Bitcoin breaks $10,000 -- crypto market exceeds $310 billion

The fact that the price of Bitcoin today went past $10,000 for the first time ever will not come as a surprise to anyone familiar with this crazy market. The most-valuable cryptocurrency has had a fantastic year, setting record after record. On January 1, trading opened at $963.

Considering that Bitcoin peaked at over $10,100 moments before writing this article, this means that it is up around 1,048 percent since the beginning of the year. Let that sink in for a moment, and let's move on to more mind-blowing figures.

Bitcoin mining and transactions use more electricity than Ireland and 19 other European countries

When Bitcoin hits the headlines, it tends to be because its value is rocketing, or because there has been a token theft. Now, however, the financial cost of mining the cryptocurrency has been revealed.

The energy consumption of Bitcoin has been investigated by Digiconomist, and the cost is staggering. Using more power per year than Ireland, the mining of Bitcoin as well as performing checks gobbles up 30.14TWh every year.

Millennials may prefer Bitcoin over savings accounts for storing their wealth

The insane growth of the cryptocurrency market is making Bitcoin very attractive as a store of value. Folks who have bought Bitcoin at the beginning of the year are now looking at an 820 percent return on investment, which is much more difficult to achieve in traditional markets and virtually impossible to match using savings accounts.

Millennials are starting to take notice, with a new report suggesting that they are shunning savings accounts in favor of Bitcoin. Baby boomers, you can add this to the "millennials are killing" list.

Ethereum passes $400

For the first time in the past few months we are starting a conversation about the cryptocurrency market that does not revolve around Bitcoin. The reason is Ethereum, which just went past $400 for the first time since the record high in mid-June.

This is a pretty significant development, as Ethereum's performance has been lackluster since its peak. The only time it got close to $400 was on September 1, after which a ban on ICOs in China helped drive its price to under $200.

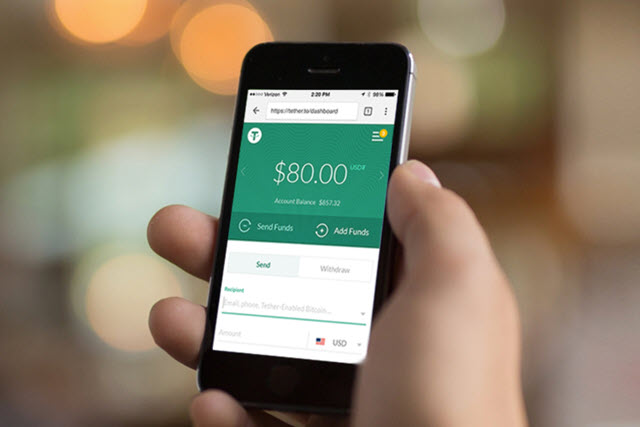

$31 million in tokens stolen from dollar-pegged cryptocurrency Tether

All eyes may be on the meteoric rise of Bitcoin at the moment, but it's far from being the only cryptocurrency on the block. Startup Tether issued a critical announcement after it was discovered that "malicious action by an external attacker" had led to the theft of nearly $31 million worth of tokens.

Tether is a dollar-pegged cryptocurrency formerly known as Realcoin, and it says that $30,950,010 was stolen from a treasury wallet. The company says it is doing what it can to ensure exchanges do not process these tokens, including temporarily suspending its backend wallet service.

Bitcoin price nearly breaks $8,000 amid renewed Segwit 2x interest

It's been an interesting past couple of weeks in the cryptocurrency market. Bitcoin set a new price record earlier this month near $7,800 as traders were eagerly awaiting the Segwit 2x hard fork, and the bonus coins that they would get as a result. When that was cancelled, the price plummeted.

Bitcoin dropped to as low as $5,519, based on Coinmarketcap.com's historical data. At the same time, Bitcoin Cash started to gain a lot of traction, setting a record of its own close to $2,500 last week.

Controversial Bitcoin hard fork Segwit2x has been shelved

Bitcoin investors, myself included, have had November 16 marked on their calendars for a while. This is when (roughly) it was anticipated the latest Bitcoin hard fork -- Segwit2x, or 2x for short -- would take place.

