Visa finds shoppers turning to AI and crypto this holiday season

Visa has released the findings of a new survey that show how AI and digital tools are beginning to have an impact on holiday spending habits across the United States. The company says that it is seeing clear differences across generations, with younger consumers moving towards AI assisted shopping, digital currencies and other emerging payment trends.

"The data tells a fascinating story about the spending shift we're witnessing: shoppers are embracing AI and digital tools at remarkable speed, with nearly half of Americans now using AI to enhance their shopping experience," said Bruce Cundiff, vice president, Consumer Insights at Visa.

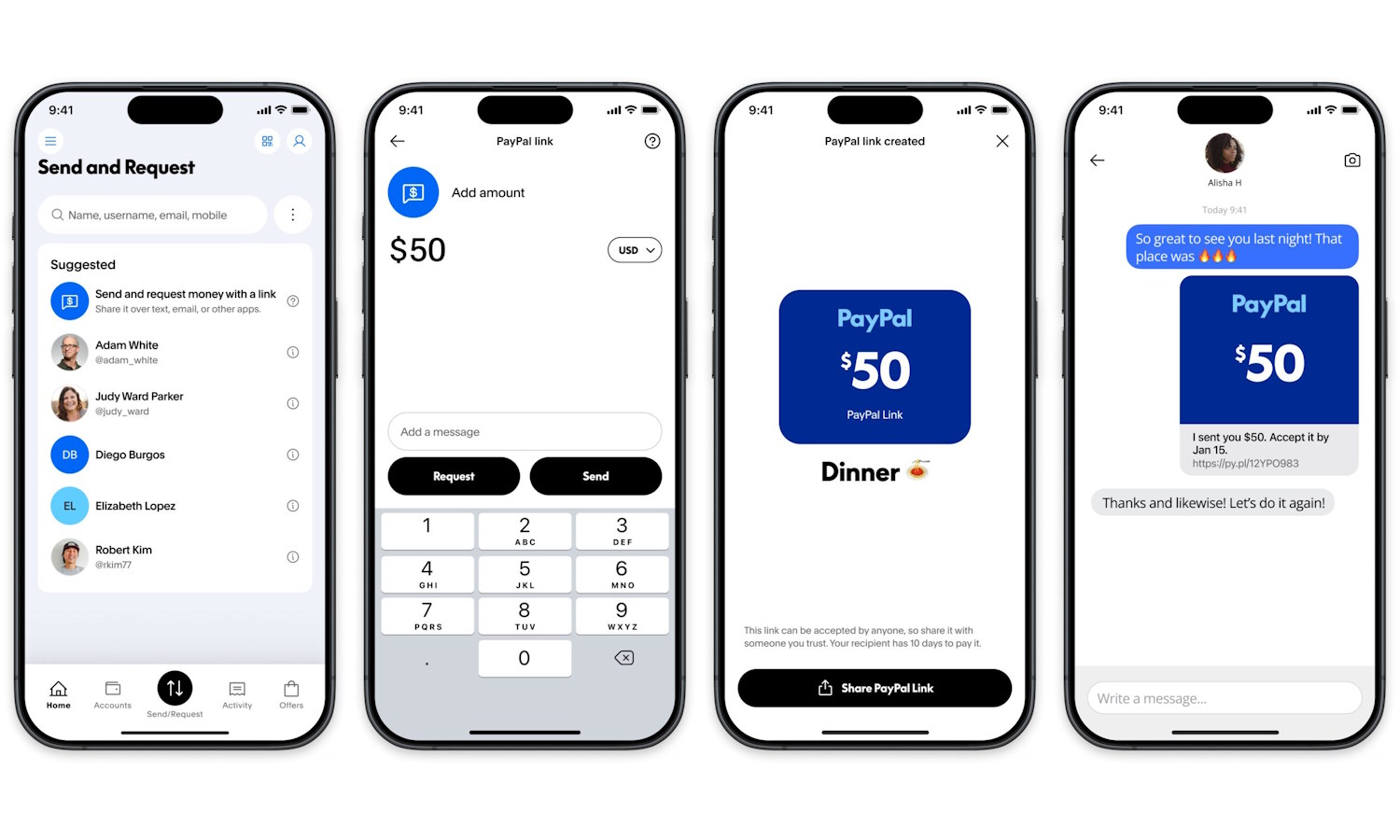

PayPal Links are personalized links for sending and receiving money and cryptocurrency

