Overcoming COVID-19: What finance leaders at recently-funded tech startups have learned so far

There’s no doubt that 2020 has been a testing year for everyone. According to data from PwC, 53 percent of CFOs expect a decrease in revenue and/or profits of up to 25 percent as a direct result of COVID-19. For many tech startups, that’s the difference between staying alive and closing for good.

With such uncertainty in the air, leadership teams have had to act fast and rethink their entire strategy.

Google Plex reinvents banking for regular folks

Banking is great for the bankers, but not so much for their customers. For many people, dealing with a bank can be a nightmare -- full of overdraft fees, poor service, and terrible location hours. Quite frankly, even the customers with huge balances aren't making out too good these days, as interest rates are almost non-existent.

And so, Google is looking to reinvent banking with a focus on regular folks -- the ones that aren't wealthy. Called "Plex," it is a special mobile-focused bank account coming in 2021 that does away with the predatory fees that seem to target middle- and lower-class people. These fees are why many people in America don't even have a bank account -- a sad reality. No, Google isn't becoming a bank with Plex -- it is instead partnering with several financial institutions to offer these accounts.

Hybrid cloud application delivery in financial services

The financial services sector is experiencing significant commercial disruption coupled with rapid innovation as established institutions strive to become more agile and meet evolving customer demand. As a result, financial services organizations are undergoing rapid digital transformation to meet changing customer needs and preferences, and to compete with a new generation of digital-native competitors. Hybrid cloud environments play a key role in this strategy, allowing greater speed, flexibility, and visibility over application delivery than on-premises data centers while also reducing costs.

But the move to hybrid cloud introduces new challenges as well. So, as financial services organizations plot their strategy for transformation, firms must make critical technical decisions about the clouds and form factors best suited to host their hybrid environment. They also need to consider how they will secure web applications against evolving threats such as ransomware, data theft, and DDoS attacks through measures such as DDoS protection and using a Zero Trust model. At the same time, they must also maintain regulatory compliance, governance, and auditability across complex, fast-evolving infrastructures.

Fintech startup Revolut brings cryptocurrency trading to US customers

British fintech firm Revolut has partnered with New York-based Paxos to bring Bitcoin and Ethereum trading to customers in the US.

Having only launched in the United States in March this year, Revolut is gradually bringing the services it already offers in Europe to its American user base. Thanks to the new partnership, residents of 49 states can now indulge in some crypto trading.

Fintech: Leak shows Google is working on a debit card to rival Apple Card

Leaked pictures suggest that Google is preparing to launch its own physical and virtual debit cards. TechCrunch cites multiple reliable sources in a report that gives a glimpse into Google's future fintech plans.

Images of not only the physical card itself but also screenshots of the Google Pay app with references to the virtual version of the card show off the design, as well as the spending tracking features that are in the pipeline.

Economic uncertainty gives fintech apps a boost

The COVID-19 crisis has led to major economic as well as health concerns and new research from mobile app marketing company Liftoff in partnership with analytics platform App Annie shows more people are turning to mobile apps to manage their money.

The report analyzed 22 billion ad impressions across 382 million clicks, seven million app installs, and five million first-time events in 117 apps for the full calendar year 2019. It shows that the self-reliant nature of contemporary fintech apps has taken precedence over legacy banking apps, a trend that is likely to continue in the current economic climate.

Fintech firm Curve launches numberless cards for investors in Europe

Curve, the UK-based fintech company, has announced that European investors from its crowdfunding round will be among the first to received more secure numberless payment cards.

The cards do not feature primary account numbers (PAN) on their face to improve security. The cards' chips have the data stored on them so they can be used for contactless payments, chip and PIN transactions or in machines, and card details can only be accessed from within the Curve mobile app.