The aim of the plan was to trigger a block size increase at block 494784 via a software upgrade. As was the case with the Bitcoin Cash hard fork, investors were expecting to receive an amount of the new Bitcoin2x asset on the Bitcoin2x blockchain.

9th anniversary of Bitcoin: Is the war between cryptocurrencies and governments over?

The global real estate market is worth $217 trillion, and one-third of income-generating real estate transactions are cross-border. But cross-border real estate transactions are notoriously complicated and rife with delays and impediments inherent to antiquated property rights registrations systems. However, an American’s purchase of $60,000 apartment in Kiev may change everything.

In September, TechCrunch founder Michael Arrington remotely purchased a $60,000 apartment in Kiev in a deal that will change real estate forever.

Bitcoin price goes over $7,300

The price of Bitcoin has skyrocketed this year, going from $1,000 in early-January to $3,000 in mid-June. Some pundits saw it coming, but not many believed it would go higher than that. Yet, in early-September, the main cryptocurrency reached $5,000. And it kept going.

Today, Bitcoin is trading over $7,300 for the first time ever. It's up 730 percent since the beginning of the year, and its market cap now sits at over $122.7 billion, which is a few billion more than what the whole market was worth at its June peak. It's quite unbelievable.

Bitcoin breaks $6,600

Just moments ago I was reading about Bitcoin setting a new price record above $6,400. The main cryptocurrency has been incredibly strong, and resilient during crashes, so this latest development does not surprise me one iota.

What also does not surprise me is that Bitcoin kept going after reaching the $6,400 mark, settling above $6,600 at the time of writing this article, based on an average from major exchanges like Bithumb (where it's actually gone past $6,700), Kraken, GDAX and Poloniex.

Online betting site predicts Bitcoin price will be around $7,250 by end of year

You don’t really invest in Bitcoin, more gamble on it. The trick to making a profit is knowing when to buy, and when to sell. Essentially you just need to buy low, sell high. But predicating how the cryptocurrency will perform isn’t easy.

At the moment, Bitcoin is riding a high (although it’s dipped a fair bit from the peak it hit over the weekend), but whether it will go up from here, or down, is anyone’s guess.

Wolf of Wall Street: cryptocurrency ICOs are 'the biggest scam ever'

Jordan Belfort -- the real-life Wolf of Wall Street -- has warned that ICOs (or "token sales" or "coin sales") are "the biggest scam ever" and will "blow up in so many people's faces."

The former stockbroker, who spent nearly two years in prison for fraud and financial scams, says that the Initial Coin Offerings used to raise money for cryptocurrencies are "far worse than anything I was ever doing." His fears seem to stem from the way ICOs differ from the more traditional IPO.

Russia set to take on Bitcoin with its own 'CryptoRuble'

Having earlier called for crypto currencies to be banned, Russian President Vladimir Putin has now officially stated that Russia will issue its own CryptoRuble using Blockchain technology.

According to communications minister Nikolay Nikiforov, CryptoRubles will be exchangeable for conventional Rubles and will be accepted by Russian banks. However, holders will need to pay 13 percent tax if they don't provide proof of origin, a measure intended to combat money laundering.

Coinbase now offers instant Bitcoin, Ethereum and Litecoin purchases

Buying cryptocurrency is not as easy as you might think. It also takes longer than you might expect, which is a problem when you want to take advantage of an opportunity in this market as quickly as possible.

Coinbase seems to have solved this issue, announcing that customers will be able to instantly buy Bitcoin, Ethereum and Litecoin using their bank account. Prior to this change, they had to wait several days for the purchased coins to be available.

Wait a minute, when has there ever been a currency bubble?

If you've scanned the crypto news in recent weeks, you will have noticed a smattering of stories suggesting that the whole cryptocurrency market, is a bubble. Such news is not exactly new. Since the spring, the crypto market has multiplied in value by a factor of six and the word "bubble" has thus inveigled its way into commentators conversations.

A few days ago, the Wolf of Wall St, Jordan Belfort, joined JP Morgan CEO, Jamie Dimon in declaring Bitcoin to be both a fraud and a bubble. Jordan can, at least, legitimately claim expertise in fraud having pleaded guilty to that very crime and served 22 months in prison for it. However, he’s wrong on both points.