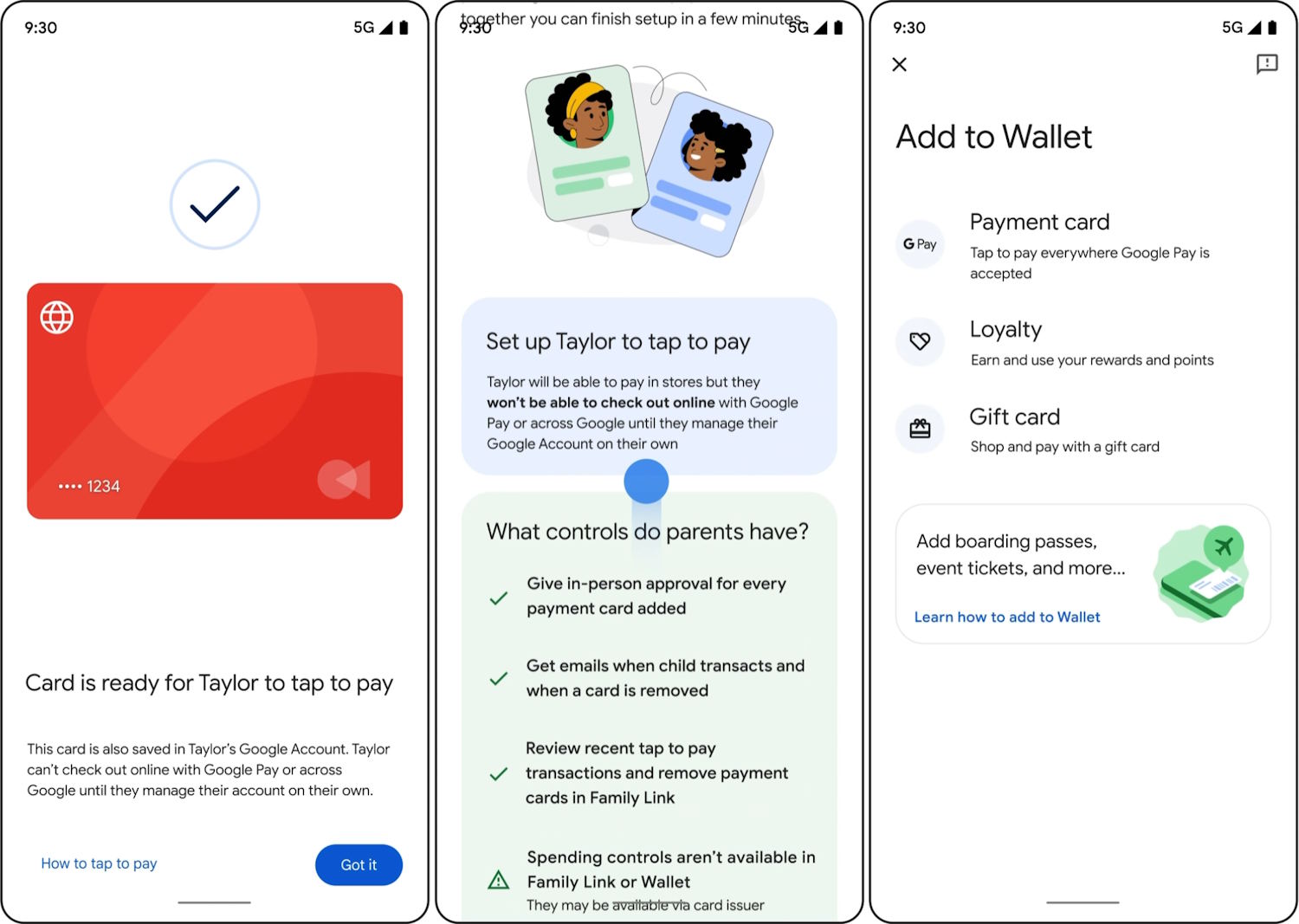

Google Wallet update means kids can now use digital payments and store their passes

Google is rolling out a significant update to Google Wallet that opens up the digital wallet to children.

The update enables children to not only make digital payments and use tap-to-pay, but also to store a range of passes, cards and tickets in one place. The consent of a parent or guardian is required to add a child’s card to Google Wallet, and there are comprehensive supervision tools available.

Google Pay app being killed off in USA

Google Pay, the digital payment service that has been around for over a decade, is being killed. Starting June 4, 2024, the standalone Google Pay app will no longer be available for use in the United States. But don’t worry, Google Wallet is stepping up to take its place, offering a platform for storing payment cards, transit passes, and more.

