Apple Pay is the reason Apple Watch won't fail

If you watched the Apple keynote, then you got a great view of the Apple Watch. While I’m definitely not one of the few who will buy the $10,000 version of the watch, I do believe it will be a success, largely due to one feature: Apple Pay.

Samsung, Motorola, and Pebble already have watches with similar features to the Apple Watch. In fact, I thought it was funny to listen to Apple employees talk about how they can’t live without their Apple watch because of all the notifications the watch sends to their wrist.

Kickstarter now accepts Apple Pay for that project you want to back

A number of popular projects have come from crowd-funding via Kickstarter. It's a great place to find new and innovative ideas. Many things there fail to reach their goal (although it could be argued that the market for those items made the decision), while others blast past the funding goal and enter the market. Pebble watch is a great example of that success.

There is some peace of mind when donating money -- for one you will get the product. But, if it fails to hit the goal you aren't out anything. Now you'll have one more option for funding that next great product. Kickstarter is announcing it will start to accept Apple Pay.

Apple Pay security scam nets fraudsters millions of dollars

The big names in tech are falling over themselves to get new payment systems out of the door at the moment. At MWC, Sundar Pichai confirmed Android Pay is on its way, and we've also learned about Samsung Pay from the Barcelona event. The convenience of paying with a smartphone is undeniable, but there are unavoidable security concerns.

Having been adopted by millions of Americans -- and with plans to expand into Europe and beyond -- Apple Pay is serving to highlight important security problems. Lax verification systems used by banks coupled with criminals exploiting stolen credit cards and IDs mean Apple Pay is used to make millions of dollars worth of fraudulent purchases. So how does it work?

Samsung announces Galaxy S6, S6 Edge and Samsung Pay at MWC 2015

Mobile World Congress 2015 is here, and the news is coming fast and furious. The most anticipated announcement, however, has been Samsung's Galaxy S6. As expected, the smartphone is here, but so is its more beautiful sibling, the S6 Edge. Potentially more important though, is Samsung Pay -- a mobile payment system to rival Apple Pay and Google Wallet.

Unfortunately for Samsung, pundits and analysts have been talking all doom and gloom for the company, something else Apple has had to face. Much like Apple, the analysts are dead-wrong to count out Samsung in the mobile market. Quite frankly, the Android market is the Samsung market -- no other brand of smartphone is more ubiquitous in public. So are these announcements enough? Are they enough to finally make the doom and gloom pundits zip their lips?

Samsung planning a mobile payments service to take on Apple Pay

Sources indicate that Samsung is lining up its own mobile payments service to launch next year.

ReCode reports that the South Korean firm is in discussions with a payments startup called LoopPay to develop a system that doesn’t require retailers to install any additional hardware.

Ad slip-up reveals Apple Pay is about to expand to Europe, Middle East, India and Africa

Oops! Less than a month ago, Microsoft accidentally let it slip that it was about to acquire email firm Acompli. Not to be outdone, Apple has now let a cat out of the bag a little early as well. A job ad spotted by iClarified shows that the company's Apple Pay service is set to expand outside of the US.

While rolling out outside of the States is not exactly surprising, Apple has given no hints about the timescale it is working to. More and more companies are signing up to get involved with Apple's contactless payment system, and a European launch was all but inevitable -- and now we know for sure.

Apple Pay gaining momentum as more companies sign up

Apple has announced that its mobile payment service Apple Pay has received even more support -- now 90 percent of all credit purchases by volume in the United States can be achieved by using Apple Pay.

SunTrust, Barclaycard, USAA, and dozens of other companies have joined the likes of Citibank and Chase in the last weeks and agreed to work with Apple, so that customers can buy things with little more than a wave on their iPhone, The New York Times reports.

