Tim Cook pulls off a Steve Jobs

I meant to write this yesterday, but day late is better than never. Listening to Apple's fiscal second quarter 2014 earnings conference call on Wednesday, I was awed by how cleverly and aggressively CEO Tim Cook stated growth metrics for iPad and iPhone. My immediate reaction: "What is he hiding?" Wall Street beat down Apple shares following release of great Q1 results three months ago. From the stated stats to announced 7-to-1 stock split, seems to me like Cook intended to aggressively and proactively manage perceptions -- and he did. He was unusually free sharing sales and growth data, which is uncharacteristic of Apple but typical of perception management tactics.

Company cofounder Steve Jobs was a master marketer. Cook isn't in the same league of inspiring people to believe that "One More Thing" aspires greater happiness. But Cook lived up to his name -- cooking the numbers -- in Jobs-like sleight of hand. Look here people, instead of over there, and witness magic rather than the trick. But behind the veil, iPad and iPhone don't look as great as he presented them. One thing you learn, if working as a journalist long enough: When to recognize misdirection or deception.

Google Camera goads iPhone

Android phones running stock or manufacturer-installed KitKat 4.4+ get a big photo-shooting upgrade today. Google Camera is now available from the Play store. The app replaces the standard shooter on Nexus devices and places a separate camera app on others. The headline feature: Lens Blur, which does exactly what the name indicates. You shoot the image, and then use the app to either blur the foreground or background. Photographers call the capability "bokeh", and it usually requires a specialized lens on dedicated hardware to produce well. The blurred effect is highly desirable for portraits. Can you say selfie?

Google does what Apple should -- use software development wits to add hardware smarts. This is exactly the kind of thing I would expect from the fruit-logo company first. But that's a number recently missing from the iOS crop. Google is by no means first to offer software blur, but in my testing delivers arguably the best effort. Hell, the new camera app even shames newfangled hardware mechanisms. HTC One M8 uses two lenses and feature UFocus to produce bokeh. In my testing, on The One and Nexus 7, blur is surprisingly comparable.

You can have Apple iPhone 5s, I'll take HTC One M8

Many new smartphone shoppers will compare the HTC One M8 and Samsung Galaxy S5, which are about the same size, offer similar high-end features, run Android (with customized user interfaces), and arrived in U.S. retail stores within days of one another. But since I move from iPhone 5s to what henceforth will be referred to as The One, the two devices are uniquely attractive, and both pack bleeding-edge cameras, my comparison is more Apple to oranges. If iPhone 5s is high up your shopping list don't buy without first considering The One. It's my choice, although granted it might not be best for you.

I moved from the original One, the M7, to the 5s a few months ago. You might laugh at the reason. I find that my daughter, who shuns Androids for Apples, is more likely to text message when we both use iPhones. She is away at college. But the 5s, like iPhone 5, immediately disappointed for phone calling. Reception tends to breakup in my neighborhood on both devices, using AT&T or T-Mobile. Calling is superior and adequate on either One, and even better on the Moto X. The One illuminates the Apple's inadequacies, which simply are unacceptable coming from the company that popularized touchscreen smartphones.

iPhone 6 can challenge Android dominance in 2014 -- if Apple makes these changes

Today is the second day of 2014, so everything from last year is now obsolete (I kid, I kid). While only a few months removed from the iPhone 5s and 5c launch, it is never too early to begin dreaming about the next iteration of Apple's smartphone.

2013 was the year of Android from a market-share perspective, but its ongoing dominance isn't entirely assured. After all, it wasn't that long ago that Blackberry led the smartphone market. Google's Android isn't likely to lose market share any time soon (there are too many manufacturers and models for that to happen) but I do think there's a chance for Apple to win big this year. Though I am an Android user, I am not opposed to switching to the iPhone 6 or iPhone Air (or whatever Apple calls it) and I think other Android users could feel the same way -- if Apple makes the following changes.

History repeats, as Android does to iPad what it did to iPhone

This week IDC released tablet market estimates and the figures are quite a bit off from my original Q1 estimate, but eerily similar to my revised estimate based on NPD's figures. Android tablets are poised to permanently steal the tablet market crown from the iPad, while Windows tablets continue to struggle. Let's take a deeper look at the figures.