So, what’s the deal with this change? Google Wallet is apparently five times more popular than the Google Pay app in the U.S., so it seems like a pretty logical move. Until June 4, 2024, you can still manage your Google Pay balance in the app. After that, you’ll need to head over to the Google Pay website for balance management and bank transfers.

How to prepare for the new PCI DSS 4.0 requirements [Q&A]

The Payment Card Industry Data Security Standard (PCI DSS) turns 20 next year and has remained largely unchanged during that time. But version 4.0, due to become mandatory from April 2024, will bring the standard bang up-to-date and usher in a number of big changes.

We spoke to Phil Robinson, principal consultant and QSA at Prism Infosec, to explore what's changing and how organizations can prepare to meet the new requirements.

Digital banking, biometric payments and more regulation -- fintech predictions for 2023

Like any other industry, the financial services sector is undergoing digital transformation. While banking and finance have historically been quite traditional, pressure from more agile startups has led larger companies to look to tech to stay competitive.

The effect of the COVID-19 pandemic has driven more people to do their banking online too. Here are the key trends that experts expect to see in the fintech sector in 2023.

Financial fraud attempts up over 200 percent in two years

A new study into financial fraud from Feedzai finds that fraud attempts globally are up by 233 percent over the last two years.

Over the same period there has also been a whopping 794 percent increase in fraud on digital entertainment transactions. The effects of the pandemic are evident too with a 65 percent increase in online transactions and a 75 percent drop in US cash withdrawals.

Snapchat is shuttering peer-to-peer money transfer service Snapcash

Snapchat confirmed that it is closing down Snapcash next month. The peer-to-peer money transfer service is due to shut up shop on 30 August.

The closure was not officially announced by Snapchat initially, but references to "Snapcash deprecation" were spotted in the code of the Android app. The company has now confirmed that Snapcash is coming to an end after four years.

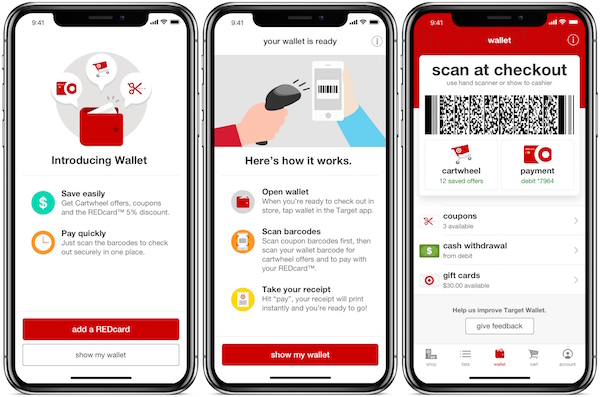

Target launches new Wallet payment method for Android and iPhone in time for Holiday Shopping

Holiday shopping is here, which means many consumers are visiting popular retailers like Walmart, Kohl’s, and Target. True, more and more shoppers are opting for an online experience from websites like Amazon, but the brick-and-mortar sellers are still wildly popular. Yeah, waiting in line stinks, but it can sometimes be more rewarding to see products in person. Shoes and clothing in particular can be tried on before buying.

Regarding those long lines that shoppers despise, Target has found a way to make them move a bit quicker. You see, starting today, the Target app for Android and iOS gains a new Wallet feature that makes the act of paying even faster. Better yet, it makes it easier to manage and use coupons.

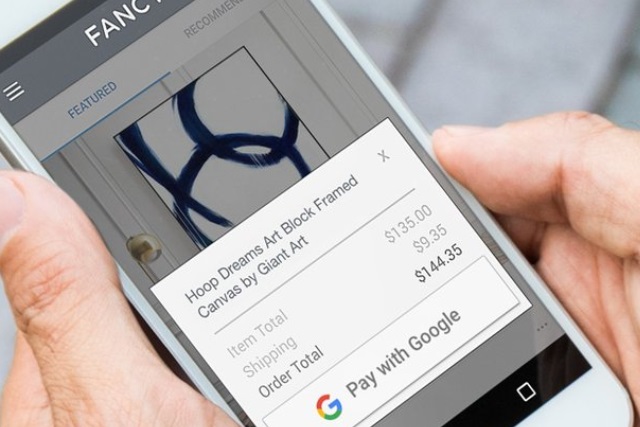

'Pay with Google' speeds up online payments for Android users

As promised earlier in the year, Google has launched its payment service to streamline the checkout process for Android users. Pay with Google aims to kill the frustration that can stem from having to fill out endless forms in order to complete a purchase.

