Apple is winning the mobile platform wars

In October 2009, I explained why "iPhone cannot win the smartphone wars". Many of the reasons then still hold true today. But I wrote that analysis before Apple released iPad. So, 10 months later I followed up with "Apple can still win the mobile platform wars, but it won't be easy". Now, 18 months later, as Mobile World Congress starts in Barcelona, Spain, I claim: Apple is winning the mobile platform wars, but achieving ultimate supremacy won't be easy.

In August 2010, I observed: "Pundits already are predicting iPhone's death brattle before the great Android god. I wouldn't write off Apple just yet. The mobile wars are bigger than smartphones, as Apple already has shown". Little has changed since. Android apologists still predict victory over iOS, while ignoring fundamental platform gains that put Apple in front.

Dollars and Sense

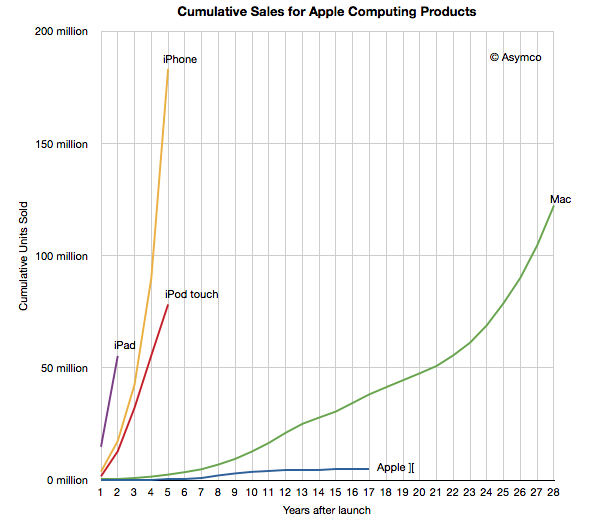

The numbers add up where they matter most, as they have trended for well over a year. At the end of 2011, Apple had 315 million cumulative iOS device sales. The 55 million iPads sold to date account for 17 percent of the total and iPhone, with 175 million sold, 56 percent.

But 2011 was the break-out year for iOS devices -- 156 million, according to Asymco's calculations. So Apple sold 49.5 percent of all iOS devices in a single year, which indicates considerable accelerated momentum.

According to company financial filings, for calendar 2011, Apple sold 92.95 million iPhones and 40.45 million iPads -- generating $61 billion and $24.95 billion revenue, respectively. For all calendar 2011, all Apple generated $127.84 billion revenue. The two products accounted for 67 percent of the company's sales for the year (again referring to calendar and not Apple's fiscal year).

If my flu-socked brain matter calculates right, Apple generated around $656 per iPhone and $616 per iPad during calendar 2011.

Update: But profits are more revealing. After I posted, on February 26, Asymco released a cost breakdown for iPhone that works out to $330 profit per handset.

Something else: During fiscal first quarter 2012 (synchronous with calendar Q4 2011) Apple generated more revenue ($46.33 billion) than all fiscal 2009 ($42.9 billion). iOS drives revenue increases at an alarming pace.

Platform Perfection

The point: There are several metrics that define successful computing platforms, with money being the most important. Apple rakes in cash from iOS at accelerating pace, which trickles down dollars to third parties of all kinds, whether they be software developers, hardware manufacturers or other partners, like retailers and wireless carriers. Everyone wants to associate with a winner, which Apple and iOS increasingly are.

As the month ends, so come two Apple milestones: 25 billion app downloads and $4 billion paid out to developers.

Quick example of the benefits: I recently received email from developer Presselite, about 3 million downloads of its Vintage Camera app during first month on Apple's App Store. There are free and 99-cent versions available. Developers go where the money -- and distribution -- is.

But money isn't everything. Typically, successful platforms share six common traits:

- There are good development tools and APIs for easily creating applications

- There is at least one killer application people really want

- There is breadth of useful applications

- Third parties make lots of money

- The platform is broadly available

- There is a robust ecosystem

Platforms succeed for combinations of reasons leading to network effects. In November 2011 "Mobile Platforms: The Clash of Ecosystems" four VisionMobile analysts explain:

It is clear that Apple’s iOS is a clever implementation of a mobile application platform coming from a company with the right kind of experience and DNA. Strong network effects between users and app developers are inherent to iOS ecosystem design...The unprecedented success of Apple iOS is a testament to the advantages of application platforms. All new platforms introduced after the original iPhone, including Android, attempt to copy Apple’s application platform recipe.

iOS has all six platform attributes covered, but so does Android. In fact, in January, British analyst firm Ovum predicted that Android will become the most important platform to developers within the next 12 months, replacing iOS.