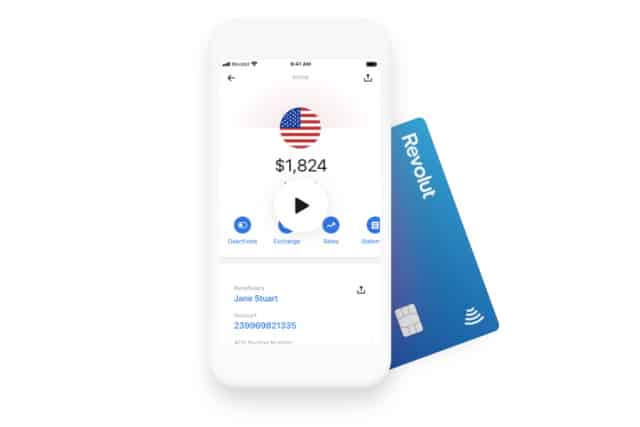

UK fintech Revolut officially launches its banking app in the US

Having amassed millions of customers in Europe, the British fintech Revolut is bringing its banking app and debit cards to the US.

The official launch comes after nine months of beta testing and has been facilitated by Revolut's partnership with Metropolitan Commercial Bank (MCB). While Revolut is not a bank, it offers many services including the ability to receive salary payments to your account, fee-free currency exchange, and a polished mobile app for easy money management.

Revolut launches Revolut Junior to help kids learn financial skills

Fintech darling and banking disruptor Revolut is launching a new product designed with 7- to 17-year-olds in mind, but it is not a standalone service.

A Revolut Junior account can only be set up by a parent who already has a Revolut account, and it gives younger people the ability to use a digital app and a payment card which can be used online and in the real world. Parents are in control at all times, choosing where payments can be made.

Revolut raises $500m in funding, valuing it at $5.5bn and making it the most valuable UK fintech startup

Financial disruptor Revolut has managed to raise $500 million in a Series D funding round. The new funding sees the value of the digital banking platform rocketing to $5.5 billion, making it the UK's most valuable fintech startup, and one of the most valuable fintech firms in Europe.

The funding comes from a group of investors headed up by TCV (Technology Crossover Ventures) and effectively triples the value of Revolut when compared to its funding round in 2018. The cash injection will be used to expand its multi-currency operations both in Europe and on a global scale.

Coinbase becomes a Visa principal member -- cryptocurrency debit cards and services to spread to more markets

Cryptocurrency exchange Coinbase has been made a Visa principal member, making it "the first pure-play cryptocurrency company" to receive such accreditation. The membership was awarded back in December, but the news has only just been made public.

This is not the first time Coinbase has had dealings with Visa. The two companies worked together last year to launch the Coinbase Card ("a Visa debit card, funded by your Coinbase balance") in the UK, but now it will be possible to bring the debit card and additional services to more markets around the world.

Why secure data exchange is vital for the fintech industry [Q&A]

Over the past few years, we've seen a surge in popularity for both consumer fintech apps, as well as fintech services for businesses.

This shift in the financial services ecosystem has empowered users to take greater control of their financial lives, equipping them with tools to better understand how and where they spend their money, increase their credit scores, prepare taxes, aggregate disparate financial and investment accounts, among many other applications.

Visa acquires fintech startup Plaid for $5.3 billion

Visa has announced that it has agreed to purchase Plaid as part of a deal worth $5.3 billion. The acquisition values the fintech company at around double its valuation following a 2018 Series C funding round.

Plaid is behind financial services APIs used by the likes of Coinbase, Gemini, Venmo and Transferwise. Its software allows for easier sharing of financial details, making it simpler to connect services to bank accounts. Plaid says the acquisition will help it continue to "accelerate the success of the fintech ecosystem".

Foreign currency specialist Travelex suspends some services after cyber attack

Travelex, the London-based foreign exchange company, has suspended some of its services and taken its UK website offline following a cyber attack that took place on New Year's Eve.

A malware infection caused the company to take the decision to cut the cord on its services. It said that this was merely a "precautionary measure" which was done "in order to protect data". The suspension of services has caused problems for customers around the world and has had a knock-on effect for other companies including Tesco Bank and Asda.

JPMorgan to ban third-party fintech platforms from accessing customer passwords

JPMorgan Chase is to enforce stricter security measures, banning third-party fintech apps from accessing customer passwords.

The existing method of data sharing provides -- with permission -- numerous apps with access to customers' bank accounts, but concerns have been voiced about the possible dangers. No timetable has been set out, but the American finance giant intends to use a token-based system that will provide third parties with access to "a narrow range of data in a secure form".