Google Wallet for digital goods to close next year -- PayPal and Apple Pay rejoice

Google has fingers in lots of pies, but in a few short months it will be pulling one of its fingers out of the digital payments pie. As of March 2, 2015 Google Wallet for digital goods will be no more. After three years of fighting off the competition, the search giant has decided to throw in the towel, get out of the digital payments game and leave it to services like PayPal and Apple Pay.

Starting life as a mobile-based payment system compatible with certain smartphones including the iPhone, Google Wallet allowed payments to be made via NFC. It then evolved into a web-based payment service, but never managed to break out of the confines of the US. In a few short months, anyone using the service to make or receive payments will have to turn to one of the alternatives. But what’s with the sudden shuttering?

How to make NFC payments with your Windows Phone

NFC payments are all the rage nowadays, in no small part thanks to the support that Apple Pay is receiving from financial institutions and iPhone users, and raving reviews from the media. Naturally, this may tempt you to give NFC payments a go, to see what all the fuss is about. But what if you have a Windows Phone? Apple Pay is obviously out of the question. What can you do then?

As you may know, Windows Phone supports NFC payments out-of-the-box, thanks to a feature known as Tap to Pay. Like Apple Pay it leverages the built-in NFC chip in your device. The only thing standing between you and paying through it is its lack of support. However, there is another way you can make NFC payments with your Windows Phone, and that is by using the Softcard app, which just arrived on the platform. Here is what you need to know about it.

Apple Pay rival CurrentC hacked -- email addresses stolen

Yesterday, Ed Oswald wrote a story about the retailer-backed payment network CurrentC, describing it as a threat to iPhone and Android users alike. In the article he spoke about the security of the system, saying "CurrentC is overly complicated, and just leaves too many opportunities for something to go wrong, or a hacker to make their way in".

He turns out to have been spot on, as today MCX admits its service has already been hacked, with email addresses of participants in the pilot program and other interested individuals being stolen. Hardly the most auspicious of starts. The following email was sent to those affected:

CurrentC is a threat to iPhone and Android users alike

In the iPhone vs. Android drama, it’s easy to pit one side against the other. Closed architecture vs. open source. Vendor lock-in vs. consumer choice. iOS vs. Android. But a new effort by retailers is one thing that actually unites either side’s fanboys towards a common cause.

It’s called CurrentC. The effort is a payment network created by an organization of vendors known as the Merchant Customer Exchange (MCX), and aims to take credit card processors out of the equation. Payments are processed by MCX itself and then sent directly to your bank for payment. MCX partners read like a who’s who of companies that have refused to accept Apple Pay: Best Buy, CVS, Rite Aid, and Walmart, plus about 50 other major national stores and chains. Target is part of MCX too, however it's playing both sides of the fence (at least for now).

Apple Pay really is that easy, and game changing

When Tim Cook stood on stage last month to introduce Apple Pay, the typically reserved chief executive could barely contain his excitement. A video plays with a woman in a shoe store. She pulls out her shiny new iPhone 6, places her finger on the Touch ID sensor, taps it on the NFC receiver, and walks out with her purchase. "That’s it!" Cook exclaims. "That’s it!"

Cook’s reaction was over the top, of course -- which some of us argue is modus operandi for any Apple keynote -- but it certainly signals the promise of NFC and is an example of how Apple Pay will streamline and advance mobile payments from here on out. Is it really as simple as it looks? I can tell you it is. Following the release of Apple Pay with iOS 8.1 on Monday, I set out to test it on the vending machines at work. Indeed, it's as simple as the demo showed. All you need to do is pull up Passbook, tap the card you’d like to use, put your thumb on the Touch ID button and place it near the receiver.

How can consumers stay secure as payment systems evolve? [Q&A]

Data breaches continue to make the news on a regular basis and payment details are high on the hacker’s shopping list when it comes to protecting information. We reported yesterday on Intel introducing a new secure solution for protecting payments and card providers are engaged in a continuing arms race to stay secure. The latest part of this is the introduction of more secure EMV (EuroPay, MasterCard and Visa) compliant payment terminals around the world. Banks are issuing the new chip cards as current cards expire or need replacement. Retailers are installing new chip-enabled terminals.