PayPal has announced the launch of a new payment option called PayPal Links. The new system of personalized one-time links makes it easier to both send and receive money, including cryptocurrency.

PayPal Links have been designed for quick and easy sharing via email, text message, chat or social media. The links can be configured for sending money or requesting it, and the company is putting a great deal of focus on how easily links can be created – and by extension how quickly payments or money requests can be made.

Social media deepfake scams push fraudulent investment schemes

Social media has seen a 335 percent boom in new scams using deepfake videos and company-branded posts to lure victims into fraudulent investment schemes.

The latest threat report from ESET tracks these as HTML/Nomani, the countries with the most detections being Japan, Slovakia, Canada, Spain, and Czechia.

The five email attacks to watch for in 2025

Despite the rise of other means of communication email remains the most commonly used. This makes it attractive to cybercriminals as it offers an entry point to businesses and the gateway that employees rely on to do their jobs.

A new report from Abnormal Security highlights the attacks that we’re likely to see in the next year and shows the need for improved defenses, including the use of AI.

The crypto nexus: The next compliance challenge

Cryptocurrency has been increasingly professionalized in recent years, offering millions of transactions to a global base of everyday users. However, this trend of mainstream investment has happened in tandem with recent high-profile prosecutions of former crypto leaders.

The decentralized nature of cryptocurrency still presents opportunities for bad actors to exploit, particularly for laundering money. Approximately $72 billion a year of illicit transactions is being paid for with crypto, a large portion of which is cleaning dirty money, according to a recent Europol report.

The next Bitcoin halving is imminent and price volatility is likely

For only the fourth time, there is a Bitcoin Halving on the horizon. Occurring -- roughly -- every fours years, the first took place in November of 2012, the second in July of 2016, and the third in May of 2020. The next is due on April 19 or 20.

The exact date and time is not known as a halving takes place every 210,000 blocks, and it is a mechanism designed to make Bitcoins rare. But just what does it mean in practice for both miners and investors? While it is hard to predict precisely what will happen, market volatility is likely to be the order of the day.

Will Artificial Intelligence power online trading solutions in the future?

Artificial Intelligence (AI) has become a buzzword in various industries and the world of online trading is no exception. With its ability to analyze vast amounts of data and make predictions, AI has the potential to revolutionize the way we trade online. Or maybe that's not the case at all. The point in fact is that AI has been integrated into various systems across numerous different industries already.

However, using AI in the financial market, especially, in trading stocks, bonds, cryptocurrencies and other assets is up to debate. After all, is using AI's machine learning and predictive analysis considered cheating? How is it any different when investors rely on informer insights and leaked documents? The software is just better at processing data than human is.

Search traffic trends in the crypto sector: Unveiling the digital gold rush

Search traffic trends offer a fascinating glimpse into the evolving interests and behaviors of investors and enthusiasts. From its early days, the crypto sector has witnessed seismic shifts that continue to shape its landscape. For instance, some investors diversify their portfolios by adding L1 Blue Chip Assets from various sectors.

As cryptocurrencies emerged from obscurity, Bitcoin led the charge, captivating the imagination of investors. But what do the search traffic trends reveal about this digital darling and its competitors?