Android now leads the tablet market, with a share of 56.5 percent, while the iPad's share falls below 40 percent. Windows tablets are still struggling, with a share below 4 percent and with struggling shipment figures, sell-through is always questionable.

As iPhone market share peaks, there's one direction to go

You will reads lots of dribble today about Samsung first quarter phone gains compared to Apple. Most will ignore something fundamental to the numbers: What they represent. IDC and Strategy Analytics separately put out data, for shipments, which mean handsets going to carriers, dealers and other sellers. That's very different from sales to businesses and consumers, Gartner's measure and the more accurate one (that data isn't ready yet).

For few quarters is the difference between shipments and sales likely to be so pronounced, actually even more so in Q2. Apple comes off its second full quarter of iPhone 5 sales and global distribution, and so shipments into the channel, nearly complete. Meanwhile, Samsung ramps up for Galaxy S4's launch, while achieving full global availability for the S III. Second quarter is the more likely bloodbath for Apple, but actual sales will foreshadow much. Still, shipments hint something now, and iPhone faces serious challenges.

Samsung and Sprint dim iPhone 5's launch-sales glow

Only T-Mobile can save iPhone now. Apple's U.S. market share, as measured by smartphone operating system, retreated in February, according to data Kantar Worldpanel ComTech released today. With the iPhone 5 initial release sales glow gone, and a rapidly saturating market for a product feature set now three models old, share isn't sustainable. Meanwhile, Android gains -- as does Windows Phone.

iPhone share, based on sales, fell to 43.5 percent for the three months ended in February. That's down from 45.9 percent in January and from 47 percent a year earlier. By comparison Android is up -- to 51.2 percent from 49.4 percent sequentially and 45.4 percent annually. By the same reckoning, Windows Phone rose to 4.1 percent from 3.2 percent and 2.7 percent share.

More smartphone owners stick with Android than iPhone

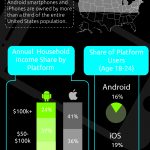

Developers must make hard choices when choosing what platforms to support. In mobile, popular convention is iPhone first. But does that approach, in the real world of smartphone ownership, really make sense in 2013? Let us take a look at the hard numbers that were recently published by comScore and see what they can tell us.

This may be a self-perpetuating problem for Apple; according to ComScore, the Google platform simply offers more opportunity because of its larger user base, though that is far from the only consideration for developers. Granted, both mobile operating systems are wildly popular, despite the best efforts of Microsoft to get Windows Phone OS into contention (OK, maybe "best efforts" is going a bit far) -- Android and Apple combine for nearly 90 percent of the smartphone market -- 53 and 36 percent respectively.

Apple holds on to U.S. Smartphone subscriber lead

In the highly saturated U.S. smartphone market, Apple's dominance grew, while iPhone nipped upwards towards Android, for the three months ended in January, according to comScore. The analyst firm, unlike most of its competitors, measures actual subscriber share rather than number of units shipped. Like Gartner's counting actual sales, comScore gives a clearer view of real-world dynamics.

During iPhone 5's first full three months of sales, Apple's share reached 37.8 percent -- up from 36.3 percent in December and 34.3 percent in October. By comparison, second-place Samsung nudged up to 21.4 percent share, from 21 percent sequentially and 19.5 percent for the same three months. HTC, Motorola and LG followed, with respective shares of 9.7 percent, 8.6 percent and 7 percent. All three lost share from December, with LG up ever-so slightly from October. Motorola's loses strongly suggest that at Verizon, carrier with the highly-visible Droid line of smartphones, subscribers shift allegiance to other brands. Good thing Moto has a new evangelist.

iPhone cracks against the Great Wall of China

The Chinese smartphone market is dominated by five top manufacturers, none of them Apple, Canalys reveals. As I've warned a couple times recently, despite CEO Tim Cook's prognostications about China's importance or his company boasting 2 million first-weekend iPhone 5 sales, competitors rapidly close out the market for costly fruit-logos.

China is the biggest market for mobiles, largely dominated by smartphones -- 73 percent of the total in fourth quarter, up from 40 percent a year earlier. Shipments soared 113 percent to 64.7 million units, or 30 percent of all smartphones globally. Samsung captured the top spot, followed by Lenovo, Yulong, Huawei and ZTE.