Ovum's Adam Leach explains: "A smartphone platform's success is dictated not only by the pull of consumers and the push of handset vendors and mobile operators but also by a healthy economy of applications delivered by third-party developers". Except the platform is bigger than smartphones, including tablets, too. So Ovum's analysis is short-sighted. Nearly one-quarter of iOS sales in calendar 2011 were iPads.

Assessing Android Tablets

Android tablets have failed to significantly challenge iPad, despite predictions otherwise. For example, in January 2011, BMO Capital Markets analyst Keith Bachman predicted that "the number of players participating in Android tablets will replicate the success Google has had on phones" and that they would "reach unit parity" late in the year.

Android tablet shipments did spike during Q4, according to Strategy Analytics, but nowhere near parity with iPad. Respective market shares: 39.1 percent to 57.6 percent. However, Android unit shipments tripled year over year: 3.1 million to 10.5 million units compared to iPad's rise to 15.4 million from 7.3 million.

Android tablet shipments did spike during Q4, according to Strategy Analytics, but nowhere near parity with iPad. Respective market shares: 39.1 percent to 57.6 percent. However, Android unit shipments tripled year over year: 3.1 million to 10.5 million units compared to iPad's rise to 15.4 million from 7.3 million.

DisplaySearch puts Apple's tablet share higher, 59.1 percent, followed by Amazon (16.7 percent) and Samsung (6.7 percent). If anything, Amazon poses more direct competition to iPad than all Android. Looked at differently: Next to Apple, Amazon is the biggest competitive threat to all other Android tablet makers. In its first, partial quarter of availability, Kindle Fire topped 5 million shipments, according to DisplaySearch.

By every measure that matters, and not just price, Amazon's tablet directly competes with iPad. Unlike other Android device manufacturers, Amazon takes complete control over the entire stack -- software, hardware, cloud services, retail sales and customer support. Kindle Fire features an Amazon-customized version of Android 2.x, its own Android app store, music and movie stores, ebook store, web browser and customized media consumption software and services. This curated approach reminds of Apple. Amazon is creating a curated experience that matches Apple's and exceeds it in some respects.

Apple faces another change, more uncertain, and not from Android. Microsoft seeks to outflank iOS with Windows 8 and Windows on ARM. Then there is Windows Phone's possible future on Nokia tablets. Microsoft isn't DOA yet in emerging mobile categories, just lying in critical condition. The company is awake from the coma. The question: How much brain function is left? The answer will come with next-versions Windows execution, which looks promising enough.

Differentiation, Dummy

As the mobile platform wars rage, Apple has several unique advantages over competitors, which significance shouldn't be ignored. The next 12 months will determine whether Apple can keep winning the platform wars or fall behind Android. To be clear: Apple winning doesn't make Android a loser. The market is rapidly consolidating around Android and iOS.

Update: In Barcelona, on February 27, Android chief Andy Rubin said that device sales had reached 300 million and daily activations 850,000, which are impressive numbers.

Key Apple differentiators:

1. Distribution. In January 2011 post "Why is iPad successful?" I explained ecosystem's advantages mainly around manufacturing and distribution. The latter is hugely important. Apple iOS devices are available from about 40,000 outlets globally. iPhone: more than 230 carriers in more than 100 countries and expanding. So the platform has huge reach, and that's ignoring 315 million cumulative sales -- install base of users buying apps.

See #3, #4 and #5 about app distribution advantages.

2. Apple Store. Apple operates more than 360 retail shops worldwide, and they give iOS huge boost over Android. In May 2011, I opined that "Apple would be nothing without its retail stores". They provide an important point of customer service and bring added confidence about buying iOS devices over others. If something goes wrong, Apple Store can fix or, often, replace the device.

Example: With iPhone 4S, Apple offers an upgraded warranty service for $99. AppleCare+ extends coverage to 24 months and up to two phone replacements (for $49 service fee). If an iPhone 4S buyer drops the phone and shatters the glass, Apple Store replaces the smartphone. Apple would be smart to offer similar option for iPad 3; it's what I would do and expect Apple will.

3. Unified platform. Apple controls the entire stack -- hardware, software and services -- and distribution. This control assures developers and users a consistent experience across iOS devices. Nothing on Android compares.

