around for some time, it’s the ecosystem to support the technology that has proved particularly challenging for any player -- including the card schemes -- to put into action. In short, everything worked in principle, but didn’t happen in practice.

Apple might offer peer to peer money transfers

Apple is looking to add peer-to-peer money transfer to its Apple Pay service and hopes it might help it take off.

According to a recent report by The Wall Street Journal, Apple believes adding the peer-to-peer money transfer would interest millennials, and it’s been talking to a number of banks about it.

Banks don't want you to share Apple Pay-enabled iPhones, iPads

Banks are warning iPhone users that if they store more than one set fingerprints on the device, they will treat them as if they had failed to keep their personal data safe. They are equalizing multiple fingerprint storing to sharing a PIN code.

Apple’s iPhone device allows up to ten fingerprints to be stored. The company designed it so to make it easier for multiple family members to use the Apple Pay service for contactless payments.

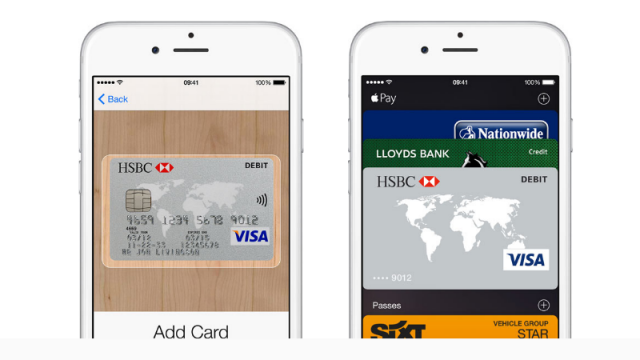

Apple Pay in UK: The story so far

On 14 July 2015, Apple’s mobile payments system Apple Pay was finally launched in the UK after a huge amount of build-up and excitement. At the time of launch, Apple Pay was supported by several of the UK’s biggest financial institutions -- including Royal Bank of Scotland, Santander, Natwest and Nationwide -- along with thousands of supermarkets, restaurants, hotels and retailers.

Initial reviews were largely positive and industry professionals were understandably excited about Apple Pay’s potential as it rode the crest of a growing mobile payments wave. Mix this in with Apple’s loyal fan base and its power in the consumer market and it’s easy to see why its competitors might struggle to keep up.

Apple Pay to arrive in Australia, Canada this year

Apple Pay is set to expand beyond the US and the UK, and before the end of 2015. The news was confirmed during the presentation of Apple’s fiscal results, by the company’s CEO, Tim Cook.

However you’ll need a particular card in order for the service to work.

Chase Pay mobile payments service arriving in 2016

JP Morgan Chase announced its own smartphone payment platform on Tuesday, called Chase Pay. The platform, due to make its debut mid-2016, will be a direct competitor to the likes of Apple, Google and Samsung.

Chase Pay is built upon the Current C, a retailer-led mobile payment system that has largely been written off by Silicon Valley techies for its reliance on barcodes rather than the more sophisticated NFC (near-field communications) technology adopted by its competitors.

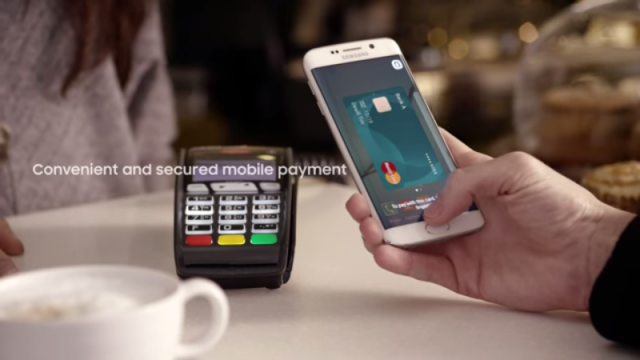

Samsung Pay takes off in South Korea, will launch on time in US

Samsung’s delayed payments service is a hit in South Korea, with $30 million (£19 million) or 1.5 million transactions in the first month alone. The company also confirmed it is on schedule with its launch in the United States, after a few delays.

The uptake is smaller than it could be, since Samsung Pay is only available on a set few devices. Using the payments service is also quite revolutionary compared to Apple Pay or Android Pay, as it doesn’t require a contactless card reader.

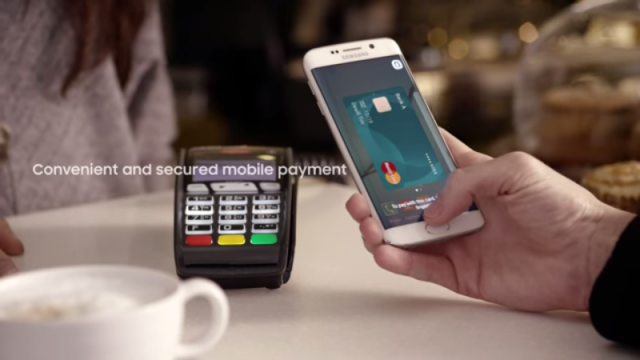

Samsung Pay hits the 500,000 users mark

Samsung’s mobile payment system Samsung Pay has hit the ground running in South Korea and the results show a lot of promise as the company prepares to launch the service in the United States.

Only last Wednesday did the media report that Samsung Pay has 25,000 subscribers but now -- less than a week after -- Business Korea reports 500,000 users.

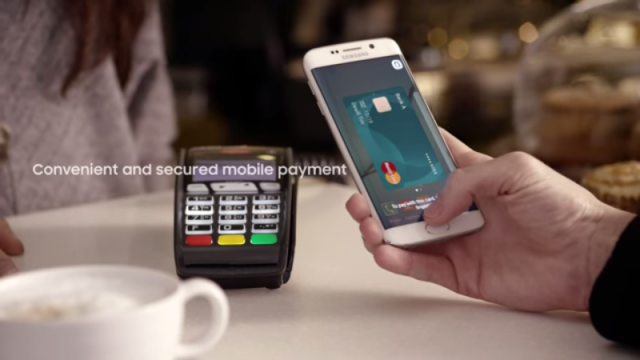

Samsung Pay attracts 25,000 new users every day

Following Samsung Pay’s launch in South Korea last month, the company is now seeing that an average of 25,000 people are signing up to use the service daily.

Samsung Electronics executive vice president and the development lead for Samsung Pay Injong Rhee, says that the payment platform’s usage has increased rapidly since its launch and is bringing in daily transaction volumes of KRW 750 million (~$630,000) on average.

Your online payments could soon be authorized with a selfie

Make an online payment with your credit card and you're probably used to having to enter a password or PIN. But if a trial scheme by MasterCard takes off, this could become a thing of the past. The finance company is testing out a new payment authorization technique including fingerprint scanning and facial recognition.

MasterCard is working with Apple, BlackBerry, Google, Microsoft, and Samsung to introduce the biometric checks. The initial plan is to trial the system with 500 participants before possibly rolling it out on a larger scale. It's something that MasterCard believes will be welcomed by millennials and should simplify the process of making payments from a smartphone.

Why you shouldn't embrace contactless payments on your phone

Changes in the payments industry are intrinsically tied to consumer behavior. How people pay, where they pay, and what they pay with, is determined by convenience.

As smartphones increasingly dominate the lives of consumers -- from how they search the internet to how they shop -- it is unsurprising that the next frontiers for payment innovation are widely anticipated to be within mobile commerce (m-commerce).