Uh-oh, $50 smartphones mean big trouble for Apple

That sound you hear: Emerging markets sucking the margins out of iPhone. Gartner predicts that Chinese brand and white-box handset manufacturers will dramatically change the smartphone market's course this year. Android is likely to be the big beneficiary, while iPhone has the most to lose. Economies of scale will bite Apple, which benefits from one of the tightest supply chains anywhere. Chipset integration, for example, will allow handset makers to ship cheaper devices that are good enough, even if less than market leaders.

"The combination of competitive pricing pressure, open-channel market growth and feature elimination/integration will very soon result in the $50 smartphone", Mark Hung, Gartner research director, says. "Semiconductor vendors that serve the mobile handset market must have a product strategy to address the low-cost smartphone platform, with $50 as a target in 2013". That's right, 50 bucks, not the $650 Apple charges carriers.

iPhone wins the U.S. (kind of), but Android rules the world

Americans love their iPhones, finally enough to topple Samsung's long-time leadership. During fourth quarter, Apple nudged ahead of the South Korean electronics giant, with 34 percent share, based on shipments, according to Strategy Analytics. To be clear, the numbers are for all mobiles, not just smartphones. The distinction is important for several reasons. The American company only ships smartphones, for which demand rages. Related: Overall phone shipments fell for the year.

"Apple has become the number one mobile phone vendor by volume in the United States for the first time ever", Neil Mawston, Strategy Analytics research director, says. "Samsung had been the number one mobile phone vendor in the U.S. since 2008, and it will surely be keen to recapture that title in 2013 by launching improved new models such as the rumored Galaxy S4".

Android stomps all over iOS

Keeping with an ongoing trend, Android solidified its global smartphone dominance in fourth quarter and for all 2012, according to Strategy Analytics. The Android Army sent iOS idolaters into retreat during Q4, iPhone 5's first full three months of sales. Like I explained in September, "Android wins the smartphone wars".

During fourth quarter, iOS share fell to 22 percent from 23.6 percent a year earlier. Meanwhile, Android rose to 70.1 percent from 51.3 percent. For all 2012, iOS nudged up to 19.4 percent from 19 percent share, while Android reached 68.4 percent, up from 48.7 percent. The differences between the quarter and year, strongly suggest sales surge at the end, for Android, which forebodes poorly for Apple when iOS got big lift from iPhone 5's recent launch.

My Apple boycott is over

Suddenly, I feel sorry for the folks over at Apple. Chicken Little bloggers and Wall Street analysts run round crying "The sky is falling!" Strangely, they are believed. Apple shares are down 38 percent from September's all-time high. On Friday, the company's market cap fell below Exxon's. Suddenly, the world's most valuable company isn't. I just don't feel right kicking fruit as it falls down, so as a gesture of goodwill my boycott ends today.

That's not to say I have plans to buy any Apple products. I'm more than satisfied with Chromebook and my three Nexus devices. That said, as an act of solidarity, I let Apple auto-charge my credit card for iTunes Match renewal today. I don't own a single device that supports the service, but, hey, what's $24.95 between friends? I was a loyal OS X and iOS user until my boycott started in June 2012, protesting aggressive patent lawsuits -- unaffectionately called innovation by litigation.

Apple has a really BIG iPhone problem

Sales growth comes from the wrong places: iPhone 4 and China.

IDC and Strategy Analytics have released fourth-quarter phone shipments, which at first glance look good for Apple. While competitively behind Samsung, the fruit-logo company continues to gain smartphone market share -- in fourth quarter, respectively, 29 percent and 21.8 percent, according to IDC. But gains largely come from older models, particularly iPhone 4, despite the newest handset shipping in volume during the quarter. This demand says much about iPhone's perceived value, its successor's appeal and future carrier subsidies and the margins Apple gets from them.

Recent Headlines

Most Commented Stories

BetaNews, your source for breaking tech news, reviews, and in-depth reporting since 1998.

Regional iGaming Content

© 1998-2025 BetaNews, Inc. All Rights Reserved. About Us - Privacy Policy - Cookie Policy - Sitemap.