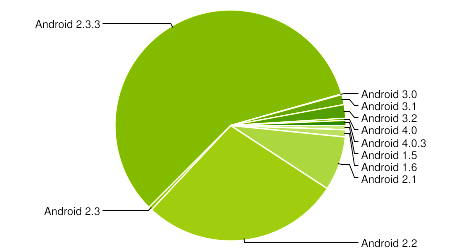

4. Software distribution. When Apple issues an iOS update, every supported device gets it. By comparison Android updating is fragmented. In November 2011, I asserted that "Android fragmentation doesn't matter" in part because carriers and OEMs already do so much customization, such as HTC Sense or Samsung TouchWiz user interfaces.

I stand by this opinion for Android 2.x on phones and even 3.x on tablets. Nevertheless, because Google doesn't exert enough control over Android, the market moves slowly to Android 4.0, which in many respects exceeds iOS 5. Hell, Google now owns Motorola and most of its own devices won't get Ice Cream Sandwich until second half of 2012 -- if ever. As of February, according to Google's official stats, only 1 percent of Android devices ran Ice Cream Sandwich.

5. Curation. Apple offers a curated app, OS, device and user experience compared to fragmented Android. Sure, Android OEMs offer more choice, but also greater uncertainty for users and developers. Only Amazon offers as much a curated platform as Apple.

"You" or "i"

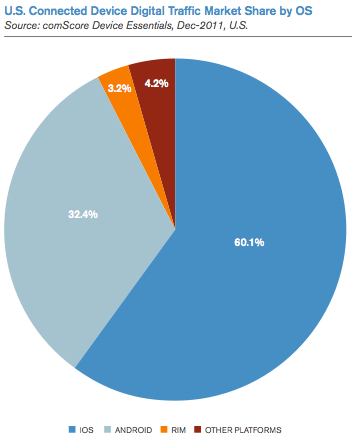

Mobile devices are by definition "connected", but iOS is considerably more so than Android. This attribute reflects much about the platform's health and long-term developer opportunity. According to comScore report "2012 Mobile Future in Focus": "By the end of 2011, iOS was driving 60.1 percent of all connected device traffic in the US from iPads, iPhones and iPod touches. In contrast, the Android OS accounted for only 32.4 percent of traffic".

More remarkable: "A breakdown of tablet traffic by platform indicates that iOS has a substantial lead, driving 90.4 percent of all tablet traffic in December 2011".

Mobile devices are more personal than PCs because of interaction, particularly fingers and touch, and how they're used to interact with people. Apps are part of this. They have caught up to browsers in terms of usage in the United States and five European countries (France, Germany, Italy, Spain, and United Kingdom), according to comScore's report. On smartphones, apps are third most-popular attribute affecting choice among US users. comScore ranked on a 10-point scale. Mobile network quality: 8.2. Operating system: 8.1. Apps selection: 7.9.

Mobile devices are more personal than PCs because of interaction, particularly fingers and touch, and how they're used to interact with people. Apps are part of this. They have caught up to browsers in terms of usage in the United States and five European countries (France, Germany, Italy, Spain, and United Kingdom), according to comScore's report. On smartphones, apps are third most-popular attribute affecting choice among US users. comScore ranked on a 10-point scale. Mobile network quality: 8.2. Operating system: 8.1. Apps selection: 7.9.

What consumers say they'll do often isn't what they do. Consider Verizon and the perceived network quality advantage of 4G LTE over its legacy CDMA data network. Yet during calendar fourth quarter, Verizon activated 4.3 million iPhones, representing 55.8 percent of smartphones sold. By comparison, Verizon sold 2.3 million 4G LTE devices, which includes mobile hotspots and tablets. At best, LTE devices accounted for 30 percent of smartphone sales.

However, since that number includes other devices, iPhone outsold LTE smartphones by about 2 to 1. At Verizon at least, something about iPhone mattered more than network quality, nor was Android or its available apps compelling enough for the majority of smartphone buyers.

Something else: According to comScore, iPhone was the most-acquired handset in the United States and five European countries. That's for all phones, not just smartphones.

Actually, iPhone was the top-three selling handsets in the United States and top-two in the Euro five. United States, in order: iPhone 4, iPhone 3GS and 4S. Euro 5: iPhone 4 and 3GS. The 4S ranked fifth. Mmmm, by one measure, iPhone is winning the smartphone wars, too, despite my prediction otherwise in October 2009.

These are all signs of Apple's increasingly mobile platform momentum, which hugely accelerated during second half 2011 and the final quarter, particularly. Apple is winning the mobile platform wars. But the market remains volatile. Winning isn't the same as won or splitting the market with another (Android). For now, many more people are putting the "you" or the "me" in mobile by choosing an "i" device.