Coinbase and GDAX will not support Bitcoin hard fork

There is a lot of discussion surrounding what will happen to Bitcoin come August 1, when two major changes to the protocol are scheduled to take place. Will we have a soft fork, which will keep Bitcoin on the current blockchain, or will a hard fork take place, creating a separate blockchain?

There is no definitive answer yet, but the major exchanges are preparing its customers for what will likely be a bumpy period in trading. Coinbase has announced its stance, revealing that it will not support the hard fork and the coins that it may create.

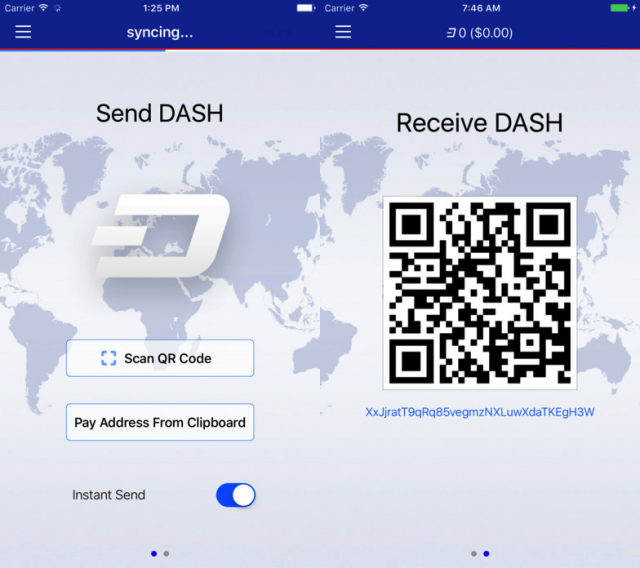

Apple greenlights Dash cryptocurrency in the App Store

Apple has a selective approach towards cryptocurrency, which is why iOS users only have access to a handful of coins in the App Store. You can find players like Bitcoin, Ethereum, Litecoin and Ripple, but most others are pushed aside.

There is no official position, but it is believed that Apple only accepts cryptocurrencies that are reputable. And Dash just rejoined that list. The sixth-largest cryptocurrency is back in the App Store, after being banned last year.

Stealing $7 million of Ethereum from CoinDash took a hacker just 3 minutes

A lightning-fast raid on a cryptocurrency platform's website earned a hacker $7 million in three minutes yesterday. Moments after CoinDash launched its ICO (Initial Coin Offering, the cryptocurrency version of an IPO), the attacker modified the address of the wallet it used and watched as millions poured into their own account.

The website was shut down as soon as the hack was discovered, but by this time $7 million had already disappeared. CoinDash managed to gather $6 million from investors, but funds stopped arriving with the shutdown.

What can you buy with Bitcoin?

Many people are talking about Bitcoin as an investment: you buy some today, hold for a while, and sell later when the price suits you. But what if you want to buy Bitcoin and use it as an actual currency? What could you get with it?

At first glance, this looks like a simple question. However, the answer is not. And here is why.

If you want to invest in the cryptocurrency market, get used to its volatility

Investing in cryptocurrency is not for the faint of heart. The market is simply too volatile. In a short period of time, it can reach all-time highs and crash, repeatedly, seemingly out of nowhere. The trick is to not let those moments define your actions.

Just like you enjoy seeing it break new records, you have to get used to the fact that there will be some terrible days as well. Today is one of those days. All the major cryptocurrencies are in the red, with the vast majority posting double-digit losses over the last 24 hours.

Criminals rarely use cryptocurrency

The fact that cybercriminals like to be paid in Bitcoin to unlock encrypted files or sell private information gives the impression that criminals must be major users of cryptocurrency. However, a new report from the European Commission suggests that the reality is very different.

Criminal organizations rarely use cryptocurrency (or, as the European Commission calls it, virtual currency) for illegal activities, like financing terrorism and money laundering, because it requires a certain level of technical expertise that hampers adoption.

Should your business embrace Bitcoin?

There’s been a lot of talk in recent months about cryptocurrencies, specifically Bitcoin. While it may not yet be on the verge of toppling the pound, dollar, euro, or yen in your wallet, the digital cryptocurrency is steadily gaining adoption within mainstream society and, with its rise, has brought many questions among regulators, consumers and small business looking to get in on the action.