As the holiday shopping season approaches keeping your details safe as you hit the shops is at the top of many people's thoughts. We spoke to Carolyn Balfany, SVP, Product Delivery and EMV of payment card specialists MasterCard to find out about what consumers can do to help protect themselves as they shop.

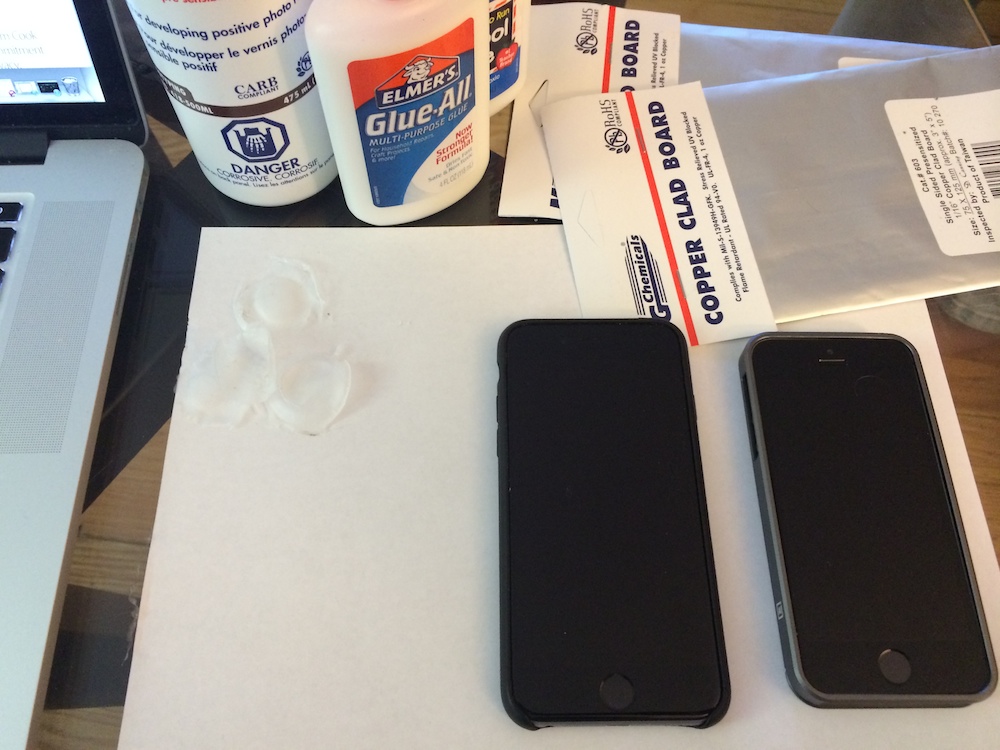

Touch ID on iPhone 6: Still hackable

Apple's recently released iPhone 6 is susceptible to the same fingerprint forging attack as the iPhone 5s, according to the latest security research.

Mark Rogers, principal security researcher for mobile security firm Lookout, used techniques which are well-known to police officials and prototypers to access the device.

Apple's Day of Bling and Cha-Ching

The big event is over. Today, Apple announced iPhone 6 and 6 Plus, with 4.7-inch and 5.5-inch screens, respectively; Apple Pay; and Apple Watch. What we don't know is as important, if not more, than what we do. For example, Apple didn't pinpoint when in 2015 the smartwatch would be available or how long the battery will last. But Cook did discuss the ease of charging overnight, which probably indicates enough.

As I suggested three days ago, today's media event marks the beginning of the Tim Cook era, as he does things his way rather than Steve Jobs'. Notice how the CEO favors emphasizing the company brand over "i" this or that in product names. He also shed typical stern look for big, bold -- and frequent -- smiles. This is Cook's day.