To start with, Pay with Google is supported by 15 vendors including Instacart, Kayak, iFood and GameTime, but there are plenty more big names -- like StubHub, Deliveroo, Airbnb and Just Eat -- due to join. The service is available from today, and can be used in various Android apps, or Chrome on the web.

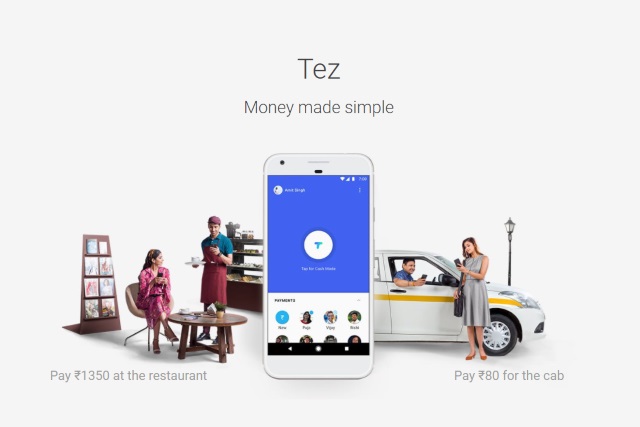

Google launches Tez in India, a new digital payment app for iOS and Android

As had been widely expected, Google has unveiled its new mobile payment service for India. Called Tez, the service is Google's first step into digital payments in Asia.

Tez makes it possible for users to link their bank accounts to the app and then use their phones to make in-person payments and transfers. Support for the government-backed UPI (Unified Payments Interface) means the service is compatible with a number of major banks. At the moment, Tez is limited to India, but there appear to be plans to spread it further.

Google will launch a mobile payment service in India called Tez

A new report suggests that Google is on the verge of launching a mobile payment service in India. Known as Tez (meaning "fast" in Hindi), the service could launch as early as Monday, according to Indian news site The Ken.

Google Tez is said to offer more payment options than Android Pay, including support for the government-backed Unified Payments Interface (UPI).

New portal helps developers integrate payment solutions

One of the keys to monetizing apps is to have an effective and easy to use payments solution built in. Payment solutions company Qualpay is aiming to make this process easier by offering a portal to make the selection of systems easier.

Qualpay for Developers allows developers looking for easy-to-implement payment APIs to use the portal to evaluate and deploy multiple payment solutions or work with Qualpay to tailor the platform for specific environments.

Mobile payments rapidly growing in popularity

The UK is continuing to embrace mobile and contactless payments, with the total spend using such services booming in the first half of 2017, new research has revealed.

The latest payment figures from Worldpay, the UK's largest credit and debit card payment processor. It found that the amount of money spent using mobile payments topped £370 million in the first six months of 2017.

Citi Pay joins the mobile/online fray

If you thought there weren't enough digital "Pay" platforms in the United States... you would be in a class by yourself. Nevertheless, there is a new option in the ever-expanding "digital wallet" marketplace.

The latest entrant is Citibank, the US's fourth-largest banking institution. Its unique take in this crowded space is its integration with Masterpass -- Citi customers can check out online and in-app anywhere Masterpass is accepted by using their existing online banking credentials.

Payment processor Worldpay agrees to $10 billion acquisition offer from Vantiv

The UK's biggest payment processor, Worldpay Group, has agreed to the terms of an acquisition offer from US rival Vantiv. News of the $10 billion (£7.7 billion) deal sent Worldpay's share price tumbling; while the planned takeover values shares at 385p, they quickly dropped to 368p.

Just days ago, Worldpay revealed it had been approached with offers from Vantiv and JPMorgan, and the latter has now ruled itself out of making an official bid. Vantiv's takeover of Worldpay would see the US company spreading into Europe with its POS and online payment services.

Apple Pay now supports purchases over £30 in UK

The latest move from Apple may soon lead to consumers leaving their wallets at home, now that a majority of cash registers in the UK will be able to accept Apple Pay mobile payments over £30.

According to the vice president of Internet Services at Apple Pay, Jennifer Bailey, more than half of the contactless payment terminals in the UK are now able to accept Apple Pay payments of any value. Previously they had been limited to £30, which is the limit for card readers when dealing with contactless card payments.