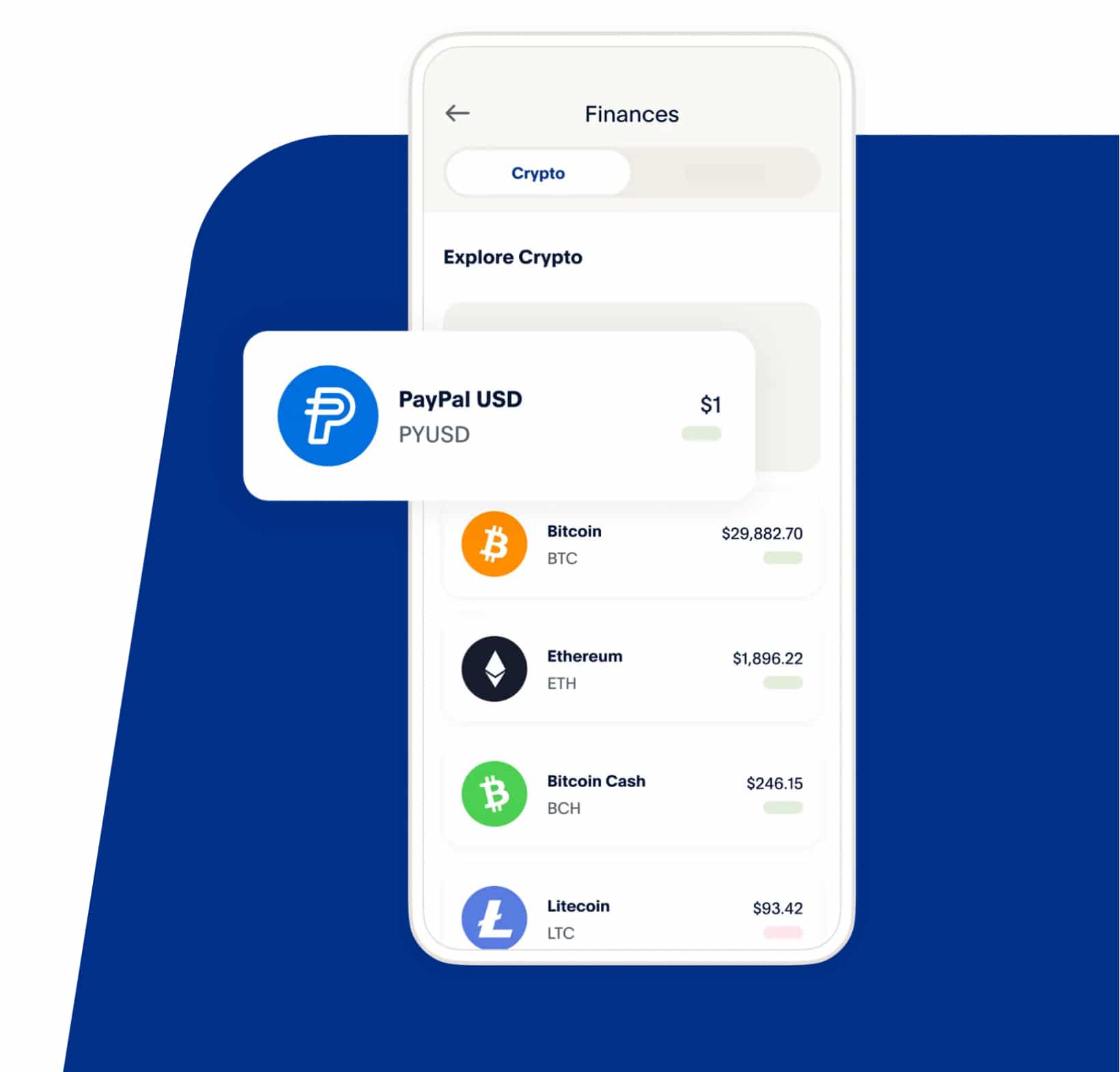

PayPal USD (PYUSD) stablecoin is designed to maintain a $1 value

Today, PayPal launched PayPal USD (PYUSD), a U.S. dollar-denominated stablecoin. As web3 gains momentum, PayPal’s newest offering aims to capitalize on the advantages stablecoins present in digital transactions.