As consumers slowly grow more comfortable with using digital currencies that use complex algorithms to make secure person-to-person payments, the businesses they serve are also beginning to accept Bitcoin and other cryptocurrencies as payment.

Major cryptocurrency exchange Bithumb gets hacked

Thanks to its rapidly growing value, relative anonymity, and easy trading opportunities, the cryptocurrency market is a highly attractive target for hackers. Making things even more interesting, the major exchanges deal with significant volumes throughout the day, making them a prime target for cryptocurrency thefts.

Bithumb is among the biggest targets, being the fourth-largest cryptocurrency exchange by volume and the largest in South Korea. And last week it got hacked, with users estimated to have lost billions of won as a result. I say estimated because Bithumb hasn't gone public yet with an accurate figure -- or any figure for that matter.

Cryptocurrency market bounces back after crash

Volatility is the norm of the day in the cryptocurrency market, so the recent crash that saw tens of billions of dollars wiped off from its value is hardly something unusual. These things happen from time to time, but, as of late, you can expect the market to recover shortly after.

Case in point: yesterday I was telling you that all the major cryptocurrencies were in the red. The market's cap was down to under $90 billion. A couple of hours later, things started to improve, reaching the point where the cap is back over the $100 billion mark.

Bitcoin is stronger than Ethereum -- the flippening will have to wait

When the price of Ethereum broke the $400 mark earlier this month, the flippening looked like a sure thing. Pundits were expecting it to soon surpass Bitcoin and become the most valuable cryptocurrency in the process. However, fast forward to today, Ethereum is crashing hard while its rival is still holding well.

The price of Ethereum has dropped to around $235, bringing its market cap down to around $21.9 billion. Meanwhile, Bitcoin is trading for around $2330, and its market cap is around $38.8 billion. From a difference of less than $8 billion in market cap, Bitcoin's lead has more than doubled in just a couple of weeks.

GDAX exchange reimburses customers affected by Ethereum price crash

A large sale order on the GDAX exchange earlier this week caused the price of Ethereum to crash massively for a brief period of time. The second most-valuable cryptocurrency dropped to as low as $0.10 in trading before bouncing back to over $300, after the sale triggered a domino effect which saw around 800 advanced orders being filled.

The customers who placed those orders -- stop loss and margin call -- have lost big as a result. However, even though it has found that "all trades this week were executed properly," GDAX says that it will reimburse the affected accounts, in what I believe is a brilliant move on its behalf.

Ethereum price plunges to $0.10 before bouncing back

Ethereum has redefined volatility in the cryptocurrency market. On the GDAX exchange, the second most valuable cryptocurrency dropped to as low as $0.10 in trading before the price swiftly recovered.

The price of Ethereum is hovering around the $336 mark at the time of writing this article. What caused the plunge? GDAX blames it on a basic sell order, albeit one of really high value.

India will regulate Bitcoin

Many analysts argue that cryptocurrencies need to be formally recognized by major governments in order to gain credibility. Well, for Bitcoin, the biggest cryptocurrency around, things are moving in the right direction.

The Indian government has decided to regulate the local Bitcoin market, just a few months after it was revealed that the Inter-Disciplinary Committee under the Ministry of Finance was assessing the legality of Bitcoin.

Bitcoin, Ethereum and other cryptocurrencies have millions of users

Cryptocurrencies like Bitcoin and Ethereum are receiving more and more attention, but the fact of the matter is, the market is still in its infancy. To put things into perspective, its capitalization is currently about six times lower than Google -- and even less compared to Apple, which is the most valuable publicly-traded company in the world.

What we do not know exactly is how many people own cryptocurrency. It may be a small market in the grand scheme of things, but according to new report from Cambridge Judge Business School, between 2.9 and 5.8 million people in 38 countries use Bitcoin, Ethereum and other cryptocurrencies.

How to buy Bitcoin and Ethereum

The insane rise of Bitcoin and Ethereum makes investments in the two main cryptocurrencies very attractive. You can turn a nice profit in trading but, to play in this market, you first need to get your hands on some coins. So, how do you buy Bitcoin or Ethereum?

Like all the cryptocurrencies that matter, Bitcoin and Ethereum are mainly available through dedicated exchanges. There are also other ways to get Bitcoin and Ethereum, like mining and private trading but, for most people, an exchange is the safest and easiest way to buy into this market, so this is what we will look at here.