PayPal USD is pegged 1:1 with the U.S. dollar, and its underlying assets include U.S. dollar deposits, short-term U.S Treasuries, and equivalent cash reserves. Issued by Paxos Trust Company, PayPal USD aims to provide the stability needed in the fast-evolving digital currency space.

The importance of blockchain security in an interconnected world [Q&A]

Blockchain is best known for its application in securing cryptocurrency. But in recent years it's expanded to drive emerging business in other sectors such as healthcare, real estate, smart contracts, and more.

Because blockchain ensures a tamper-proof ledger of the distributed transactions, it's sometimes used for high-risk transactions and exchanges. But this presents high stakes opportunities for adversaries to steal money and sensitive information.

The legal implications of digital money: What you need to know

Digital money, digital currency, most popularly known as cryptocurrency, has seen its rise to fame over recent years. Despite its popularity, many remain skeptical of cryptocurrency and its impact on society.

According to the World Economic Forum, cryptocurrency helps continue, stabilize, and substitute existing money. However, cryptocurrencies operate totally differently than legal tender, and the authorities are concerned about a non-existent monetary policy for this digital money. This article will discuss digital money, its impact, and all the legal implications of cryptocurrency transactions.

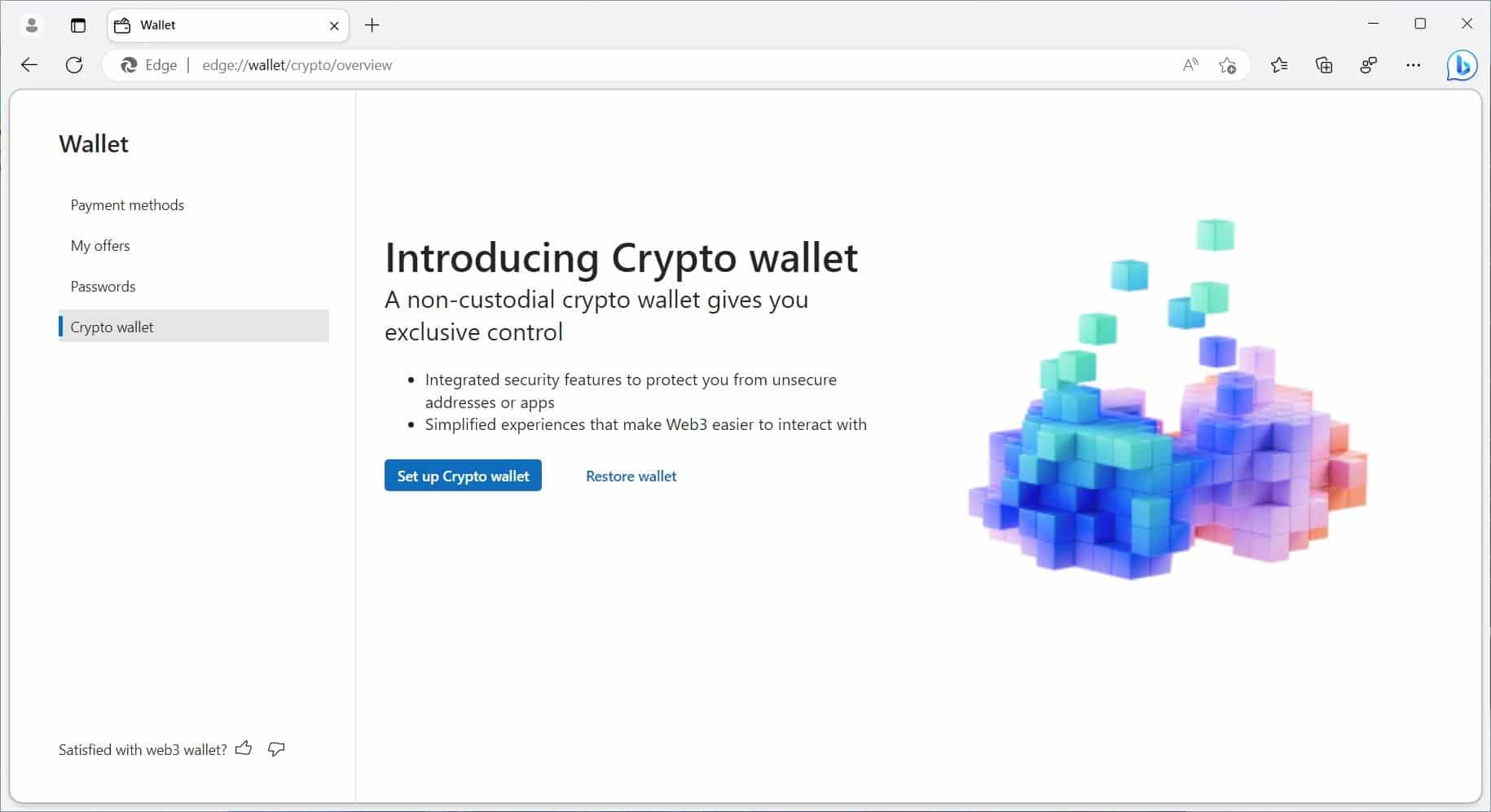

Microsoft Edge is getting an integrated crypto wallet

Microsoft is working to bring a cryptocurrency wallet feature to its Edge browser.

Known simply as "Crypto wallet" the feature is currently undergoing development and is being trialed on a test group of unknown size. Microsoft highlights the benefits of having the non-custodial wallet embedded in Edge, eliminating the need for a browser extension.

Should crypto investors seek new ventures?

Since the COVID-19 pandemic began in 2020, it seems like everything has gone online for safety and convenience -- including work, education, medical care, entertainment, sales and more. It’s no surprise that cryptocurrency, which encompasses all types of digital or virtual currency, took off in 2021 as well.

Crypto investment has skyrocketed recently. Cryptocurrency users and investors have created a lot of buzz about this market and its potential. The biggest cryptocurrencies include Bitcoin and Ethereum, while exchanges like Binance, Coinbase Exchange and Kraken provide places to invest, trade and explore new markets. However, cryptocurrency is volatile. Recently, as the novelty has worn off, many investors have begun questioning crypto's risks and long-term viability. Here are some ways to diversify your investment portfolio or find cryptocurrency alternatives.

Microsoft slaps cryptomining ban on Azure users

Microsoft has updated the Universal License Terms for Online Services that apply to Azure to indicate that the service cannot be used to mine cryptocurrency.

The change appears in the Acceptable Use Policy section of the license terms that apply to all Microsoft Online Services, but the ban is not an outright one. While the criteria have not been revealed, it seems that there are circumstances in which the company may be willing to lift the ban on cryptomining.

How fraudsters attack blockchain technology and how it can be prevented

The global financial crisis of 2008-09 resulted in the development of the Bitcoin whitepaper which introduced the world to the idea of blockchain technology and cryptocurrency. Within blockchain, information is stored in several databases (blocks) that are linked together chronologically through cryptographic hashes to form a distributed network (chain). Since its inception the global blockchain market is expected to hit $67.5 billion by 2026.

Within the realm of banking, financial services, and insurance (BFSI) the evolution of cryptocurrencies as an asset class for investors has furthered the commercialization of blockchain technology through decentralized finance (DeFi) services. As of 2021, there are over 6,000 cryptocurrencies being traded freely with global cryptocurrency market capitalize reaching $990 billion. Serving investors' needs are exchanges, lenders, asset managers, custodians, cross-border payment applications, and clearing & settlement houses that all benefit from the surge in blockchain use-cases.